PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444157

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444157

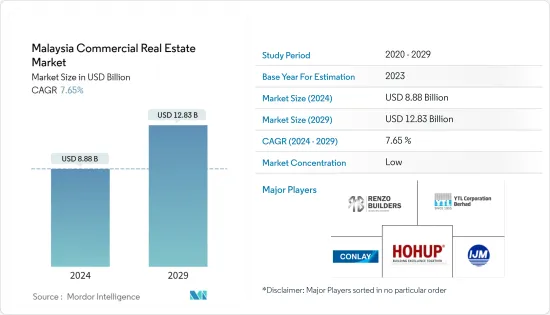

Malaysia Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Malaysia Commercial Real Estate Market size is estimated at USD 8.88 billion in 2024, and is expected to reach USD 12.83 billion by 2029, growing at a CAGR of 7.65% during the forecast period (2024-2029).

Key Highlights

- As per industry experts, in the first half of 2022 (H1 22), across property market performance in the Klang Valley, Penang, Johor Baru, Johor, and Kota Kinabalu in Sabah, the industrial real estate sector continued to grow in comparison to the retail industry. The industrial sector has consistently grown over the past few years due to rising e-commerce penetration rates. The rise in long-distance shipping increased the need for warehouse space and a structural change toward omnichannel retailing. There is strong interest in selling or buying existing commercial assets (land or buildings) in Sabah, Johor, and Klang Valley, whether taking advantage of bargains for high-quality assets or implementing a portfolio rationalization exercise. The Logistics and Industrial sub-sectors remain the real estate industry's new darlings. As people exit pandemic management after two years, there is a clear interest in the Healthcare sub-sector becoming an alternative investment to watch.

- According to Industry experts, the real estate market in Malaysia is slowly improving as buyers are still dealing with the repercussions of COVID-19. According to the company's most recent research on the Malaysian real estate market, the Landed Property Sale Price Index increased by 1.1% quarter over quarter and 3.64% year over year in the second quarter (Q2) of 2022. It is accompanied by a 5.21% increase but a QoQ decline of 1.96% in the Landed Property Sale Demand Index. Even though potential purchasers are discouraged by affordability and financial instability challenges, the group claimed that the pattern showed that landed properties are still the preferred purchasing option. It led to slower demand for homes.

- Year-on-year (y-o-y), Malaysia's volume of property transactions registered a 1.78% marginal drop in the first nine months of 2021 to clock in at 201,068 transactions. However, the transaction value rebounded nearly 14% to almost MYR 98 billion (USD 22.10 billion) or up to about MYR 11.2 billion (USD 2.53 billion) in 2020. Investments into the Office, Retail, Hotel / Leisure, Industrial, and Logistics sub-sectors will increase in 2022-23. Developers have increased their investment across the board in all sub-sectors, indicating increased activity in 2022-23 over the previous two years. Managers of mutual funds and real estate investment trusts have increased their exposure to industrial and hospitality assets, with a roughly equal distribution in the other sub-sectors. Lenders have reduced their exposure in almost all sub-sectors except the Office sub-sector.

Malaysia Commercial Real Estate Market Trends

Rise in growth in retail sector

Post-pandemic structural trends in the country's commercial real estate (CRE) market will likely exacerbate already-existing imbalances. This is because vacancy and rental rates of office and retail spaces have gotten worse since the pandemic outbreak and may take longer to get better due to the structural changes seen. In Malaysia's real estate market, the value of the massive transactions grew 61% QoQ (MYR 1.13 billion (USD 0.25 billion): Q4/2021) to over MYR 1.82 billion (USD 0.48 billion).

According to Savills, the most significant transaction occurred in Kuala Lumpur, when Hap Seng Consolidated Bhd paid MYR 868 million (USD 195.83 million) to acquire a vacant 15.3-acre commercial site on Jalan Duta from TTDI KL Metropolis Sdn Bhd (a wholly-owned subsidiary of Naza TTDI Sdn Bhd). It is to construct a mixed-use development with a projected gross development value of MYR 8.7 billion (USD 1.96 billion).

In 2021, the value of construction work grew by -5.0% to MYR 112.0 billion (USD 25.27 billion) compared to MYR 117.9 billion (USD 26.6 billion) in 2020. Budget 2022 announced that the government would invest MYR 2 billion (USD 0.45 billion) in guarantees to banks via the Guaranteed Credit Housing Scheme. It is aimed at assisting those in the gig economy, people with funds to pay for loans but who cannot produce an income statement because they do not earn in the traditional sense.

Increase in government spending in private sector

In its 2021 budget, the Malaysian government announced a Protection of People and Recovery of the Economy (PEMULIH) aid package to support construction businesses that may benefit private companies. It includes the allowance of price changes or Variation of Price (VoP) for government projects. It follows a significant increase in the cost of building materials and assistance for local G1-G4 contractors to carry out small-scale government projects by conducting lottery and tendering processes. It also enables the use of new civil engineering and building and electrical work rate schedules and the allowance of Extension of Time (EoT) or extension of contract on government projects for supply and service contracts affected by the implementation of the Movement Control Order (MCO) subject to a contract clause.

The private sector continued to propel the construction activity with a 58.7% share of the value of construction work done MYR 16.2 billion (USD 3.87 billion) as compared to the public sector with a 41.3% share of the value of construction work done MYR 11.4 billion (USD 2.72 billion). The value of construction work done in residential and non-residential building subsectors remained significant in the projects owned by the private sector, which contributed 37.9% and 37.1%, respectively. Meanwhile, the project owned by the public sector remained underpinned by the Civil engineering subsector with a share of 69.4%.

Malaysia Commercial Real Estate Industry Overview

The Malaysia Commercial Real Estate Market is fragmented, with many players having scope for growth. Major Malaysian commercial real estate market players include Conlay Construction, YTL Corporation, IJM Corporation, Ho Hup Construction Company, and Renzo Builders. The developers are trying to bring new, lower-cost products to meet current demand. Evolving technological advancements such as new proptech solutions drive the market in terms of increased transactions and better management of real estate assets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth trajectory with a steady pipeline of distribution and warehouse projects

- 4.2.2 Increasing investment in Greater Kuala Lumpur for Office Space

- 4.3 Market Restraints

- 4.3.1 Rising commodity prices

- 4.4 Market Oppurtunities

- 4.4.1 The ongoing mega projects will have a positive multiplier effect for the commercial property market

- 4.5 Insights into Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Insights into Existing and Upcoming Projects

- 4.10 Insights into Interest Rate Regime for General Economy and Real Estate Lending

- 4.11 Insights into Rental Yields in the Commercial Real Estate Segment

- 4.12 Insights into Real Estate Tech and Startups Active in the Real Estate Segment (Broking, Social Media, Facility Management, and Property Management)

- 4.13 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Industrial

- 5.1.4 Logistics

- 5.1.5 Multi-family

- 5.1.6 Hospitality

- 5.2 By Key Cities

- 5.2.1 Kuala Lumpur

- 5.2.2 Seberang Perai

- 5.2.3 Kajang

- 5.2.4 Klang

- 5.2.5 Rest of Malaysia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Conlay Construction Sdn Bhd

- 6.2.2 YTL Corporation Berhad

- 6.2.3 IJM Corporation Berhad

- 6.2.4 Ho Hup Construction Company Berhad

- 6.2.5 Renzo Builders (M) Sdn. Bhd.

- 6.2.6 UEM Group

- 6.2.7 Gamuda Berhad

- 6.2.8 China Construction Development (Malaysia) Sdn. Bhd.

- 6.2.9 NS Construction

- 6.2.10 Malaysian Resources Corporation*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX