PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687049

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687049

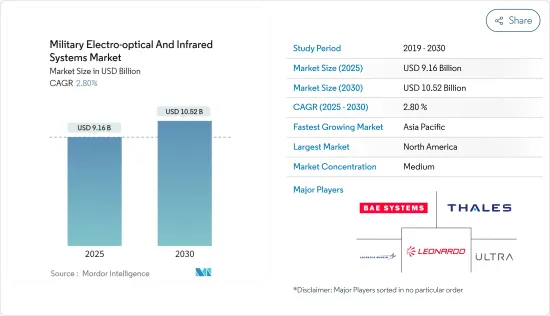

Military Electro-optical And Infrared Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Military Electro-optical And Infrared Systems Market size is estimated at USD 9.16 billion in 2025, and is expected to reach USD 10.52 billion by 2030, at a CAGR of 2.8% during the forecast period (2025-2030).

Key Highlights

- The outbreak of the COVID-19 pandemic and the subsequent shutdowns affected the defense manufacturing sector and the pace of military R&D activities in several countries. The negative impacts of the pandemic were visible in the global defense supply chains, as several programs relied upon a unique global network of part suppliers.

- The market studied is likely to grow steadily during the latter half of the forecast period due to the growing demand for enhanced ISR capabilities for various manned and unmanned systems. These systems make use of electro-optical/infrared (EO/IR) sensors. Countries are progressively adopting these systems to increase their situational awareness.

- However, various design challenges, technological constraints, supply chain risks, the evolving global crisis, and unprecedented factors are projected to restrain the market growth during the forecast period.

Military Electro-optical and Infrared Systems Market Trends

The Sea-based Segment is Expected to Experience the Highest Growth During the Forecast Period

- The sea-based segment of the market is anticipated to register the highest CAGR during the forecast period. The growth of territorial conflicts and border issues increased the risk for maritime assets of militaries, which led to increasing emphasis on surveillance, threat detection, and target identification at sea. As modern combats emphasize these capabilities, armed forces mostly focus on incorporating and integrating sophisticated and advanced sensor systems into their naval vessels.

- Navy vessels need to obtain motion imagery from electro-optical/infrared (EO/IR) sensors that provide day-night and long-range eyes on the target, which improves their ability to identify targets, perform threat assessment, assess intent by the rules of engagement, and support weapon engagement through automatic tracking and fire control solutions through line-of-sight. Thus, the need for better sensor systems that are highly reliable and accurate for maritime patrol to improve sea-based situational awareness has increased.

- In addition, as the naval vessels are isolated from the terrain, it becomes important for them to possess advanced threat detection and countermeasure systems for their long-time survival from impending threats. This is driving the growth of research and development in these sea-based EO/IR sensors currently. Several nations are upgrading their naval EO/IR sensor systems. For instance,

- In March 2022, the Japan Maritime Self-Defense Force (JMSDF) commissioned a new stealth frigate into service. One notable feature is an advanced integrated combat information center developed by Mitsubishi Heavy Industries. This system has a large circular screen where operators may view all navigation, propulsion, tracking, and fire control data. The same system provides the crew 360 degrees of visibility through cameras, enabling them to see the areas around the ship without any blind spots. The remaining essential systems include an APY-2 active electronically scanned array (AESA) X-band radar, fixed and towed sonars, and an OAX-3 EO/IR sensor. Mitsubishi Electric supplied the radar and the EO/IR sensor.

- In June 2022, US Navy selected a team led by L3Harris Technologies to deliver a Shipboard Panoramic Electro-Optic/Infrared (SPEIR) system for enhancing fleet protection. The initial value of the contract is USD 205 million, with a ceiling value of USD 593 million if all the options are exercised until March 2031.

- The SPEIR program marks a generational leap in using 360-degree electro-optic and infrared (EO/IR) imagery and situational awareness, as well as improved EO/IR sensors - from a weapon support sensor to a completely passive mission solution capability. Such developments are expected to bolster the sea-based segment prospects in the future.

North America Held Highest Shares in the Market

- North America held the largest share, primarily due to high demand from the US armed forces for EO/IR systems. The enhanced capabilities of adversaries on the battlefield forced the US to increase its investment in technologically advanced weapon systems. Furthermore, the growing involvement of the US armed forces in various global conflicts significantly contributed to the increased procurement of advanced ISR and other systems that enhance the situational awareness of the military.

- In July 2022, the US House of Representatives recently approved the nation's USD 840 billion defense budget for the next fiscal year, which begins on October 1, 2023, for enhancing the mission readiness of various armed forces of the country. This will increase the Pentagon budget by USD 37 billion, focusing on providing funds to Ukraine's military, competing with China, and addressing the issues of Afghanistan's military withdrawal. Meanwhile, in April 2022, the US House of Representatives approved legislation that loosened the criteria for defense equipment lend-lease agreements with war-torn Ukraine and other countries in Eastern Europe, paving the path for more US weapons to enter the region.

- In February 2022, the US Army announced its plans for a next-generation laser target locator. The Defence Blog website reported that a branch of the Army's acquisition agency is reaching out to the industry to determine vendors' ability to produce and deliver a self-contained Laser Target Locator Module III (LTLM III) that meets updated performance requirements. The PdM SPTD is considering a competitively awarded contract in the first quarter of the fiscal year 2023 and is seeking information from interested companies on their demonstrated ability to meet the requirements for the new locator module within the stated timeline.

- In August 2021, L3Harris Technologies announced that it had received a five-year, USD 96 million IDIQ contract from the US Special Operations Command to procure WESCAM MX electro-optical, infrared, and laser designator sensor suites and services. The sensor systems are expected to provide multi-spectral imaging and designation capabilities for various aircraft within the US Army Special Operations Aviation Command inventory. Similar orders for new electro-optical sensors and the upgrading of various military systems with advanced EO/IR sensors are anticipated to propel the market growth in the region during the forecast period.

Military Electro-optical and Infrared Systems Industry Overview

The military electro-optical & infrared systems market is semi-consolidated in nature, with the presence of few players holding significant shares in the market. Some prominent players in the market are Leonardo S.p.A, BAE Systems plc, THALES, Ultra Electronics Holding, and Lockheed Martin Corporation. Prominent market players have multifaceted product portfolios. Additionally, they try to modify and enhance their current capabilities through continuous research and development and introduce sophisticated features to deliver value-added electro-optical/infrared (EO/IR) solutions to end users. This also helps them introduce low-differentiated products at competitive pricing.

Most of the integration programs are long-term; hence, several IDIQ contracts are currently underway, signifying design modification and production of sophisticated EO/IR sensors per end-user specifications. Since the end-user requirements are diverse, it encourages strategic collaboration between market players.

The development of new integration platforms drives the demand for the integration of sophisticated EO/IR sensors and systems, which, in turn, may create a positive outlook for the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Air-based

- 5.1.2 Land-based

- 5.1.3 Sea-based

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Mexico

- 5.2.4.2 Brazil

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems plc

- 6.2.2 Elbit Systems Ltd.

- 6.2.3 Teledyne FLIR LLC

- 6.2.4 Israel Aerospace Industries Ltd.

- 6.2.5 L3Harris Technologies Inc.

- 6.2.6 Leonardo S.p.A

- 6.2.7 Lockheed Martin Corporation

- 6.2.8 Raytheon Technologies Corporation

- 6.2.9 Rheinmetall AG

- 6.2.10 Saab AB

- 6.2.11 THALES

- 6.2.12 Ultra Electronics Holdings

- 6.3 Other Players

- 6.3.1 Danbury Mission Technologies

- 6.3.2 System Controls

- 6.3.3 Zygo Corporation

- 6.3.4 Navitar

- 6.3.5 Optikos

7 MARKET OPPORTUNITIES AND FUTURE TRENDS