PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444897

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444897

India Aquafeed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

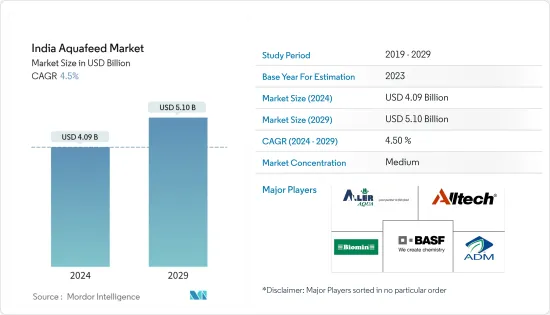

The India Aquafeed Market size is estimated at USD 4.09 billion in 2024, and is expected to reach USD 5.10 billion by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

Key Highlights

- India is the primary market for aquaculture feed as a wide diversity of aqua species contributes mainly to the export business. In this country, aqua feed sales have moved from unorganized retail channels, like wet markets, to organized retail channels, like supermarkets, because of rising disposable incomes, more health consciousness, and improved cold chain facilities. The fish caught volume also increased for several years and reached 12.18 million metric tons in 2020, according to the Ministry of Fisheries, Animal Husbandry & Dairying. Thus, the increase in fish caught-up volume shows the rise in aquafeed, thereby driving the market growth.

- Additionally, Indian aqua feed mills can produce 2.9 million metric tons. Andhra Pradesh is the largest fish feed-consuming state in India. The country's coastal line is about 7,517 km with 195.20 km of river and canal systems, aiding the country in the high aqua products cultivation. For instance, according to the Ministry of Agriculture and Farmers Welfare (India), Karnataka, the southwestern coastal state of India, produced over 861 thousand metric tons of fish in the financial year 2020, which was a significant increase from the previous year, which accounted for about 588 thousand metric tons. From these sources, it is clear that the aquaculture industry is enormous in India, which provides vast opportunities and potential for the aquafeed industry.

- Furthermore, in the Asia-Pacific region, there is an increase in the fish population, prompted by the growing demand for meat and aquaculture products, which is the primary driving force behind the aquafeed market growth.

Aquafeed Market Trends

Increase in Fish Seed Production

The key driver behind the increasing demand for fish seed and aquaculture feed production is the increased demand for aqua food products. In India, under the scheme of contract farming, farmers are provided with aquafeed and fish seeds needed for the growth of aquaculture. For instance, according to the Ministry of Agriculture and Farmers Welfare (India), during the fiscal year 2020, fish production in India amounted to over 14 million metric tons, an increase from about 13.57 million metric tons in the fiscal year 2019.

Similarly, initiatives taken by many government agencies are increasing fish seed production and boosting the demand for aquafeed. For instance, according to the Ministry of Fisheries, Animal Husbandry and Dairying (India), fish seed production increased in 2021 which is INR 5,40,690 (USD 662.23) from INR 4,81,974 (USD 590.31) in 2019. Additionally, in August 2021, the Aquaculture Development Agency Kerala (ADAK) started stocking fish with seeds in three of Kerala's four reservoirs where cage fish culture is implemented. The agency asserted that introducing cage culture in reservoirs is a significant step toward enhancing fish production in light of declining wild catch. It enters a new era in utilizing the vast area currently available for aquaculture in the State.

Moreover, owing to the increase in health consciousness, people are consuming residue-free food, which is building pressure on exporters to grow seafood that is good for their health. It significantly affects the aquafeed industry as proper feed for aqua animals will help grow animals without diseases. This factor creates many new opportunities in the industry for the players to launch many natural and new-generation products.

Increase in Export Value for Fish

In India, fish traders usually pick up fish at harvest and trade it off for a higher price to different markets. However, fish exports are on the rise due to increased production and government initiatives. For instance, frozen shrimp remained India's major export item in quantity and value in 2021-22, accounting for a share of 53% in amount and 75% of the total revenue, as per government data. Shrimps make up a significant portion of the aquaculture sector. Thus, companies making aqua feed have started concentrating on creating more shrimp feed to meet domestic and global demand.

Moreover, people worldwide are consuming food free of residue due to rising health and hygiene awareness and increasing pressure on Indian exporters to produce healthy seafood. For instance, according to the Reserve Bank of India, in the fiscal year 2022, the export value of fish and fishery products from India amounted to over INR 579 billion (USD 7.01 billion). It was a significant increase from the previous year, in which the export value of fish and fishery products amounted to INR 441.76 billion (USD 5.35 billion). It favors the aqua feed sector since high-quality fish and feed will help aquatic animals grow without acquiring diseases.

As aquatic products hold a specific position in the market, India is predicted to experience a rise in demand for cultured seafood products that are chemical-free and nutritious. Because of this, there will be a high need for aquaculture feed for farming, driven by population increase, growing incomes, and rapid urbanization. Thus, demand for aqua product exports from India is expected to rise faster during the forecast period.

Aquafeed Industry Overview

The Indian aquafeed market is moderately fragmented, with international players capturing the overall market and many small players competing with world leaders. Aller Aqua, Altech Inc., Archer Daniels Midland Co., BASF SE, and BiominGmH are the few active players in the market. The most adopted strategies by these companies have been mergers and acquisitions and investments in R&D and facility expansions to maintain a strong customer base across India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fish Feed

- 5.1.1.1 Ray-Finned Fish Feed

- 5.1.1.2 Mackerel Feed

- 5.1.1.3 Ribbon Fish Feed

- 5.1.1.4 Cuttlefish Feed

- 5.1.1.5 Catfish Feed

- 5.1.1.6 Other Fish Feeds

- 5.1.2 Mollusks Feed

- 5.1.3 Crustaceans Feed

- 5.1.4 Other Types

- 5.1.1 Fish Feed

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Aller Aqua

- 6.3.2 Altech Inc.

- 6.3.3 Archer Daniels Midland Co.

- 6.3.4 BASF SE

- 6.3.5 Biomin GmbH

- 6.3.6 Cargill Inc.

- 6.3.7 Avanti

- 6.3.8 Nutreco NV

- 6.3.9 Growel Feeds Private Limited

- 6.3.10 UNO Feeds

7 MARKET OPPORTUNITIES AND FUTURE TRENDS