PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444558

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444558

Utility Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

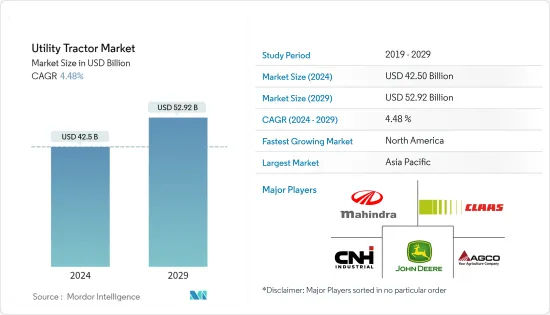

The Utility Tractor Market size is estimated at USD 42.5 billion in 2024, and is expected to reach USD 52.92 billion by 2029, growing at a CAGR of 4.48% during the forecast period (2024-2029).

Key Highlights

- Utility tractor is designed for various tasks such as front loader work, soil cultivation, and transportation. This type of tractor is used for farming operations such as plowing and pulling heavy implements. Globally the use of machinery in agriculture is increasing due to increased demand for food and higher penetration of farm mechanization. Utility tractors help the farmer carry out the agriculture process with ease.

- The utility tractors comprise a range of 35 HP to 100 HP segments, including many compact and utility-type tractors meant for small- to mid-sized farming tasks. Small-scale farmers are increasingly adopting compact utility tractors (40HP-70HP) as they are much smaller than the average agricultural tractors and priced much lower. Despite the low-cost, compact tractors can help farmers perform many tasks with the help of farm equipment, such as backhoes and front-end loaders, and save labor wage expenses. Although a key reason for the increasing demand for larger (41-50 HP) tractors is the hard soil condition, increased use in non-agricultural segments, such as infrastructure and construction fields, has also contributed to the increase in demand in this category, which will boost the utility tractors industry to grow in the coming years.

- Utility tractors can work with significant front or rear attachments, like front-end loaders and backhoes, for loading and digging. Still, they can also be used for landscaping, seeding, hay cultivation, and snow removal, which drives the market for this segment globally. The farm mechanization level in India was recorded at 40.0%-45.0% in 2019. The penetration of farm equipment is slow, as almost 80.0% of small and marginal farmers own less than five hectares of land in the country. The agriculture sector in India has witnessed a substantial decline in the use of animal and human power in the agriculture sector. Many of these are driven by fossil fuel-operated vehicles, such as tractors and diesel engines. This has shifted from the traditional agriculture process to a more mechanized one.

- Though the level of mechanization in India is lower than in other developing countries, like China and Brazil, it is certainly in a growing phase. To increase the mechanization level, the Indian government has been promoting 'Balanced Farm Mechanization' by providing subsidies on various equipment and supporting bulk buying through front-end agencies, which is expected to strengthen the utility tractors market during the forecast period.

Utility Tractor Market Trends

Growing Preference For Farm Mechanization

- Precision farming and the increasing adoption of farm technology to boost production are driving up demand for utility tractors in minimum arable landholdings across the globe. The growing number of farm training programs promoting the use of agricultural machinery on a wide scale is also driving the tractor industry. Moreover, governments in several developing nations are providing subsidies and financial aid to help automate key agricultural processes.

- Furthermore, modern tractors with pre-installed GPS and telematics systems have emerged due to different technical breakthroughs. The global agriculture tractor market is likely to be driven by the rising popularity of automated tractors and the widespread use of wireless connectivity for remote monitoring, which can be used for agriculture purposes.

- Agricultural mechanization is essential to increase farmers' income in modern agriculture. However, the use of machinery for crop production in China is inefficient. According to a study conducted by China Agricultural University (CAU), Beijing, in 2020, the national crop planting and harvesting mechanization rate reached 71%.

- The total mechanization rate of planting and harvesting exceeded 95%, 85%, and 90% for wheat, rice, and maize, respectively. To accelerate agricultural mechanization, the Chinese government issued a series of policies to encourage farmers to use machinery, including financial subsidies for machine purchases and machine operations and support for cooperatives to provide machinery for individual farmers.

- Farmers in the Asia-Pacific region also seek utility tractors with tailored features to fulfill their needs for effective farming. So, to meet consumer demand, many international and domestic agriculture machinery manufacturers are developing new technologically advanced utility tractors which can handle various farming applications to push the market to grow in the future.

- In 2022, John Deere US launched Gtaor Utility Tractor for Farmers. The AutoTrac-assisted steering system increases operator productivity by maintaining consistent, repeatable accuracy and efficiency as the vehicle moves across the field. With AutoTrac engaged, farmers can remain alert and focused on controlling machine settings and varying field conditions. Farmers use the utility tractor for precise grid sampling, spraying, and field boundary creation.

Asia-Pacific Dominates the Market

- Despite abundant and cheap labor in India, there has been a growing demand for food, which has led to an increase in the adoption of farm mechanization, particularly in the form of tractors. This is also true for China, where there has been a similar trend toward mechanization in agriculture. For several reasons, farmers in India and China are increasingly turning to mechanization. One reason is the growing demand for food due to population growth and urbanization, which has led to a need for increased productivity in agriculture. Another reason is the rising cost of labor, which has made it more cost-effective to invest in machinery.

- The penetration of utility tractors in the country is higher in North India, particularly in Punjab, Uttar Pradesh, and Haryana. In India, under the mechanization component of the Macro-Management of Agriculture Scheme, by the Indian government, there is a provision of subsidy to promote agricultural mechanization, including 25% of the cost limited to INR 30,000 for buying tractors of up to 35 Power-take-off (PTO) HP. In India, custom hiring services have benefitted smaller farmers, and a new breed of entrepreneurs who operate utility tractors for the benefit of small landholders has emerged. These factors will lead the market to grow in the region during the forecasting period.

- The trend behind the increase in farm mechanization in China has been increased agricultural investments and the government's push toward farm mechanization. The investments in farm mechanization create the demand for utility tractors in the Asia Pacific. According to data from the National Bureau of Statistics of China, China produced 617,700 tractors in 2019. Large and medium-sized tractors gradually replaced small tractors.

- By the end of 2019, China boasted of 22.24 million agricultural tractors, including 4.44 million large- and medium-sized tractors. China has also introduced the 'Made in China 2025' scheme, which focuses on producing 90% of its agricultural equipment with high-end machines, like agricultural tractors, holding a one-third share of their segments by 2020. This, in turn, boosts indigenously produced tractors and propels the country's agricultural tractor market.

- Utility Tractors are being used for the agricultural process, and major players in the country are contributing to it, such as Mahindra & Mahindra and John Deere, with the help of their products, are contributing a lot to the agricultural practices carried out in the region to increase the market growth in the coming years. In developing countries, the demand for 35HP - 100HP tractors is high due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized compact/utility tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps to empower small and marginal farmers.

Utility Tractor Industry Overview

The utility tractors market is highly consolidated, with few players cornering most of the market share. Deere & Company, CNH Industrial, AGCO Corporation, CLAAS KGaA mbH, and Mahindra & Mahindra Corporation are major players in this market. New product launches, partnerships, and acquisitions are the major strategies the leading global companies adopt. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Rest of North America

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 United Kingdom

- 5.1.2.3 France

- 5.1.2.4 Spain

- 5.1.2.5 Italy

- 5.1.2.6 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 Japan

- 5.1.3.3 India

- 5.1.3.4 Rest of Asia-Pacific

- 5.1.4 Rest of the World

- 5.1.4.1 Brazil

- 5.1.4.2 South Africa

- 5.1.4.3 Other Countries

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Deere and Company

- 6.3.2 CNH Global NV

- 6.3.3 AGCO Corporation

- 6.3.4 CLAAS KGaA mbH

- 6.3.5 Mahindra and Mahindra Corporation

- 6.3.6 Kubota Corporation

- 6.3.7 Escorts Group

- 6.3.8 Tractors and Farm Equipment Limited (TAFE)

- 6.3.9 Kuhn Group

- 6.3.10 Yanmar Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS