Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693621

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693621

Asia-Pacific Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 350 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

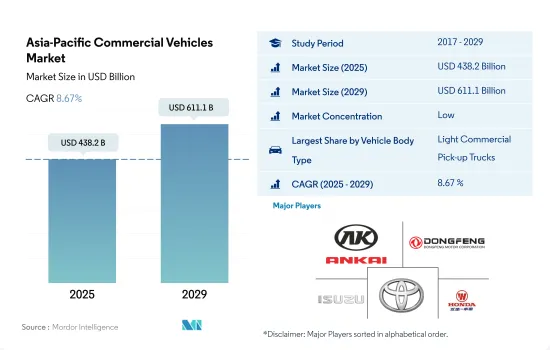

The Asia-Pacific Commercial Vehicles Market size is estimated at 438.2 billion USD in 2025, and is expected to reach 611.1 billion USD by 2029, growing at a CAGR of 8.67% during the forecast period (2025-2029).

APAC's significance as a pivotal player in the global commercial vehicle industry is marked by resilience, adaptability, and growth potential

- The light commercial pickup trucks segment of the Asia-Pacific commercial vehicles market has been showcasing resilience and steady growth. Starting at 4,620,401 units in 2017, there was a brief lull in 2018 and 2019. However, subsequent years witnessed a notable uptick, underscoring a robust demand for these vehicles. Projections indicated that by 2023, this segment would hit 6,042,081 units, showcasing a remarkable recovery and growth trajectory. In contrast, the light commercial vans segment registered a decline from 1,176,110 units in 2017 to 885,614 units in 2019. While there has been a modest rebound since 2019, it has not matched the pace of pickup trucks. The forecast for 2023 stood at 1,082,025 units for light commercial vans, indicating a steady but moderate demand for these vehicles.

- The medium-duty commercial trucks segment of the Asia-Pacific commercial vehicles market has faced challenges in recent years. After peaking at 461,391 units in 2017, it experienced a significant drop to 327,819 units by 2019. However, there were positive signs of recovery, with projections indicating a rise to 492,106 units by 2023. In the heavy-duty commercial trucks segment, a distinct pattern emerges. While the figures fluctuated between 2017 and 2021, the overall trend has been upward. Starting at 1,459,599 units in 2017, there was a peak in 2020 at 1,754,298 units. Despite a dip in 2021, the segment rebounded strongly, with 2,318,219 units projected for 2023.

- Lastly, the buses segment, crucial for mass transit, initially saw a decline from 680,162 units in 2017 to 546,164 units in 2019 across the Asia-Pacific market. However, the post-2019 period has been marked by stabilization and gradual growth, with projections indicating a rise to 709,944 units by 2023.

Asia-Pacific is likely to continue witnessing a consistent increase in CV registrations, supporting the region's expanding logistical and commercial demands

- The relocation of industrial output, primarily to China, has opened up trade channels, indirectly benefiting the commercial vehicle market and the logistics sector. With the growth of the logistics and e-commerce sectors, the demand for LCVs is expected to rise. The expanding Chinese economy has led to an increase in disposable income for the middle class, driving up demand for both commercial and passenger vehicles. Additionally, the nation's low production costs have fueled a significant surge in automobile demand over the past five years.

- The Asia-Pacific commercial vehicles market faced a setback during the COVID-19 outbreak, with local authorities imposing restrictions on commerce and travel. This led to a sharp decline in commercial vehicle sales. The pandemic shifted consumer preferences toward low-cost goods, reshaping the local commercial vehicle market.

- Despite hurdles, the Indian government is committed to developing a shared, connected, and electric mobility ecosystem. Such initiatives are expected to drive the growth of commercial electric vehicles in the long term. Asian governments are projected to invest USD 26 trillion in infrastructure by 2030, significantly bolstering the transportation of construction materials and machinery across Asia-Pacific. Stringent pollution regulations have prompted automakers (OEMs) to pivot toward electric vehicles. With a growing understanding of the future of mobility, modern start-ups and entrepreneurs are increasingly favoring commercial electric vehicles.

Asia-Pacific Commercial Vehicles Market Trends

APAC's rapid electric vehicle demand and sales growth are driven by government initiatives and commercial vehicle electrification

- Electric vehicle (EV) demand and sales have surged in the APAC region in recent years. China, the dominant market, saw a 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. Factors driving this trend include mounting environmental concerns, stringent regulations, and the advantages of EVs, such as fuel efficiency, lower maintenance costs, and zero carbon emissions. Government subsidies further bolster the adoption of EVs in Asian nations.

- Conventional fuel-powered commercial vehicles, notably trucks and buses, are contributing to the escalating pollution levels in several Asia-Pacific countries. In response, many nations in the region are making substantial investments to transition their internal combustion engine (ICE) vehicles to electric ones, aiming to curb carbon emissions. For instance, in December 2020, TransJakarta, a city-owned bus operator in Indonesia, unveiled an ambitious plan to expand its electric bus (e-bus) fleet to 10,000 units by 2030. Such initiatives across the region are propelling the electrification of commercial vehicles.

- Government bodies in various APAC countries are actively proposing measures to phase out fossil fuel vehicles, a move that is poised to bolster the market for electric commercial vehicles. In a notable development, in May 2022, Tata Motors secured a government contract in India to supply 5,450 electric buses worth INR 5,000 crore under the FAME 2 scheme. Additionally, the company announced plans to deliver 20,000 light electric trucks to six major e-commerce players. These advancements in the EV space are anticipated to further fuel the demand for electric commercial vehicles in the APAC region from 2024 to 2030.

Asia-Pacific Commercial Vehicles Industry Overview

The Asia-Pacific Commercial Vehicles Market is fragmented, with the top five companies occupying 31.67%. The major players in this market are Anhui Ankai Automobile Co. Ltd., Dongfeng Motor Corporation, Isuzu Motors Limited, Toyota Motor Corporation and Wuling Motors Holdings Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93009

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Ankai Automobile Co. Ltd.

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Ford Motor Company

- 6.4.5 General Motors Company

- 6.4.6 Great Wall Motor Company Ltd (GWM)

- 6.4.7 Honda Motor Co. Ltd.

- 6.4.8 Hyundai Motor Company

- 6.4.9 Isuzu Motors Limited

- 6.4.10 Kia Corporation

- 6.4.11 Mazda Motor Corporation

- 6.4.12 Mitsubishi Motors Corporation

- 6.4.13 Nissan Motor Co. Ltd.

- 6.4.14 Renault-Nissan-Mitsubishi Alliance

- 6.4.15 Subaru Corporation

- 6.4.16 Suzuki Motor Corporation

- 6.4.17 Tata Motors Limited

- 6.4.18 Toyota Motor Corporation

- 6.4.19 Wuling Motors Holdings Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.