PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906959

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906959

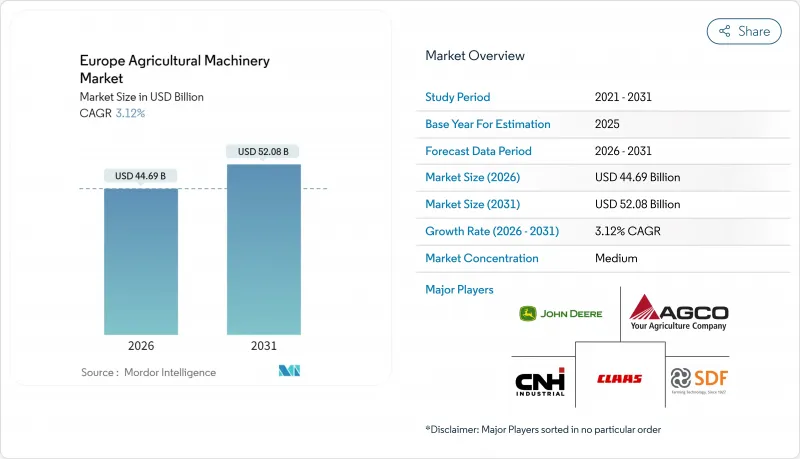

Europe Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe agricultural machinery market size in 2026 is estimated at USD 44.69 billion, growing from 2025 value of USD 43.34 billion with 2031 projections showing USD 52.08 billion, growing at 3.12% CAGR over 2026-2031.

Tight farm-labor supply, stringent European Union environmental mandates, and widespread digitalization are reshaping capital-spending priorities toward low-emission, sensor-rich equipment. Farmers are shifting from horsepower upgrades to intelligent systems that automate repetitive tasks, document sustainability performance, and integrate with enterprise software. Original Equipment Manufacturers (OEMs) are responding with modular platforms that accept continuous software and sensor retrofits, shortening model life cycles and expanding recurring-revenue streams. Rising semiconductor availability and falling battery costs from 2027 onward are anticipated to stabilize delivery schedules and accelerate electrification, closing the gap between early-adopter and late-adopter regions of the Europe agricultural machinery market.

Europe Agricultural Machinery Market Trends and Insights

European Union and National Subsidies are Accelerating Mechanization

The European Investment Bank's EUR 1 billion (USD 1.05 billion) sustainability-linked agtech loan window covers up to 70% of equipment list prices for emissions-verified purchases. When stacked with Germany's federal 20% machinery grant, net acquisition costs for Stage V tractors drop to parity with legacy Tier III units, flattening payback curves for conservative buyers. France and Italy deploy similar top-up schemes, ensuring that subsidy budgets are front-loaded into the 2025-2027 window, which drives a spike in advance orders. OEMs are synchronizing product-launch calendars with grant-application deadlines to maximize uptake. Leasing companies are extending contracts to seven years to align with subsidy claw-back periods, lowering annual cash footprints and fostering premature retirement of sub-40-horsepower fleets.

Rapid Model Upgrades in Agricultural Machinery

Average release cycles for mainstream tractor lines have compressed from six years to fewer than two, propelled by emission revisions and the influx of digital subsystems. Deere & Company's 2025 autonomous tractors debuted new LiDAR arrays and over-the-air firmware that optimize path planning without hardware swaps. Farmers now view machinery as an evolving platform, with 47% of German survey respondents plan to upgrade software quarterly to capture agronomic gains. The speed of iteration pushes dealers to invest in advanced service tools. Manufacturers in the Europe agricultural machinery market are pivoting to subscription pricing for feature unlocks, diversifying revenue beyond unit sales.

High Upfront and Maintenance Costs

List prices for sensor-rich combines and autonomous sprayers jumped 18% between 2024 and 2025, pushing some configurations beyond USD 1 million per unit. Mid-sized growers operating 200-400 hectares face difficult trade-offs between machinery and land-improvement projects, especially in Eastern Europe where average net margins hover near 7%. Maintenance expenses have also climbed as proprietary electronics require dealer intervention. Hourly service rates in France now average EUR 105 (USD 110) compared with EUR 68 (USD 71) in 2020. Smaller farms mitigate costs by forming machinery rings, but coordination overhead can erode efficiency gains.

Other drivers and restraints analyzed in the detailed report include:

- High Adoption of Telematics and Predictive Maintenance

- Eco-Scheme Incentives for Low-Emission Machinery

- Cybersecurity Risks in Connected Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors maintain commanding market leadership with a 48.85% share in 2025, reflecting their fundamental role as the primary power source for most European farming operations. Within the tractor category, the 100-150 HP segment captures the largest share among European farms that average 65 hectares, while the greater than 150 HP segment experiences the fastest growth as large-scale operations pursue efficiency through higher-capacity equipment. Plowing and cultivating equipment represents the second-largest category, with cultivators and tillers showing particular strength as conservation tillage practices gain adoption across the continent. The financial grant of Euro 430 million (USD 455 million) by the European Commission for the farmers opting for high-cost inputs in 2023, including agricultural equipment such as plows, is also one of the major factors increasing the adoption rates.

Irrigation machinery emerges as the fastest-growing segment at 3.74% CAGR, driven by increasingly erratic precipitation patterns and water usage regulations that mandate efficiency improvements. Drip irrigation systems lead this expansion as they deliver 40-60% water savings compared to traditional sprinkler systems while enabling precise nutrient delivery that enhances crop yields. Harvesting machinery maintains steady demand with combine harvesters dominating the category, though smart and autonomous harvesters represent the highest-growth subsegment as labor shortages intensify during critical harvest windows. Haying and forage machinery serves the substantial European dairy sector, with balers experiencing particular demand as farmers optimize feed production efficiency. The "Other Types" category, including drones and precision seeders, shows explosive growth from a small base as farmers experiment with emerging technologies that promise operational advantages over conventional approaches.

The Europe Agricultural Machinery Market Report is Segmented by Type (Tractors, Plowing and Cultivating Equipment, Irrigation Machinery, Harvesting Machinery, and More), and by Geography (Germany, France, United Kingdom, Italy, Spain, Russia, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- SDF S.p.A

- Kuhn SAS (Bucher Industries AG)

- Yanmar Holdings Co., Ltd.

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- Horsch Maschinen GmbH (HORSCH PIRK Forestry GmbH)

- Mahindra & Mahindra Ltd.

- Pottinger Landtechnik GmbH

- Tractors and Farm Equipment Limited (TAFE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic farm-labor shortage

- 4.2.2 European Union and national subsidies are accelerating mechanization

- 4.2.3 Rapid model upgrades in agricultural machinery

- 4.2.4 High adoption of telematics and predictive maintenance

- 4.2.5 Eco-scheme incentives for low-emission machinery

- 4.2.6 OEM ag-software hardware-bundle financing

- 4.3 Market Restraints

- 4.3.1 High upfront and maintenance costs

- 4.3.2 Cybersecurity risks in connected equipment

- 4.3.3 Semiconductor supply constraints

- 4.3.4 Diesel-emission compliance cost escalation

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractor

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 100 HP

- 5.1.1.3 100 to 150 HP

- 5.1.1.4 More than 150 HP

- 5.1.2 Plowing and Cultivating Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment (Ridger, Rotary tillers, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler

- 5.1.3.2 Drip

- 5.1.3.3 Other Irrigation Machinery (Micro-irrigation, Pivot irrigation, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Smart/Autonomous Harvesters

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying Equipment (Rakes, Tedders, etc.)

- 5.1.6 Other Types (Drones, Precision Seeders)

- 5.1.1 Tractor

- 5.2 By Geography

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Russia

- 5.2.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 CLAAS KGaA mbH

- 6.4.6 SDF S.p.A

- 6.4.7 Kuhn SAS (Bucher Industries AG)

- 6.4.8 Yanmar Holdings Co., Ltd.

- 6.4.9 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.10 Horsch Maschinen GmbH (HORSCH PIRK Forestry GmbH)

- 6.4.11 Mahindra & Mahindra Ltd.

- 6.4.12 Pottinger Landtechnik GmbH

- 6.4.13 Tractors and Farm Equipment Limited (TAFE)

7 Market Opportunities and Future Outlook