PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910715

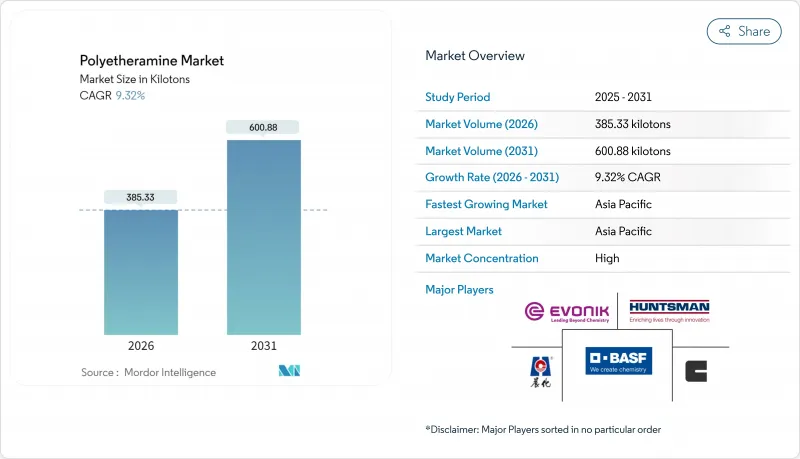

Polyetheramine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Polyetheramine market size in 2026 is estimated at 385.33 kilotons, growing from 2025 value of 352.47 kilotons with 2031 projections showing 600.88 kilotons, growing at 9.32% CAGR over 2026-2031.

Momentum stems from escalating demand in wind-turbine blade production, composites manufacturing, and high-performance coatings as downstream industries target lighter, more durable materials. Diamine grades dominate because their balanced reactivity suits large-scale blade curing and structural composites. Offshore wind expansion, automotive lightweighting, and infrastructure resilience projects continue to pull specialty amine volumes, while 3D-printing formulators adopt polyetheramine-cured epoxies for complex geometries. Feedstock price swings and tightening amine-emission regulations temper short-term margins, yet bio-based variants, capacity builds in Asia-Pacific, and vertical integration strategies position leading suppliers for sustained earnings growth.

Global Polyetheramine Market Trends and Insights

Increasing Investments in Adhesives and Sealants Industry

Capital allocation into advanced construction and e-mobility adhesives is rising as builders and automakers seek lighter, corrosion-resistant bonding options. Polyetheramine-modified systems command a premium because they deliver low-VOC profiles and high peel strength under extreme temperatures. BASF's Baxxodur portfolio, distributed in North America via Univar Solutions, illustrates how integrated logistics strengthen market penetration. Sustainability mandates also spur launches such as Evonik's bio-content Ancamide 2853/2865, reinforcing polyetheramine uptake in ISO 14001-certified plants.

Growing Demand from Composites Manufacturing

Aerospace certification and automotive fuel-efficiency rules push resin suppliers toward curing agents that lengthen pot life yet boost fatigue resistance. With global wind capacity already above 743 GW, blades exceeding 100 meters require polyetheramine-cured epoxies that maintain structural integrity during low-temperature, large-part processing. Embedded fiber-optic sensing systems further raise the need for optically clear, low-shrinkage hardeners. Chinese petrochemical majors such as Hengli and Shenghong are integrating downstream to secure feedstocks and compress lead times, which intensifies competitive pricing but also broadens supply resilience.

Environmental Concerns over Amine Emissions

Expanded EPA NESHAP scopes compel plants to retrofit scrubbers or adopt closed-loop systems, raising capex for mid-scale producers. Emission caps also influence public perception of amine-based carbon-capture solvents, indirectly affecting polyetheramine reputations. Suppliers counter by marketing low-odor, bio-content grades and partnering with equipment OEMs to co-develop lower-emission processing protocols.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Wind-Turbine Blade Production

- Surge in High-Performance Polyurea Protective Coatings

- Slow Approval for Food-Contact Adhesive Grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diamine grades accounted for 49.05% of 2025 shipments, underpinning wind-blade and structural composite uses that demand balanced reactivity and flexibility, and is on track for a 9.88% CAGR to 2031. Huntsman's JEFFAMINE D-series ranges from molecular weight 230 to 2,000, letting processors tune crosslink density for blades designed to last 20 years.

Monoamine and triamine volumes trail but address niche needs: monoamines improve surface wetting in coatings, while triamines hike crosslink density for high-Tg aerospace panels. Chinese producer Zibo Dexin Lianbang Chemical scaled to 30,000 tons per year, widening raw material choice for cost-sensitive buyers. Bio-based diamine research and development from Evonik's Ancamine 2880 evidences a shift to sustainable feedstocks while retaining UV stability for outdoor kits.

The Polyetheramine Report is Segmented by Type (Monoamine, Diamine, and Triamine), Application (Polyurea, Fuel Additives, Composites, Epoxy Coatings, Adhesives and Sealants, and Others), End-User Industry (Automotive, Building and Construction, Wind Energy, Electronics and Electrical, and Other End-User Industries), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific commanded 53.42% of the polyetheramine market share in 2025 as China, India, and Southeast Asia intensified blade and composite part output. Capacity additions include BASF's Nanjing specialty amine plant and a Caojing expansion to 18,800 tons per year, consolidating regional supply and shortening delivery times.

North America remains an innovation nucleus anchored by aerospace primes and advanced 3D-printing service bureaus. EPA NESHAP compliance rewards suppliers with robust environmental credentials and motivates users to adopt low-VOC diamine chemistries. BASF's exclusive Baxxodur distribution via Univar Solutions strengthens technical-service reach, supporting rapid specification cycles among tier-one auto and construction OEMs.

Europe's energy-transition agenda sustains demand for recyclable blades and circular-economy coatings. TPI Composites' Turkish site adds capacity serving European wind parks, and the REACH regulation favors established suppliers able to navigate documentation complexity. Emerging regions in South America and the Middle East ramp up renewable capacity and industrial coatings needs, depending chiefly on imports from APAC hubs, though local blending facilities are under evaluation.

- BASF

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Material Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing investments in adhesives and sealants industry

- 4.2.2 Growing demand from composites manufacturing

- 4.2.3 Expansion of wind-turbine blade production

- 4.2.4 Surge in high-performance polyurea protective coatings

- 4.2.5 Adoption in 3-D-printing-grade epoxy systems

- 4.3 Market Restraints

- 4.3.1 Volatile propylene-oxide feedstock prices

- 4.3.2 Environmental concerns over amine emissions

- 4.3.3 Slow approval for food-contact adhesive grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Monoamine

- 5.1.2 Diamine

- 5.1.3 Triamine

- 5.2 By Application

- 5.2.1 Polyurea

- 5.2.2 Fuel Additives

- 5.2.3 Composites

- 5.2.4 Epoxy Coatings

- 5.2.5 Adhesives and Sealants

- 5.2.6 Others

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Building and Construction

- 5.3.3 Wind energy

- 5.3.4 Electronics and Electrical

- 5.3.5 Other End-User Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Clariant

- 6.4.3 Evonik Industries AG

- 6.4.4 Huntsman International LLC

- 6.4.5 Qingdao IRO Surfactant Co., Ltd.

- 6.4.6 Shandong Longhua New Materials Co., Ltd.

- 6.4.7 Wuxi Akeli Technology Co., Ltd.

- 6.4.8 Yangzhou Chenhua New Material Co., Ltd.

- 6.4.9 Yantai Dasteck Chemicals Co., Ltd.

- 6.4.10 Zibo Zhengda Polyurethane Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment