Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693662

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693662

North America Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 200 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

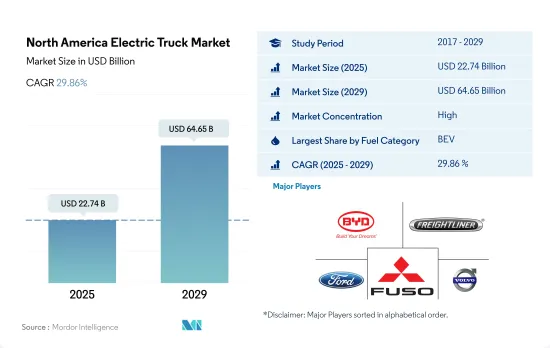

The North America Electric Truck Market size is estimated at 22.74 billion USD in 2025, and is expected to reach 64.65 billion USD by 2029, growing at a CAGR of 29.86% during the forecast period (2025-2029).

The electric commercial truck market witnesses remarkable growth, becoming a key player in sustainable transport with a growth spurt expected through 2030

- Fuel cell electric vehicles hold the largest share in the overall electric vehicle category due to the growing logistics industry, stringent emission regulations by the government, logistics companies replacing IC engines with electric fleets, and logistics companies placing more electric vehicle orders.

- Major delivery firms are beginning to replace their gas-powered fleets with electric or low-emission vehicles to combat climate change and urban pollution. Big e-commerce companies have already announced plans to turn their entire fleets electric. For instance, in March 2021, FedEx announced its global target for 50% of all newly procured vehicles to be electric by 2025, rising to 100% of all new purchases by 2030. FedEx aims to achieve carbon-neutral operations globally by 2040, with the electrification of its pickup and delivery vehicles as a major investment area.

- The US government has been proactive in enacting policies to encourage the adoption of electric vehicles. For instance, New York City relaunched its Clean Trucks Program in June 2020, which provides funding to incentivize the transition from diesel to electric models. Incentive funding between USD 12,000 and USD 185,000 is available for replacing older diesel Class 4 to Class 8 trucks. This program will be instrumental in helping the city achieve its goal of carbon neutrality by 2050.

- The demand for electric trucks is anticipated to increase as the logistics and e-commerce industries are growing rapidly. Retail e-commerce sales in the United States were estimated at USD 768 billion in 2021, with a y-o-y growth of 19.25%. In 2020, retail e-commerce sales were around USD 645 billion. Thus, the demand for electric trucks is anticipated to register a CAGR of 2.9% between 2024 and 2030.

North America registering emerging interest in electric trucks, with country-specific adoption rates influenced by regulatory incentives and the push for green logistics

- The electric truck market in North America is witnessing a notable shift toward sustainable transportation. In the United States, this market is experiencing rapid expansion, driven by substantial investments from both startups and established automotive manufacturers. The surge is further bolstered by state and federal policies, exemplified by California's Advanced Clean Trucks regulation, which mandates a rise in zero-emission truck sales.

- Increasing corporate sustainability commitments, coupled with federal incentives, are prompting fleet operators and businesses across North America to explore electric trucks as viable alternatives to traditional ICE vehicles. While Canada's electric truck market is in its early stages, it shows promise, propelled by the government's environmental goals and incentives. The Canadian government's focus on carbon emissions reduction extends to support for zero-emission vehicles (ZEVs), including electric trucks. Programs like the Incentives for Zero-Emission Vehicles Program (iZEV) and investments in charging infrastructure underscore the country's dedication to fostering an electric mobility ecosystem.

- Provinces like Quebec and British Columbia, with their own ZEV mandates and incentives, are at the forefront of electric truck adoption, particularly in urban logistics and municipal services. In Mexico, the electric truck market is still emerging, driven by concerns over urban air quality and the demand for sustainable transportation. Notably, initiatives in Mexico are concentrated in major urban centers, such as Mexico City, where pollution is a pressing issue.

North America Electric Truck Market Trends

Growing demand for electric vehicles in North America driven by government support and growing environmental concerns

- The CVP in Russia has experienced significant fluctuations in recent years. It climbed steadily from USD 208.2 million in 2017, peaking in 2019. However, it dipped to USD 193.9 million in 2020, largely due to the economic challenges brought on by the COVID-19 pandemic. Notably, the market rebounded sharply in 2022, reaching USD 269.8 million. This resurgence highlights both the resilience of the Russian automotive sector and the potential impact of economic stimulus measures and heightened consumer demand.

- Government incentives and subsidies are proving to be a strong draw for customers, particularly logistics and e-commerce firms, in their adoption of electric commercial vehicles. A case in point is Canada and North America, where, in April 2022, the government unveiled federal rebates of USD 5000 for electric light- and medium-duty vehicles. These initiatives are expected to significantly bolster the demand for electric commercial vehicles in North America from 2024 to 2030.

- Government initiatives, including plans for EV deployment, attractive incentives, and foreign investment allowances, are set to propel the electric vehicle market across North American nations. In a notable move, in March 2022, Volkswagen committed a staggering USD 7 billion to establish an electric car manufacturing facility in North America. By 2030, the automaker plans to roll out 25 new EV models, catering to customers in the US, Mexico, and Canada. As a result, the demand for electric vehicles is projected to witness a notable surge across various North American countries from 2024 to 2030.

North America Electric Truck Industry Overview

The North America Electric Truck Market is fairly consolidated, with the top five companies occupying 89.48%. The major players in this market are BYD Auto Co. Ltd., Daimler Truck North America LLC (Freightliner Trucks), Ford Motor Company, Mitsubishi Fuso Truck and Bus Corporation and Volvo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93055

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Trucks

- 5.1.1.1 Heavy-duty Commercial Trucks

- 5.1.1.2 Medium-duty Commercial Trucks

- 5.1.1 Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 US

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler Truck North America LLC (Freightliner Trucks)

- 6.4.3 Ford Motor Company

- 6.4.4 Mitsubishi Fuso Truck and Bus Corporation

- 6.4.5 Nikola Corporation

- 6.4.6 Orange EV

- 6.4.7 PACCAR Inc.

- 6.4.8 Sany Heavy Industry Co. Ltd.

- 6.4.9 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.