Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685907

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685907

Feed Phytogenics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 372 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

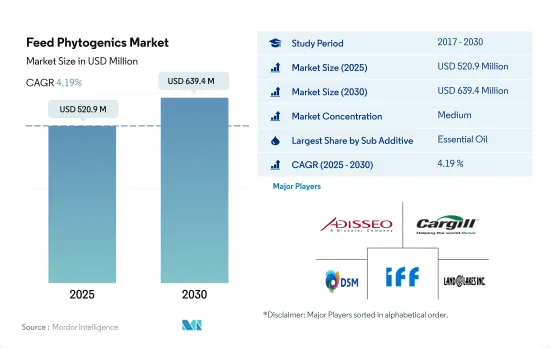

The Feed Phytogenics Market size is estimated at 520.9 million USD in 2025, and is expected to reach 639.4 million USD by 2030, growing at a CAGR of 4.19% during the forecast period (2025-2030).

- The use of antibiotics in animal diets led to concerns about animal health, resulting in a growing demand for alternative solutions. Phytogenics, or plant-derived substances, are potential alternatives to antibiotics and are increasingly used in animal diets to improve performance. In 2022, phytogenics accounted for 1.4% of the feed additives market. Phytogenics are popular due to their improved resistance and gut efficiency compared to antibiotics. The global feed phytogenics market is expected to record a CAGR of 4.2% during the forecast period.

- Essential oils, which are cost-effective, enhance the production of digestive secretions, and stimulate blood circulation, accounted for USD 0.3 billion of the global feed phytogenics market in 2022.

- Asia-Pacific held the largest share of the global feed phytogenic market, accounting for 31.3% in 2022, due to the higher feed production of around 0.5 million metric tons and a higher animal population. In the same year, North America and Europe accounted for 25.3% and 23.7% of the market, respectively. North America is the fastest-growing market for feed phytogenics, recording a projected CAGR of 5% during the forecast period. The United States was the fastest-growing country in 2022, with a CAGR of 5.5%, due to the adoption of new technologies in animal farming.

- The ban on antibiotics and the growing demand for alternative solutions to antibiotics are expected to drive the global feed phytogenics market at a CAGR of 4.2% during the forecast period.

- The global market for feed phytogenics, which is primarily consumed in the Asia-Pacific region, experienced substantial growth in recent years. Between 2017 and 2022, the market increased by 40% due to the rapidly developing livestock industry and an increase in regional demand for meat and meat products. As a result, the demand for feed phytogenics in the Asia-Pacific region is expected to register a CAGR of 4.2% during the forecast period.

- In 2022, the largest consumption of feed phytogenics in the Asia-Pacific region was due to the increase in livestock farming, which led to a boost in feed production. The region had 17.25 billion animals in 2021, accounting for 51.7% of the global market. North America and Europe were also major regions for feed phytogenics, accounting for 25.3% and 23.7% of the market, respectively. Feed production in North America increased significantly, from 215.5 million metric tons in 2017 to 281.2 million metric tons in 2022.

- In 2022, the United States and China were the leading countries in the feed phytogenics market, occupying 17.7% and 13.7% of the market, respectively. With a ban on the use of feed antibiotics in the United States, European countries, and other countries, phytogenics have become an important alternative to AGPs.

- The growing demand for quality meat and milk in the global market and rising disposable income in developed economies are increasing the preference for natural ingredients in animal feed, creating numerous profitable opportunities for the feed phytogenics market. As a result, the market is expected to continue registering a CAGR of 4.1% during the forecast period due to the growing animal population and the demand for quality feed for animals.

Global Feed Phytogenics Market Trends

High demand for animal protein and poultry products such as eggs with increasing investment in poultry sector is increasing poultry population

- The poultry population has witnessed a significant increase over recent years, primarily due to the growing demand for chicken meat and eggs in daily diets globally. The shift toward poultry products has been driven by the increasing prices of other meat, such as pig meat, in the United States. The consumption of eggs in Europe increased by 4.6% between 2017 and 2021, amounting to 6,135 metric tons in 2021.

- Asia-Pacific is the largest producer of poultry birds, with production registering a 6.6% increase in 2022 compared to 2017. The rise in poultry production is due to the growing demand for animal protein following the outbreak of African Swine Fever, which reduced the pork meat supply. China, which accounts for 40% of global production, has more than 900 million stock-laying hens, and the largest layer poultry farming center can hatch 60 million chicks per year. The Middle East is also expected to witness growth in poultry production during the forecast period (2023-2029). Companies such as Almarai in Saudi Arabia have invested heavily in the industry, with USD 1.12 billion spent on establishing new farms to expand production.

- The increasing demand for poultry products and rising investments in the poultry industry are expected to strengthen feed production. This, in turn, is expected to drive the demand for feed additives in the global market during the forecast period. The global poultry industry is poised for significant growth over the coming years, driven by the increasing shift toward poultry products and increasing investments in the industry.

The growing demand for seafood consumption in Asia-Pacific and South America, and government initiatives is increasing the feed production for aquaculture species

- The demand for feed is rapidly increasing due to the expansion of aquaculture, which is driving the growth of compound feed production. In 2022, compound feed production increased by 13.1% over the previous year, and fish feed production increased by 46.3% between 2017 and 2022. The rise in consumption of fish feed is driven by the need to maintain and improve the performance of aquatic animals and increase productivity to meet the growing demand for seafood.

- Fish feed accounted for 73.2% of the global feed market in 2022, as fish is highly consumed and produced in the Asia-Pacific region. Fish was followed by shrimp and other aquatic species in the global market, with shrimp being highly imported by European countries and the United States from other regions. Countries are focusing on expanding aquaculture production to meet the growing demand for seafood. For instance, India increased its budget allocation to the Department of Fisheries from USD 114.1 million in 2020 to USD 168.8 million in 2021 to increase production, which is expected to boost the demand for feed during the forecast period.

- South America is also recording increased feed production, which rose by 46.4% in 2022 from 2017 to reach 5.1 million metric ton, in line with the expansion of aquaculture farming. The region is one of the major seafood-consuming regions, and the increasing demand for seafood is driving the growth of aquaculture production. As aquaculture continues to expand to meet the growing demand, the development of the industry and a focus on its expansion are expected to fuel feed production. This increase in feed production for aquatic species is expected to aid in the growth of the aquaculture segment during the forecast period.

Feed Phytogenics Industry Overview

The Feed Phytogenics Market is moderately consolidated, with the top five companies occupying 59.28%. The major players in this market are Adisseo, Cargill Inc., DSM Nutritional Products AG, IFF(Danisco Animal Nutrition) and Land O'Lakes (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49196

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 Brazil

- 4.3.3 Canada

- 4.3.4 China

- 4.3.5 France

- 4.3.6 Germany

- 4.3.7 India

- 4.3.8 Italy

- 4.3.9 Japan

- 4.3.10 Mexico

- 4.3.11 Netherlands

- 4.3.12 Philippines

- 4.3.13 Russia

- 4.3.14 South Africa

- 4.3.15 Spain

- 4.3.16 Thailand

- 4.3.17 Turkey

- 4.3.18 United Kingdom

- 4.3.19 United States

- 4.3.20 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Essential Oil

- 5.1.2 Herbs & Spices

- 5.1.3 Other Phytogenics

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Kenya

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 South Korea

- 5.3.2.1.8 Thailand

- 5.3.2.1.9 Vietnam

- 5.3.2.1.10 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Chile

- 5.3.6.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Borregaard AS

- 6.4.4 Cargill Inc.

- 6.4.5 DSM Nutritional Products AG

- 6.4.6 IFF(Danisco Animal Nutrition)

- 6.4.7 Kemin Industries

- 6.4.8 Land O'Lakes

- 6.4.9 Marubeni Corporation (Orffa International Holding B.V.)

- 6.4.10 Prinova Group LLC

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.