PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687710

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687710

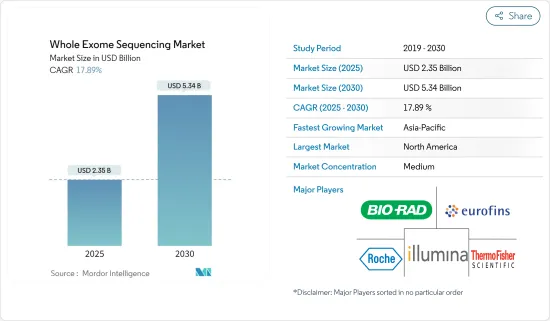

Whole Exome Sequencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Whole Exome Sequencing Market size is estimated at USD 2.35 billion in 2025, and is expected to reach USD 5.34 billion by 2030, at a CAGR of 17.89% during the forecast period (2025-2030).

Key factors propelling the global whole exome sequencing market include its rising applications in clinical diagnostics, heightened demand for rare disease diagnoses, intensified R&D efforts in genomics and next-generation sequencing, and an increasing appetite for personalized medicine. For example, a March 2022 article in the British Medical Journal highlighted that whole exome sequencing is routinely available for a select group of patients diagnosed with rare childhood genetic diseases. The article further emphasized that next-generation sequencing can rapidly sequence hundreds or even thousands of genes at a significantly reduced cost. Given these advantages, the market for whole exome sequencing is poised for growth in the coming years.

Additionally, whole exome sequencing plays a pivotal role in testing the genomes of viruses linked to diseases like HIV, cancer, and COVID-19. As the prevalence of these diseases rises, so does the demand for whole-exome sequencing. For instance, according to the World Health Organization (WHO) HIV Statistics, around 39.9 million people globally were living with HIV in 2023. Such genomic sequencing methods shed light on genetic variants that may lead to diseases, further amplifying the demand for RNA sequencing.

Moreover, the surge in R&D within genomics and next-generation sequencing is fueling market growth. For instance, in May 2022, NanoString Technologies Inc. unveiled a cloud-based workflow designed to enhance spatial data analysis for users of the Illumina NextSeq 1000, NextSeq 2000 sequencing systems, and the GeoMx Digital Spatial Profiler. This innovation streamlines the spatial analysis of whole transcriptomes in tandem with proteome analytes due to its integrated, user-friendly run planning tool. Such advancements are expected to bolster the market further.

In conclusion, the aforementioned factors indicate a robust growth trajectory for the market. The intricate nature of the technique, a pressing need for skilled professionals, and the legal and ethical dilemmas surrounding whole exome sequencing may restrain the market's expansion.

Whole Exome Sequencing Market Trends

Personalized Medicine Segment is Expected to Witness Significant Growth Over the Forecast Period

Personalized medicine tailors therapies to individual patients based on the molecular underpinnings of their diseases. This approach has gained traction in recent years. Often referred to as "individualized medicine," precision medicine diverges from traditional methods by emphasizing each patient's distinct genetic profile. With advancements in genetics and a deeper comprehension of human genetic makeup, especially how it influences health, development, and drug responses, medical professionals are crafting safer, more effective treatments for a myriad of health conditions. The benefits of precision medicine are manifold, enhancing both health and healthcare.

Factors propelling the personalized medicine segment include the rising prevalence of various cancers, the affordability of personalized therapies for cancer and other diseases, reduced side effects from tailored treatments, widespread adoption in developed markets, and the emergence of innovative drugs.

For example, in August 2022, the Medical Device Innovation Consortium initiated a pilot project under its Somatic Reference Sample (SRS) Initiative. This project aims to refine the validation and regulatory review processes for cancer diagnostics utilizing next-generation sequencing (NGS). NGS stands out as a transformative technology, unlocking new avenues in diagnostics and therapeutics. However, for these diagnostic tests to be clinically viable, they must undergo rigorous validation, a process heavily reliant on reference samples.

Furthermore, market players are engaging in strategic maneuvers like partnerships, mergers, acquisitions, and product launches, all of which are expected to fuel the segment's expansion. For instance, in November 2023, Illumina unveiled its Global Health Access Initiative, targeting pathogen sequencing in low- and middle-income countries. This initiative offers discounted rates on a range of sequencing applications. These include drug resistance profiling for tuberculosis, whole-genome sequencing to monitor evolving and reemerging viruses, respiratory pathogen detection for influenza-like illness surveillance, environmental monitoring (like wastewater analysis) to track pathogens, and overseeing population-level antimicrobial resistance.

Given these dynamics, the personalized medicine segment is poised for substantial growth in the coming years.

North America is Expected to Witness a Significant Growth Over the Forecast Period

North America stands out as a leading regional market in terms of revenue. Key drivers fueling the growth of the whole-exome sequencing market include the rising prevalence of genetic and chronic disorders like cancer, an aging population, an increasing demand for targeted and personalized medicine, and supportive government initiatives. As reported by HIV.gov in October 2022, approximately 1.2 million individuals in the United States were affected by HIV. This underscores a rising burden of infectious diseases, which is expected to register a heightened demand for diagnostics and bolster market growth during the forecast period.

Mergers, acquisitions, product launches, and partnerships among key players further energize market dynamics in the region. A notable example is QIAGEN's exclusive strategic partnership with California-based Helix, a population genomics leader established in January 2023. This collaboration is set to advance the development of companion diagnostics for hereditary diseases. The integrated services, powered by advanced NGS and PCR technologies, promise rapid patient recruitment, real-world evidence, and comprehensive diagnostic solutions.

Given these dynamics, including the rising prevalence of infectious diseases and active product launches, the North American market is poised for substantial growth in the coming years.

Whole Exome Sequencing Industry Overview

The whole exome sequencing market is moderately consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of some international and domestic companies that hold market shares and are well known, including Eurofins Scientific Group, Bio-Rad Laboratories Inc., F. Hoffmann-La Roche AG, illumine Inc., and Thermo Fisher Scientific Inc. Konica Minolta Inc. (Ambry Genetics), Beijing Genomics Institute, Azenta Inc., Psomagen Inc. (Macrogen Inc.), PerkinElmer Inc., GENEYX GENOMEX, and CD Genomics, QIAGEN Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Applications in the Clinical Diagnosis and Growing Demand for the Diagnosis of Rare Diseases

- 4.2.2 Increasing R&D in the Field of Genomics and Next-generation Sequencing

- 4.2.3 Increasing Demand for Personalized Medicine

- 4.3 Market Restraints

- 4.3.1 High Complexity of Technique and Lack of Skilled Personnel

- 4.3.2 Legal and Ethical Issues Associated with Whole Exome Sequencing

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD)

- 5.1 By Product Type

- 5.1.1 System

- 5.1.2 Kits

- 5.1.3 Services

- 5.2 By Technology

- 5.2.1 Second-Generation Sequencing

- 5.2.1.1 Sequencing by Synthesis (SBS)

- 5.2.1.2 Sequencing by Hybridization and Ligation (SBL)

- 5.2.2 Third-generation Sequencing

- 5.2.1 Second-Generation Sequencing

- 5.3 By Application

- 5.3.1 Diagnostics

- 5.3.2 Drug Discovery and Development

- 5.3.3 Personalized Medicine

- 5.3.4 Other Applications (Agriculture, Animal Research, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Konica Minolta Inc. (Ambry Genetics)

- 6.1.2 Beijing Genomics Institute

- 6.1.3 Bio-Rad Laboratories Inc.

- 6.1.4 Eurofins Scientific Group

- 6.1.5 F. Hoffmann-La Roche AG

- 6.1.6 Azenta, Inc.

- 6.1.7 Illumina Inc.

- 6.1.8 Psomagen Inc. (Macrogen Inc.)

- 6.1.9 PerkinElmer Inc.

- 6.1.10 Thermo Fisher Scientific Inc.

- 6.1.11 GENEYX GENOMEX

- 6.1.12 CD Genomics

- 6.1.13 QIAGEN Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS