Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693631

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693631

Japan Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 251 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

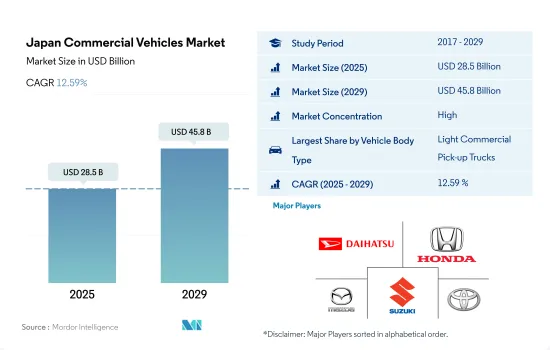

The Japan Commercial Vehicles Market size is estimated at 28.5 billion USD in 2025, and is expected to reach 45.8 billion USD by 2029, growing at a CAGR of 12.59% during the forecast period (2025-2029).

The Japanese government's ambitious goal of carbon neutrality by 2050, coupled with incentives for green investments, is driving the rapid adoption of electric vehicles (EVs) in Japan, despite challenges posed by the COVID-19 pandemic

- In 2020, the Japanese government set a 'carbon neutral' target, aiming for zero carbon emissions by 2050. Despite the challenges posed by the COVID-19 pandemic, Huis Ten Bosch took a step toward its environmental objectives by introducing all-electric buses. The market for alternative vehicles, including plug-in hybrids, fuel cell electric vehicles, and battery electric vehicles, has witnessed a remarkable surge in recent years.

- While the COVID-19 pandemic disrupted numerous sectors, the electric vehicles (EVs) market has been on a notable expansion trajectory, driven by a rising global adoption rate. In the wake of the pandemic, consumers are increasingly seeking more cost-effective options. However, Japan's transportation industry, which accounted for 19% of the nation's total emissions, contributed to a staggering 1.11 billion tons of CO2 emissions in 2019. In response, the automotive sector is actively bolstering efforts to reduce CO2 emissions, ramping up the supply of next-gen vehicles and enhancing fuel efficiency.

- The Japanese government is actively endorsing the use of ethanol in gasoline. By the mid-2030s, the policy aims to phase out gasoline-powered vehicles, favoring a shift toward electric vehicles, including hybrids and fuel cells. To drive economic growth, the government is offering tax exemptions and financial incentives, targeting a boost of JPY 90 trillion (USD 870 billion) annually through green investments and sales by 2030, and a staggering JPY 190 trillion (USD 1.8 trillion) by 2050. This heightened emphasis on battery electric and full hybrid vehicles is poised to shape the market's growth in the coming years.

Japan Commercial Vehicles Market Trends

Japan's electric vehicle market grows gradually due to government and industry partnerships

- The electric vehicle industry in Japan is growing gradually, and the government's norms and targets to electrify all new car sales by 2035 are shifting the country toward electric mobility. Moreover, government efforts in terms of subsidies and rebates are driving the country's electric vehicle market. In November 2021, the government of Japan announced that it would provide subsidies on electric vehicles, i.e., up to USD 7200 per vehicle. However, hybrid vehicles are not included in the subsidy program. Such factors contribute to the growth of electric vehicles (passenger cars) by 11.11% in 2022 over 2021.

- Various companies are signing partnerships and ventures to enhance electric mobility in various sectors across Japan. In June 2022, the technology company Sony and the Japanese automaker Honda signed a joint venture to work on electric mobility together. The objective of the venture is to produce and sell electric cars in Japan by 2025. Moreover, Honda has announced the launch of 30 electric vehicles and the production of 2 million vehicles annually by 2030. Each company has invested approximately USD 37.52 million in the venture. Such factors are expected to impact electric mobility positively.

- In April 2022, the US-based automaker General Motors announced an expand its partnership with Honda to produce electric vehicles. As part of the expansion, the companies will develop new affordable electric vehicles, including cars. The production of the vehicles is expected to start in early 2027. Moreover, such international expansions are expected to develop new designs and enhanced cars, which further is expected to raise the sales of electric cars During the 2024-2030 period in Japan, which will also accelerate the demand for battery packs across Japan.

Japan Commercial Vehicles Industry Overview

The Japan Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 81.27%. The major players in this market are Daihatsu Motor Co. Ltd., Honda Motor Co. Ltd., Mazda Motor Corporation, Suzuki Motor Corporation and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93019

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daihatsu Motor Co. Ltd.

- 6.4.2 Honda Motor Co. Ltd.

- 6.4.3 Isuzu Motors Limited

- 6.4.4 Mazda Motor Corporation

- 6.4.5 Mitsubishi Motors Corporation

- 6.4.6 Renault-Nissan-Mitsubishi Alliance

- 6.4.7 Stellantis N.V.

- 6.4.8 Subaru Corporation

- 6.4.9 Suzuki Motor Corporation

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.