PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687215

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687215

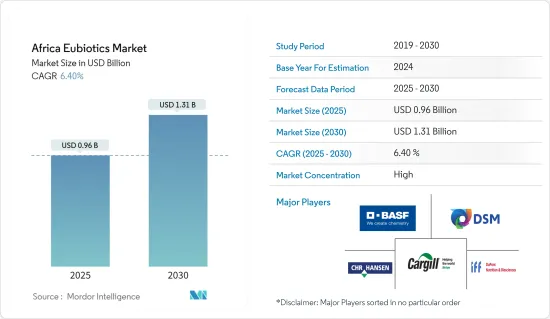

Africa Eubiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Africa Eubiotics Market size is estimated at USD 0.96 billion in 2025, and is expected to reach USD 1.31 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

The restrictions imposed by African governments, such as restrictions on transportation and nationwide lockdowns to mitigate the spread of the COVID-19 virus during the pandemic, led to adverse effects on the industry. These included manufacturing facilities remaining closed, the movement of raw materials and finished goods being restricted, and manpower becoming unavailable due to restrictions. This resulted in economic loss to various eubiotics manufacturing companies. As restrictions were relaxed, the African eubiotics market witnessed a slight increment.

The growing demand for animal production in line with the increasing population and improving the standard of living coupled with growing health concerns over the usage of antibiotics are the factors driving the demand for eubiotics in the region. By type, probiotics was the largest segment, accounting for a majority of the share in 2021. Due to the increased environmental concerns by animal farmers coupled with strict regulations imposed by the European Union, the market for probiotics is projected to grow over the coming years. In terms of geography, South Africa was the largest market in the region, holding the majority market share in 2021. An increase in production and demand for livestock products, a rise in the population and consumption levels, and increasing urbanization are factors resulting in the rising demand for eubiotics in South Africa during the forecast period.

Africa Eubiotics Market Trends

Increasing Industrialization of Livestock

Although the livestock industry in African countries is far behind compared to that in developed nations such as the United States in terms of industrialization, the rate of adaptation of commercial livestock production systems in these countries has been remarkable in recent years. For instance, according to the report 'Africa Sustainable Livestock 2050,' published by the Food and Agriculture Organization (FAO) in 2018, the organized poultry sector in Nigeria produces 21% of the total chicken output in the country. Similarly, in Zimbabwe, large-scale producers provided 2,600-3,000 ton of chicken per month to the organized market. Thus, the significant contribution of the organized sector to the livestock production in these countries implies the increasing industrialization of livestock in the region. Eubiotics play an important role by escalating the growth of animals using many additives. Usage of various eubiotics, like probiotics, has played a decisive role in the development of intensive and industrialized livestock production during the recent decade. Eubiotics have gained popularity as a cost-effective solution for the better and timely growth of animals and livestock. Lower production cost in the case of animal rearing leads to lower market prices and a more plentiful supply of food commodities. The use of eubiotics gives the ability to control and manipulate production to the level of human food demand. Thus, the rising industrialization of livestock production in the region is anticipated to drive the eubiotics market during the forecast period.

Probiotics Dominate the Market

The demand for meat and other animal proteins is rising in the region in line with the increasing population. Furthermore, the Gross National Income (GNI) per capita was recorded at USD 1,561.9 in 2019, an increase from the USD 1,491.1 recorded in 2017. Thus, living standards are also rising in the region in line with the increasing income. This has resulted in higher demand for high protein foods of animal origin, such as meat, milk, and eggs. Therefore, the livestock industry in the region is under pressure to increase productivity in order to meet the growing demand for animal products among consumers. Probiotics give the ability to control and manipulate animal production in line with the increasing demand. Lactobacillus is one of the most commonly used probiotic agents known to improve growth performance, feed conversion efficiency, and regulate the immune system in pigs. Further, the latest research has shown that a specific Bacillus subtilis strain can reduce inflammatory responses and improve intestinal barrier integrity. This would aid the inclusion of probiotics in feed in order to promote gut health and, therefore, animal performance.

The lactobacilli strains have a positive effect on the growth performance of broilers. Chickens supplemented with lactobacillus probiotics during the first week of their birth have shown higher body weight in Ethiopia. The results showed that there was a significant body weight gain in all probiotic-fed groups of chickens.

Thus, the increasing demand for animal protein sources, such as meat, milk, and eggs, is putting the onus on the livestock industry to increase production to match the consumer demand. Therefore, the growing demand for animal protein sources in the region resulting from the increasing population and rising living standards is anticipated to drive the market over the forecast period.

Africa Eubiotics Industry Overview

The African eubiotics market is fragmented, with major players occupying 26.6% of the market studied and others accounting for 73.4%. The top players in the market are Cargill Inc., BASF SE, DuPont de Nemours Inc., Royal DSM, and Chr.Hansen AS. Leading companies are focused on acquiring feed mills, and small manufacturers are expanding their business in local and foreign markets. Some players have been expanding their geographical presence by acquiring or merging with other manufacturers in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Probiotics

- 5.1.1.1 Lactobacilli

- 5.1.1.2 Bifidobacteri

- 5.1.2 Prebiotics

- 5.1.2.1 Inulin

- 5.1.2.2 Fructo-Oligosaccharides

- 5.1.2.3 Galacto-Oligosaccharides

- 5.1.2.4 Other Prebiotics

- 5.1.3 Organic Acids

- 5.1.4 Essential Oils

- 5.1.1 Probiotics

- 5.2 Animal Type

- 5.2.1 Ruminant

- 5.2.2 Poultry

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Pet Food

- 5.2.6 Horses

- 5.2.7 Other Animal Types

- 5.3 Geography

- 5.3.1 South Africa

- 5.3.2 Egypt

- 5.3.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Addcon

- 6.3.2 Royal DSM

- 6.3.3 BASF SE

- 6.3.4 CHR Hansen AS

- 6.3.5 Kemin Industries Inc.

- 6.3.6 Cargill Incorporated

- 6.3.7 EI Du Pont De Numours & Company

- 6.3.8 Novus International Inc.

- 6.3.9 Behn Meyer Group

- 6.3.10 Beneo Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 AN ASSESSMENT OF THE IMPACT OF COVID-19