PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444267

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444267

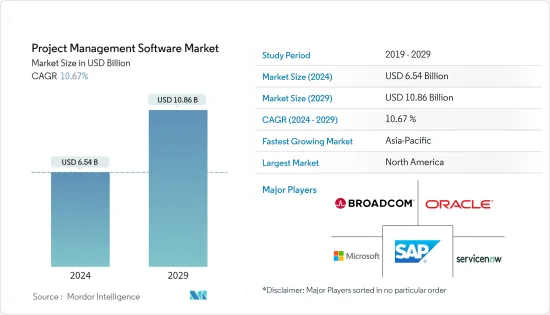

Project Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Project Management Software Market size is estimated at USD 6.54 billion in 2024, and is expected to reach USD 10.86 billion by 2029, growing at a CAGR of 10.67% during the forecast period (2024-2029).

As today's corporations increase in size and complexity, an all-inclusive solution is needed to manage and coordinate an entire organization's portfolio of different projects. These solutions help the management to shuffle between plans, workload, budgets, and resources, carefully observe the project progress and report on delivery success.

Key Highlights

- Project management software (PMS) has evolved into a strategic function of today's business due to the accelerating pace, technological advancements, digital transformations, and disruptions happening across almost every industry.

- Some of the factors that are expected to enhance the growth of the project management software (PMS) systems market include the increasing use of software to manage resources, the rising demand for software that minimizes project risks and project costs, budget and shuffle plans, and help in accessing real-time dashboard anywhere and anytime. On the other hand, increasing sophistication and rising capabilities, such as reminders and setting due dates, are also anticipated to provide further impetus to the market's growth during the forecast period.

- While the factors such as increased sophistication of software systems, growing awareness among end users, and ability to connect and integrate multiple disparate systems are anticipated to drive the demand, the high installation costs of setting up these systems, coupled with high maintenance costs, are dissuading the enterprises in the end user from investing in project management software systems, thus leading to slow market penetration.

- Project management has also evolved into a means of new product development, owing to the emergence of the Internet of Things and the adoption of agile NPD, which has now merged with PMS and has led to the development of new firms like UMT360, GenSight, and Decision Lens in the field of enterprise product creation.

- During the COVID-19 pandemic, project management software provided a 360-degree view of import and fare control analysis, flexibility chain, provincial government strategy, and future impact on the business, among others. Hence, the reliance on such digital solutions has greatly increased and is anticipated to witness no retreat even in the post-pandemic era.

- These software systems also helped project managers evaluate the critical ways the pandemic affected their teams to mitigate the adverse effects and plans to recover, even remotely. Enterprises intend to harness digital channels that can provide proper planning and scheduling, team collaboration, and project budgeting, among others, ultimately leading to supplementing and further strengthening their relationships with their customers.

Project Management Software (PMS) Market Trends

Oil and Gas Segment to Witness High Growth

- Digital transformation and tight budgets are due to global economic conditions and the need to provide a growth platform that can cause an intense change in the oil and gas industry. The smallest delays can cost millions of dollars to an oil and gas or chemical company.

- Enterprises are continuously leveraging the benefits of project management software to increase business productivity, streamline communication, improve project quality, and minimize overall project costs.

- Projects are increasing in volume, size, and scope and need to be scalable. Relying on manual processes and decentralized spreadsheets exposes projects to risks and time to prevent errors. The need for accurate forecasts and useful progress reports is essential. Accurate forecasts and useful progress reports are crucial for business operations.

- Oil and gas organizations are utilizing project management software for real-time accurate project data to focus more time on data analysis over data entry. Industry players focus on adopting capital investment decisions and leveraging digital technologies to achieve higher capital productivity. For instance, in September 2022, Kodiak Gas Services LLC (Kodiak), the largest privately-owned contract compression company in the United States, selected IFS Cloud(TM) to enhance its cross-functional business operations, This allows Kodiak to consolidate its three main systems of record into one system with multiple functional areas and business processes, including sales, supply chain, procurement, human capital management (HCM), and finance. Furthermore, IFS Platinum Partner, Astra Canyon, implements the solution and rolls it out across Kodiak's entire US operations, encompassing 16 sites and 1,157 users.

North America Occupies the Largest Market Share

- The North American region is expected to dominate the project management software market due to the increasing number of enterprises adopting project management software solutions. The increasing demand among organizations to efficiently track and manage their projects is expected to act as a stimulator for adopting PMS in the region.

- The deployment of PMS solutions for task management for successfully executing tasks and flexible work planning is anticipated to drive the market during the forecast period. Additionally, organizations' increased focus on promoting collaborations among the workforce and boosting the team's efficiency drives the market growth.

- In January 2022, TD SYNNEX Corporation announced a new strategic collaboration agreement (SCA) with Amazon Web Services Inc. (AWS) that covers North America, Latin America, and the Caribbean regions. This partnership significantly expands cloud solutions for independent software vendors (ISV) and in cloud technology, enabling partners to expand their offerings to reach larger markets throughout the channel.

Project Management Software (PMS) Industry Overview

The project management software market is very competitive. The market is mildly concentrated because of many small and large players. The key strategies adopted by the major players are mergers and acquisitions and product innovations to stay ahead of the competition and to expand their global reach.

In July 2022, Arcadis and IBI Group agreed to a recommended all-cash offer of USD 19.50 per share for Arcadis to acquire all issued and outstanding shares of IBI Group. This acquisition amplifies the ability to deliver the most innovative and impactful project management software globally and locally, all aimed at new and innovative technology-enabled solutions.

In February 2022, RedTeam Software LLC, a leading construction management software provider, announced the acquisition of paskr Inc., a cloud-based construction management solution. This acquisition robusts a suite of integrated software solutions purpose-built for commercial construction entities of all sizes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Sophistication and Growing Awareness Among End Users

- 4.2.2 Ability to Connect and Integrate Multiple Disparate Systems

- 4.3 Market Restraints

- 4.3.1 High Initial Investment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Vertical

- 5.2.1 Oil and Gas

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Government

- 5.2.5 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 SAP SE

- 6.1.4 Broadcom Inc. (CA Technologies)

- 6.1.5 Basecamp LLC

- 6.1.6 AEC Software

- 6.1.7 Workfront Inc.

- 6.1.8 ServiceNow Inc.

- 6.1.9 Unit4 NV

- 6.1.10 Atlassian Corporation PLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS