PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444608

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444608

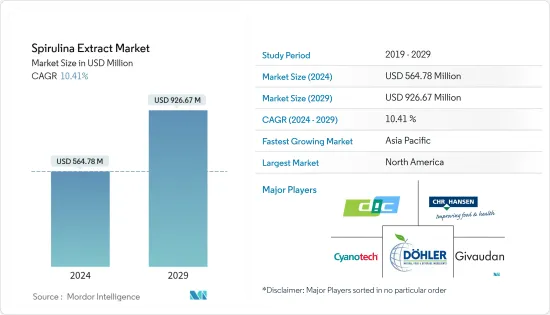

Spirulina Extract - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Spirulina Extract Market size is estimated at USD 564.78 million in 2024, and is expected to reach USD 926.67 million by 2029, growing at a CAGR of 10.41% during the forecast period (2024-2029).

Spirulina is extracted from different sources like microalgae, plants, and flowers. Spirulina is rich in different compounds like phycocyanin, phenolics, and polysaccharides. it gives antioxidant, anti-inflammatory, and immunostimulating effects. Spirulina can be used in different applications like in foods, pharmaceuticals, cosmetics, and personal care products. The growing demand for natural and clean label colors is expected to create a demand for spirulina extracts. Moreover, manufacturers are in the process of developing beverages based on Spirulina which is still not available in the market. This development is expected to create new business segments once introduced into the market. Only a few Spirulina juices and smoothies are available in a few regions under the beverage segment. For instance, in December 2021, Ful launched the Ful Spirulina Fizz range, a non-alcoholic soft drink in the United Kingdom.

Manufacturers are also exploring the potential of spirulina in cosmetics. Recently, microalgae have been used to treat various skin problems like tanning, aging, and pigment disorders. Additionally, Spirulina can also be used in the areas like skin whitening and anti-aging. Algae species are already being used in a few cosmetic formulations like moisturizing and thickening agents. For instance, in August 2021, the Algenist brand launched spirulina-based vitamin C skin brightening serum. However, stringent regulations and a ban on synthetic food additives by the European and the United State governments have opened the gates for the demand for natural additives. Over the medium term, the market is expected to grow owing to the increasing demand for natural and clean-labeled ingredients.

Spirulina Extracts Market Trends

Growing Demand for Natural and Clean Label Colors

The safety concerns regarding artificial colorings and their long-term detrimental health effects have led to a paradigm shift in the strategies of key giants and their product offerings. Many processed food manufacturers have also started offering food products made with natural food colorings. Natural food colors are being used in many food processing industries like beverage industries and other food preparations. Consumers are being aware of the food ingredients present in their food and their demand for clean-labeled natural ingredients is increasing owing to their health benefits over synthetic colors. Additionally, government regulations on the use of synthetic colors are also promoting the market for natural colors. Spirulina can be extracted from natural sources like algae and plants. The market players have been launching new spirulina products in different forms as per government regulations. For instance, in November 2022, the color supplier GNT secured FDA approval for the use of its spirulina extract for the use in beverages.

North America Holds the Major Share

Spirulina extract is a rich source of peptides and phytonutrients. Spirulina extracts can be used in food as well as in cosmetics and personal care products. The demand for Cosmetics and personal care products is increasing in the North American region. Consumers are becoming aware of the ingredients in their personal care products. Due to the rise in disposable income, the demand for organic and natural products in cosmetic products is also increasing. Owing to this, the demand for spirulina extract is increasing in cosmetic and personal care products as spirulina moisturizes the skin and gives anti-aging effects. Additionally, the demand for clean-labeled bakery products is rising in the region owing to increasing demand for convenience foods. In February 2021, Selerant Canada extended the use of spirulina extract in puddings, custards, dessert coatings, and others.

Spirulina Extracts Industry Overview

The Spirulina extract market is fragmented with global and regional players dominating the market. Some prominent players in the market are DIC Corporation, Cyanotech Corporation, Dohler Group, Chr Hansen A/S, and Givaudan (DDW-The Color House). Major players in the market and are adopting strategies like product development, mergers & acquisitions, and partnerships & collaborations to gain a competitive advantage in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Nutraceuticals

- 5.1.2 Food

- 5.1.3 Cosmetics

- 5.1.4 Agriculture

- 5.1.5 Feed

- 5.1.6 Others

- 5.2 Formulation

- 5.2.1 Powder

- 5.2.2 Tablet & Capsule

- 5.2.3 Liquid

- 5.2.4 Granule

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Sensient Technologies Corporation

- 6.3.2 Givaudan (DDW - the Color House)

- 6.3.3 DIC Corporation- Earthrise Nutritionals

- 6.3.4 Chr. Hansen A/S

- 6.3.5 Naturex SA

- 6.3.6 Royal DSM

- 6.3.7 Dohler Group

- 6.3.8 E.I.D. Parry (India) Limited.

- 6.3.9 C.B.N. Spirulina Canada Co., Ltd

- 6.3.10 BASF SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS