PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441651

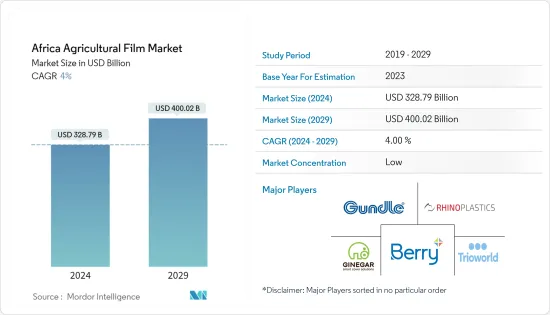

Africa Agricultural Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Africa Agricultural Film Market size is estimated at USD 328.79 billion in 2024, and is expected to reach USD 400.02 billion by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the working of several markets, including the agricultural film market in the region. The pandemic affected the manufacturing process and supply chain networks, resulting in losses for companies and greenhouse producers. It caused delays in customers' investment projects in 2020, which led to a large decrease in order intake of greenhouse projects compared to 2019. The market demand was severely impacted for production companies that are dependent on certain components being imported from other countries owing to the production shortage in importing nations during the COVID-19 pandemic.

Agricultural films are treated like a modern-day application in many innovative agricultural practices. Focus on the improvement of agricultural productivity in the advent of shrinking farmland and expanding population are the main reasons behind the commercialization of this specialty product. The popularity of greenhouse agriculture and modern-day farming practices necessitates the use of agricultural films in the region.

The linear low-density polyethylene (LLDPE) dominates the market by type. LLDPE exhibits excellent mechanical properties for covering linear cultivations, such as watermelon, melon, and tomatoes, under low tunnels. Product innovation that includes ultraviolet (UV) blocking, NIR blocking, fluorescent, and ultra-thermic films are expected to help the market grow further over the forecast period.

Mulching is one of the applications in which agricultural films are widely used. Since most of the area under agriculture was open cultivation, mulching the soil using films has become a common practice globally. Large strips of areas under greenhouse vegetables and a growing emphasis on high value and export-oriented cultivation of fruits and vegetables are driving the market for agricultural films in Africa.

The demand for protected horticultural production systems is expected to increase over the coming years in Africa. Climate change, urbanization, and more professional production are underlying processes. Greenhouses in South Africa produce both flowers and (fruit) vegetables, and greenhouses in Ghana mainly produce tomatoes and some other vegetables for the local market. Therefore, the expanding cultivation of fruits and vegetables by the greenhouse method in Africa is expected to drive the demand for agricultural films further in the future. Therefore, with the adoption of newer production technologies, agricultural films are gaining popularity and driving the market's growth.

Africa Agricultural Film Market Trends

Increased Food Demand and Need for Increased Agricultural Food Productivity

According to FAO, the African population is expected to grow between 2009 and 2050. At the same time, per capita income is also projected to grow across Africa. With the increasing per capita income and growing population, the demand for food is also estimated to grow. As per FAO, the food demand in Africa is expected to increase by 20 to 60% by 2050. Many factors such as climate change, the outbreak of pests, and the lack of investments make it challenging to produce enough food.

Due to the increasing population, African food production needs to increase by more than 15% by 2050 to cater to the growing food demand. This suggests a need for a significant increase in the production of certain food commodities. For instance, the production of cereals must reach around 0.5 billion ton by 2050, an increase from nearly 0.2 billion ton in 2018. There is also a decline in arable land all across Africa. According to a report by the Food and Agricultural Organization (FAO), in Africa, arable land decreased from 387.9 million hectares in 2014 to 319.2 million hectares in 2018, and it is estimated to decrease further in the near future. The primary vegetable area harvested in 2020 increased to 10,218.3 thousand hectares, with productivity reaching 83,331 hg per hectare compared to the harvested area of 10,022.3 thousand hectares with 82,785 hg per hectare of yield in 2019.

Hence, to meet the increasing food demand in the country, the production of crops, such as cereals and pulses, needs to increase despite the limited availability of arable land. Farmers are focusing on increasing production by growing the crops in various advanced techniques, including greenhouses. This has boosted the demand for agriculture film usage in Africa. The agricultural film market is gaining a competitive advantage due to the above factors.

Greenhouse Applications Dominating the Market

The growing rise of sustainable farming due to rising urbanization is among the important factors that might help the greenhouse film segment grow during the forecast period in Africa. Mulch films are used to protect the crop from the proliferation of weeds. They also prevent moisture loss and improve crop yield. These factors can be advantageous in the dry parts of Africa and are offering growth opportunities to players in the mulch film market.

There is a constant decline in arable land and a growing need to improve crop productivity. Moreover, the world's expanding population and the subsequent increase in food demand are driving sustainable growth in the global agriculture industry. These factors can help increase the demand for mulch films in the market as they improve crop quality and aid water retention.

The film protects the crops and the soil from adverse weather conditions. Additionally, the growing environmental concerns are projected to increase the usage of biodegradable mulch films in Africa. Mulching is a part of conservation agriculture, which improves food production in smallholder farming systems in Africa. Tomatoes and onions, the most common vegetables, grow in large quantities along the coast of North Africa, where mulching can be practiced. These advantages are anticipated to boost the usage of mulch films in Africa.

Africa Agricultural Film Industry Overview

The African agricultural film market is highly fragmented, with prominent players occupying around 12.8% of the market share. Berry Global Inc. dominates the market, followed by Rhino Plastics (Pty) Ltd, Gundle Plastics Group (Pty) Ltd, Ginegar Plastic Products Ltd, and Trioworld.

These major players invest in new products and improvise products, expansions, and acquisitions to grow their businesses. Another central area of investment is in R&D to launch new products at lower prices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Low-density Polyethylene

- 5.1.2 Linear Low-density Polyethylene

- 5.1.3 High-density Polyethylene

- 5.1.4 Ethyl Vinyl Acetate (EVA)/Ethylene Butyl Acrylate (EBA)

- 5.1.5 Reclaims

- 5.1.6 Other Film Types

- 5.2 Application

- 5.2.1 Silage

- 5.2.2 Mulching

- 5.2.3 Greenhouse

- 5.3 Geography

- 5.3.1 South Africa

- 5.3.2 Morocco

- 5.3.3 Egypt

- 5.3.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Berry Global Inc.

- 6.3.2 Ginegar Plastic Products Ltd

- 6.3.3 INDEVCO (Industrial Development Company) Group

- 6.3.4 BASF SE

- 6.3.5 Gundle Plastics Group (PTY) Ltd

- 6.3.6 Grupo Armando Alvarez

- 6.3.7 Trioworld

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 AN ASSESSMENT ON THE IMPACT OF COVID-19