Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689755

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689755

United States Ice Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 152 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

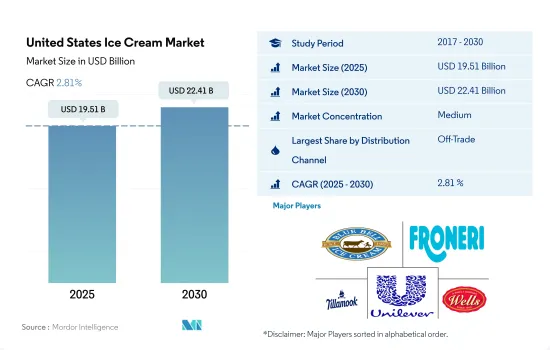

The United States Ice Cream Market size is estimated at 19.51 billion USD in 2025, and is expected to reach 22.41 billion USD by 2030, growing at a CAGR of 2.81% during the forecast period (2025-2030).

Revitalized stores, enhanced supply chains propel supermarkets and hypermarkets to witness surge in ice cream sales

- In 2020, the on-trade segment was significantly impacted by the COVID-19 pandemic due to lockdowns imposed worldwide. Despite these challenges, US consumers spent an average of 8.6% of their disposable personal income on food in 2020. This amount was split between meals consumed at home (5.0%) and away from home (3.6%). However, restaurants, bars, and casinos had to shut down operations in the country. Therefore, the on-trade sales value of ice cream decreased by 14% in 2020 compared to 2019, with around 32,109 restaurants shutting operations during the pandemic.

- The online retail channel is expected to be the fastest-growing distribution sub-segment in the off-trade segment. It is projected to register a growth value of 13% during 2023-2028 due to the increasing number of smartphone users, which rose by 11 million between 2020 and 2021. Around 45% of the US population browses online websites through mobile devices. The sales of ice cream through online channels increased by 6% during 2018-2021.

- In the off-trade segment, consumers prefer buying ice cream from supermarkets/hypermarkets, as the country is home to a large number of supermarkets. Currently, there are 63,419 supermarkets in the United States. Supermarket sales for ice cream in the United States grew by 3% in terms of value from 2018 to 2021. About 60% of mass players and large national supermarket retailers in the United States invested in 2020 to improve their ability to better personalize promotions and pricing by strategizing on significant price drops, store remodels, and supply chain investments. Several supermarket chains also introduced click-and-collect and delivery services through third-party providers.

United States Ice Cream Market Trends

The increasing influence of innovative flavors is impacting the consumption of ice cream in the United States

- The increasing preference of consumers for premium ice creams and intercontinental flavors has led to a sharp increase in the per capita consumption of ice cream in the United States during the last decades. In 2022, per capita consumption of ice cream increased by 1.3% compared to the previous year, 2021. Consumers purchase ice cream in large cartons as well as individually wrapped frozen novelties that include ice-cream sandwiches, ice cream cones, chocolate-dipped bars, Klondike bars, and popsicles. Approximately 87% of the US population has ice cream in their freezers at any time, while Sunday is the most common day for them to purchase ice cream.

- Ice creams with low-calorie (150 calories per serving) or no-sugar options compared to regular ice creams have gained popularity among health-conscious consumers. Due to this, regular ice cream consumption experienced a dip of 9% up to 2021, compared to the historical years, while low-fat ice cream consumption increased by 20%. As of 2021, almost 74% of the US population eats ice cream at least once a week, which they also like to eat at home, while 84% of the US population purchased ice cream at grocery stores and ate it at home.

- Popular flavors of ice cream in the United States include vanilla, chocolate, strawberry, butter pecan, and mint chocolate chip. Despite this, chocolate remains the favorite among consumers. In 2021, 17% of US consumers preferred the chocolate flavor, followed by vanilla with 15%, and strawberry and mint chocolate chip with 8% each. Almost half of the consumers bought ice cream in half-gallon containers, and about 23% preferred to buy pints.

United States Ice Cream Industry Overview

The United States Ice Cream Market is moderately consolidated, with the top five companies occupying 41.56%. The major players in this market are Blue Bell Creameries LP, Froneri International Limited, Tilamook CCA, Unilever PLC and Wells Enterprises Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 67996

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Milk

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Distribution Channel

- 5.1.1 Off-Trade

- 5.1.1.1 Convenience Stores

- 5.1.1.2 Online Retail

- 5.1.1.3 Specialist Retailers

- 5.1.1.4 Supermarkets and Hypermarkets

- 5.1.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.1.2 On-Trade

- 5.1.1 Off-Trade

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Blue Bell Creameries LP

- 6.4.2 Dairy Farmers of America Inc.

- 6.4.3 Focus Brands LLC

- 6.4.4 Froneri International Limited

- 6.4.5 Giffords Dairy Inc.

- 6.4.6 Tilamook CCA

- 6.4.7 Turkey Hill Dairy

- 6.4.8 Unilever PLC

- 6.4.9 Van Leeuwen Ice Cream

- 6.4.10 Wells Enterprises Inc.

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.