Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693634

India Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 172 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

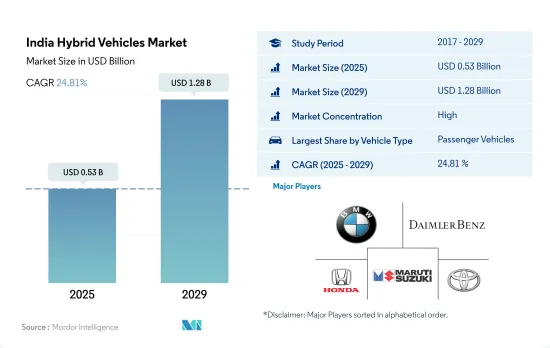

The India Hybrid Vehicles Market size is estimated at 0.53 billion USD in 2025, and is expected to reach 1.28 billion USD by 2029, growing at a CAGR of 24.81% during the forecast period (2025-2029).

Hybrid vehicles serve as a bridge in the country's shift to full electric mobility, marking India's incremental steps toward electrification

- The Indian hybrid vehicles market, though not as vast as that for purely electric vehicles, presents a critical stepping stone toward achieving broader goals of fuel efficiency and reduced emissions across different vehicle types, such as passenger cars, commercial vehicles, and two-wheelers. Full hybrids, which can operate on both an internal combustion engine and an electric motor without the need to be plugged in, offer a practical compromise between traditional and fully electric vehicles, providing enhanced fuel efficiency and lower emissions compared to conventional vehicles.

- In the passenger car segment, full hybrid vehicles are gradually gaining traction among Indian consumers, primarily in the mid to high-end market segments. The appeal of hybrid cars in India lies in their ability to offer significant improvements in fuel efficiency and reduced operational costs without the range anxiety or infrastructure demands associated with pure electric vehicles. However, the growth of HEVs in the passenger car segment has been somewhat constrained by higher initial purchase prices and a limited selection of models, although this is beginning to change as more manufacturers enter the market and technology costs decrease.

- The commercial vehicle segment in India has seen limited but growing interest in hybrid technology, particularly in sectors where environmental concerns and fuel efficiency are becoming increasingly important. Hybrid buses are a notable example, with several cities initiating trials or small-scale deployments of hybrid technology to reduce emissions and fuel consumption in public transportation.

India Hybrid Vehicles Market Trends

India's auto interest rates have shown a consistent downward trend, driven by RBI's measures and evolving lending practices

- In recent times, India's auto interest rate stood at approximately 8.567%, marking a decline from the 8.698% observed in 2021. This slight decrement of about 1.5% continues the trend from the prior year, wherein rates reduced from 9.15% in 2019 to 8.698% in 2021. Factors underpinning these dynamics may encompass monetary policy decisions by the Reserve Bank of India (RBI), domestic credit demand, and broader macroeconomic conditions.

- During 2017-2023, India's auto interest rate was observed at 9.508%. Over the subsequent years, the rate experienced minor fluctuations, descending slightly to 9.454% in 2018 and then marginally ascending to 9.466% in 2019. However, a more significant decline was observed from 2019 onwards, culminating at 8.567% in 2022. Reports from the RBI suggest that these shifts could be attributed to a combination of monetary easing measures, evolving lending practices, and attempts to bolster economic growth in the face of challenges such as the global pandemic.

- The recent trend analysis of India's auto interest rates anticipates a continued trend of relatively lower interest rates in the coming years. The current decrease to 8.567% in 2022, building on the decline from 9.15% in 2019, reflects a deliberate effort by the Reserve Bank of India (RBI) to stimulate economic growth. This downward pressure on rates is likely to persist as the RBI continues to employ monetary easing measures and lending practices evolve to support credit demand.

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Hybrid Vehicles Industry Overview

The India Hybrid Vehicles Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are BMW India Private Limited, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited and Toyota Kirloskar Motor Pvt. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93022

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Logistics Performance Index

- 4.12 Used Car Sales

- 4.13 Fuel Price

- 4.14 Oem-wise Production Statistics

- 4.15 Regulatory Framework

- 4.16 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Audi Auto India Pvt. Ltd.

- 6.4.2 BMW India Private Limited

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Honda Cars India Limited

- 6.4.5 Hyundai Motor India Limited

- 6.4.6 Maruti Suzuki India Limited

- 6.4.7 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.8 Volvo Auto India Private Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.