PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686560

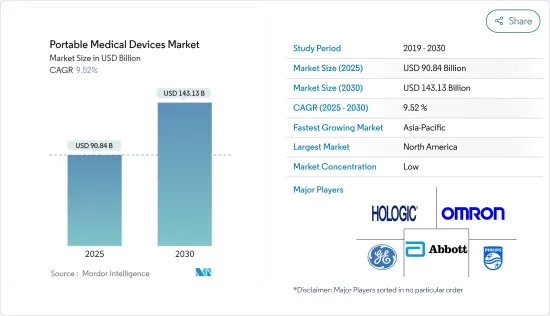

Portable Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Portable Medical Devices Market size is estimated at USD 90.84 billion in 2025, and is expected to reach USD 143.13 billion by 2030, at a CAGR of 9.52% during the forecast period (2025-2030).

The outbreak of the COVID-19 pandemic extended the role of portable medical devices in the healthcare trade. Portable technologies have always been crucial for both patients and professionals in effectively managing health in remote settings. With increasing focus on health management during COVID-19, portable medical devices have experienced increased demand in home settings. For example, according to the study titled 'A Wearable Tele-Health System towards Monitoring COVID-19 and Chronic Diseases' published in March 2021, simple, wearable, non-obtrusive sensor devices that can be monitored remotely can cut down on hospital admissions and visits. Such studies show the importance of portable medical devices, positively impacting the market growth.

Various companies are entering the landscape with innovative portable products. In June 2021, Mohali-based Walnut Medical developed 5L and 10L portable medical-grade oxygen concentrators based on pressure swing adsorption (PSA) technology in India with an oxygen purity of above 96% at a pressure of 55-75 kpa. This offered a unique opportunity during pandemic.

The portable medical devices market is expected to witness rapid growth due to the escalating demand for portable medical devices and wearable electronics, increased technological advancements, and a rise in the geriatric population. The rise in technological advancements in portable medical devices (such as the incorporation of new technology in the device to enhance its utility, accuracy, ease of access, and workflow) will lead to an increase in the adoption of the portable devices, driving the market growth. In August 2022, SmartCardia launched their 7L patch, a 7-lead cardiac monitoring patch. With the use of artificial intelligence (AI), this cutting-edge patch monitor integrates wearable medical technology with remote patient monitoring to deliver tailored and predicted patient insights.

Additionally, in June 2022, GE Healthcare launched Portrait Mobile, a wireless patient monitoring technology that allows for constant monitoring throughout a patient's stay. The technique aids doctors in identifying patient decline. A mobile monitor can communicate with patient-worn wireless sensors in Portrait Mobile. Therefore, owing to the rise in the launch of technologically advanced portable medical devices, the market is expected to grow over the forecast period.

Moreover, the growing geriatric population is expected to propel the growth of the market. According to the World Population Prospects 2022 report published by the United Nations Department of Economic and Social Affairs, 771 million people worldwide will be 65 years or above in 2022. Furthermore, according to the same source, by 2030, there will be 994 million older adults in the world, and by 2050, the number will hit 1.6 billion. Thus, all aforementioned factors are expected to boost the market over the forecast period.

However, security concerns and high cost of medical devices may restrain the market over the forecast period.

Portable Medical Devices Market Trends

Diagnostic Imaging Segment Expected to Hold Significant Market Share Over the Forecast Period

The diagnostic imaging equipment segment covers a wide array of medical devices used for diagnostic purposes like ultrasound, X-ray, and MRI, among others. It has a vast range of applications in the oncology, orthopedic, gastro, and gynecological fields. The key factors bolstering the diagnostic imaging segment are the rising burden of chronic diseases (as these devices are used in diagnosing diseases) and technological advancements in diagnostic imaging. According to the American Cancer Society 2022, in the United States, around 1.9 million new cancer cases and 609,360 cancer-related deaths are anticipated to be identified in 2022. Thus, a rise in the incidence of cancer escalates the demand for diagnostics imaging devices and is expected to drive market growth.

Technological advancements and product launches in diagnostic imaging are driving the diagnostic imaging equipment segment globally. For instance, in July 2022, Fujifilm Europe launched a new flexible, hybrid C-arm and portable X-ray machine. The device, called FDR Cross, is designed to offer high-quality fluoroscopic and static X-ray images during surgery and other medical procedures.

Additionally, in January 2022, ClariusMobile Health launched a third-generation product line of high-performance handheld wireless ultrasound scanners for all medical specialists. Similarly, in December 2021, EagleViewultrasound introduced its wireless portable ultrasound device, which provides much freedom for ultrasound imaging and makes the point-of-care solution more affordable. Thus, the abovementioned factors are expected to drive the segment over the forecast period.

North America Leading the Portable Medical Devices Market and Expected to do the Same Over the Forecast Period

North America is estimated to hold the largest value share in the portable medical devices market. High adoption of technologically advanced devices, high treatment rates, and supportive government initiatives for early diagnosis of diseases are among the few factors driving the market. An example of government initiatives in the area of imaging is the Cancer Imaging Program initiated by the National Cancer Institute. This program is aimed at promoting and supporting cancer-related basic, clinical, and translational research in imaging and technology. It is also aimed at developing, integrating, and applying these imaging innovations for the clinical management of cancer.

High adoption of monitoring, diagnostic, and therapeutic systems for disease management is anticipated to bode well for regional growth. The growing geriatric population and a subsequently rising burden of chronic diseases are also propelling the market. According to the Centers for Disease Control and Prevention (CDC), in July 2022, 12.1 million Americans were expected to have atrial fibrillation (AFib) by the year 2030. Thus, the increasing prevalence of AFib is expected to increase market growth as these patients require constant monitoring.

In addition, as per data published by the National Cancer Institute, in 2021, there were around 1,806,590 new cases of cancer diagnosed in the United States, and 606,520 people died from the disease. Therefore, due to the rising burden of chronic diseases such as cancer and cardiovascular diseases in the country, the demand for portable medical devices is expected to increase and subsequently drive the market.

Moreover, the launch of technologically advanced products in the country is expected to further drive market growth. For instance, in March 2022, MobvoiInc., in partnership with the global health tech company CardieX, launched its first heart health monitoring smartwatch, the TicWatchGTH Pro. The watch also utilizes sensors to provide insights into general and arterial health through high-fidelity sensing points that track both from the wrist and through the finger. Additionally, in September 2021, GE Healthcare launched the AMX Navigate, a new portable, digital X-ray system designed with a first-of-its-kind power-assisted Free Motion telescoping column that aims to reduce lift force by up to 70% and decrease technologist injury. Thus, due to the abovementioned factors, the market studied is expected to grow significantly in the country.

Portable Medical Devices Industry Overview

The portable medical devices market is highly competitive with the presence of a large number of players. The market has a considerable number of companies that are significantly contributing to its growth. Product innovation and ongoing R&D activities to develop advanced technologies have helped boost the market's growth. Various strategies and collaborations are being adopted by key players to maintain their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Demand for Portable Medical Devices and Wearable Electronics

- 4.2.2 Increase in Technological Advancements

- 4.2.3 Rise in Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Security Concerns

- 4.3.2 High Cost of Portable Medical Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Products

- 5.1.1 Diagnostic Imaging

- 5.1.2 Monitoring Devices

- 5.1.2.1 Cardiac Monitoring

- 5.1.2.2 Neuro Monitoring

- 5.1.2.3 Respiratory Monitoring

- 5.1.2.4 Other Monitoring Devices

- 5.1.3 Other Products

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Physician Offices

- 5.2.3 Homecare Settings

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Becton, Dickinson and Company

- 6.1.2 General Electric (GE Healthcare)

- 6.1.3 Hologic Inc.

- 6.1.4 Abbott Laboratories

- 6.1.5 Samsung Electronics Co. Ltd (Samsung Healthcare)

- 6.1.6 Fujifilm Holdings Corporation

- 6.1.7 Koninklijke Philips N.V.

- 6.1.8 Omron Healthcare

- 6.1.9 Medtronic Inc.

- 6.1.10 Siemens Healthcare

7 MARKET OPPORTUNITIES AND FUTURE TRENDS