PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689709

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689709

Plant Growth Chambers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

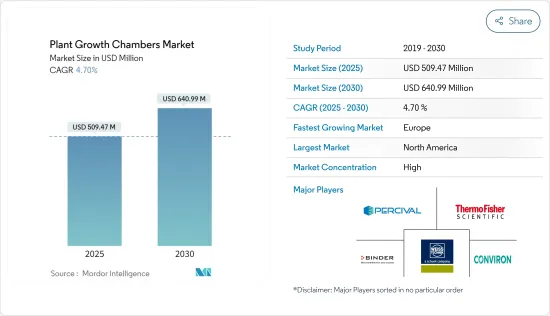

The Plant Growth Chambers Market size is estimated at USD 509.47 million in 2025, and is expected to reach USD 640.99 million by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

Key Highlights

- Rapid urbanization, rising population, and declining arable land are leading to increasing food security concerns around the world. This represents one of the key factors catalyzing the demand for plant growth chambers as they enhance the productivity of agricultural land. These chambers are utilized in horticulture crop production and provide consistent crop quality, increased productivity, flexibility in changing plant location, and thus an efficient usage of the space.

- There is increasing adoption of plant growth chambers for both industrial and academic research purposes. The need to feed an ever-growing global population, coupled with the increasing demand for sustainable agricultural practices, fuelled a significant rise in the demand for plant growth chambers across the world. Moreover, a decreased arable land worldwide is driving the demand for these artificial growth chambers for sustainable crop production. According to the FAO, in the year 2022, the global agricultural land accounted for 4,781,220.8 thousand hectares, which decreased from 4,787,265.1 thousand hectares in 2021.

- Furthermore, advancements in biological engineering, along with the growing adoption of genetically modified crops, are also contributing to market growth. Moreover, the increasing popularity of plant growth chambers in dry climatic regions that are more susceptible to drought conditions is also driving the growth of the market.

Plant Growth Chambers Market Trends

Rising Food Demand and Shrinking Arable Land Propel Reach-in Equipment Demand

The need to feed an ever-growing global population, coupled with increasing demand for sustainable agricultural practices, fueled a significant rise in demand for plant growth chambers across the world. According to FAO, agricultural production is anticipated to grow two-fold over the coming 36 years, to meet the demands of a population of 9 billion. The need to produce a larger quantity of food is fueling the demand for new innovative technologies for sustainable crop production. Thus, there is broader acceptance and recognition of the increasing benefits of plant growth Reach-in equipment in developed and developing countries.

Additionally, with the amount of arable land per person declining and the population expanding, global crop yields must increase to meet food production needs. According to the World Bank statistics, in South Asia, there was a decline in the agricultural land percentage of the total land, from 56.8% in 2020 to 56.7% in 2021. Also, as per FAOSTAT, the total global arable land accounted for 1.39 million hectares in the year 2019 decreased to 1.38 million hectares during the year 2022. Thus, with decreasing arable land, the global agriculture industry is looking for more convenient ways to produce various agricultural goods and a plant growth chamber is one of the alternatives that is also convenient to use.

North America Dominates the Market

North America is one of the largest markets for plant growth chambers in the world, with countries, like the United States, Canada, and Mexico, demonstrating massive adoption of incubators for controlled and sustainable plant growth. This is largely attributed to the declining arable land, which spurred the demand for plant growth chambers in the United States and other countries. These chambers are significantly utilized in the region to avoid disturbances in the continuous supply of food and to develop innovative and quality plants that are free of diseases. The presence of major companies, such as Thermo Fisher, Caron, and Conviron is majorly contributing to the growth of the market in this region.

Additionally, the rise in the use of plant growth chambers in academic research organizations and cosmetic industries is another key factor propelling the demand for plant growth chambers in the region. According to the International Society for Horticultural Sciences, there are nearly over 250 commercial plant laboratories in the United States with probably 50 more within the research units of agribusinesses. Moreover, new tissue culture laboratories are under progress in the country to undertake research activities, which, in turn, is creating a demand for plant growth chamber equipment.

Canada holds numerous sets of opportunities that embark on the possibility of scaling the production of foods using plant growth chambers over the near future as the need for healthy, fresh, and sustainable produce is increasing in the country. Alberta is one of the advanced provinces when it comes to adopting protected and indoor cultivation practices as well as carrying out various plant research activities. Tomatoes, cucumber, and peppers are the three main crops generally grown commercially in growth chambers in the province. Other commercial crops grown include lettuce, basil, arugula, eggplant, and snap beans, but typically on a much smaller scale.

Plant Growth Chambers Industry Overview

The plant growth chambers market is consolidated, with the major industry players occupying a majority share of the market. ThermoFisher, Conviron, Weiss Technik, Binder GmbH, and Percival Scientific Inc. are some of the major players. The companies are largely focusing on expansions, partnerships, mergers, and acquisitions, among other strategies, to move ahead of their competitors in the global market. These players are expanding their presence in many regional markets by partnering with domestic manufacturers to strengthen their foothold in the market. Along with innovations and expansions, investments in R&D and developing novel product portfolios are likely to be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Precision Agriculture

- 4.2.2 Growing Focus on Food Security and Crop Research

- 4.2.3 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 High Initial Costs

- 4.3.2 Energy Consumption

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Reach-in

- 5.1.2 Walk-in

- 5.2 Application

- 5.2.1 Short Plants

- 5.2.2 Tall Plants

- 5.3 Function

- 5.3.1 Plant Growth

- 5.3.2 Seed Germination

- 5.3.3 Environment Optimization

- 5.3.4 Tissue Culture

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Aralab

- 6.3.2 BINDER GmbH

- 6.3.3 Brs Bvba

- 6.3.4 CARON Products & Services Inc.

- 6.3.5 Conviron

- 6.3.6 Darwin Chambers

- 6.3.7 Freezers India

- 6.3.8 Hettich Benelux BV

- 6.3.9 Percival Scientific Inc.

- 6.3.10 Saveer Biotech Limited

- 6.3.11 Thermo Fisher

- 6.3.12 Weiss Technik

7 MARKET OPPORTUNITIES AND FUTURE TRENDS