Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693626

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693626

Europe Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 274 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

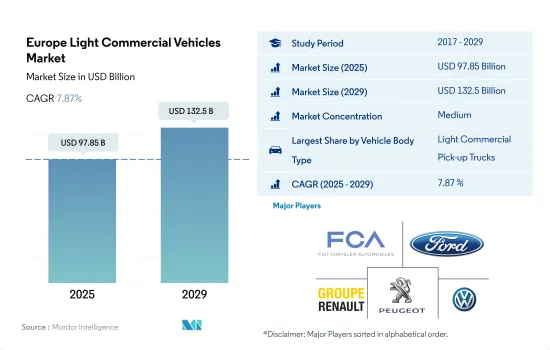

The Europe Light Commercial Vehicles Market size is estimated at 97.85 billion USD in 2025, and is expected to reach 132.5 billion USD by 2029, growing at a CAGR of 7.87% during the forecast period (2025-2029).

The European LCV market thrives on infrastructure investments and e-commerce surge, with continued growth expected amid urbanization and green initiatives

- In 2022, the light commercial vehicle (LCV) market in Europe witnessed a robust 6.2% growth in sales volume. This positive momentum is expected to carry forward, with a projected growth of 3.5% in 2023. This growth is primarily fueled by heightened infrastructure investments and the surging tide of e-commerce. The EU's focus on transportation and energy projects has stimulated demand for LCVs, especially from the construction and utilities sectors. The expansion of last-mile delivery networks, a trend amplified during the pandemic, has spurred purchases of light commercial vans for parcel and food delivery.

- From 2017 to 2023, Europe's LCV market witnessed a remarkable upswing, with volumes surging by 38%. This surge was propelled by the e-commerce boom, which fueled the expansion of delivery networks and subsequently boosted van sales. Additionally, replacement demand from sectors like retail, construction, and services played a pivotal role. While the market contracted in 2020 due to pandemic disruptions, it swiftly rebounded, riding the wave of accelerated digital adoption. Overall, steady economic growth and robust infrastructure investments were key drivers of the European LCV market's expansion during this period.

- The LCV market in Europe is poised to register a CAGR of 3.1% from 2024 to 2030. This growth trajectory will be propelled by ongoing infrastructure development, the continued expansion of last-mile delivery networks, and the rising urbanization trend. These factors, coupled with the increasing demand for LCVs in services, food delivery, and construction sectors, paint a promising outlook. However, the market may face headwinds as evolving regulations on emissions and urban access could bolster the adoption of alternatively fueled vans.

Country-specific trends within the European light commercial vehicles market highlight the region's push toward reducing emissions and enhancing efficiency

- Major European markets witnessed varying LCV sales volumes in 2022, reflecting their distinct economic landscapes. Germany, buoyed by a resilient economy, saw a robust 6.3% growth. Conversely, the United Kingdom faced economic uncertainties, leading to a contraction of 2.1% in LCV sales. France, Italy, and Spain experienced declines of 3% to 5%, aligning with broader macroeconomic challenges. However, as the post-pandemic conditions improve, 2023 is projected to witness a rebound, with most countries eyeing a volume growth of 4-6%.

- From 2017 to 2021, the prominent European LCV markets - Germany, France, Italy, Spain, and Poland - showcased healthy expansion, registering a pre-pandemic CAGR of approximately 3-5%. This growth was propelled by robust economic activities, particularly in industries like construction, delivery, and services. While the pandemic-induced contractions in 2020 were relatively short-lived, the recovery has been uneven, primarily due to disparities in fiscal stimulus measures and vulnerabilities in industries such as retail and hospitality.

- The European LCV market is poised for a steadier growth trajectory, with an anticipated annual average of 3-4% from 2023 to 2029. Factors such as infrastructure investments, the rise of last-mile delivery networks, and ongoing economic recovery are expected to bolster demand. However, risks loom from factors like high inflation, energy costs, and political uncertainties. Additionally, the market's shift toward electric drivetrains will further shape its dynamics. The European LCV market is set for a gradual expansion in the long run.

Europe Light Commercial Vehicles Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Light Commercial Vehicles Industry Overview

The Europe Light Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 62.47%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93014

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Latvia

- 5.3.11 Lithuania

- 5.3.12 Norway

- 5.3.13 Poland

- 5.3.14 Russia

- 5.3.15 Spain

- 5.3.16 Sweden

- 5.3.17 UK

- 5.3.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 Mercedes-Benz

- 6.4.5 Peugeot S.A.

- 6.4.6 Toyota Motor Corporation

- 6.4.7 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.