PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445689

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445689

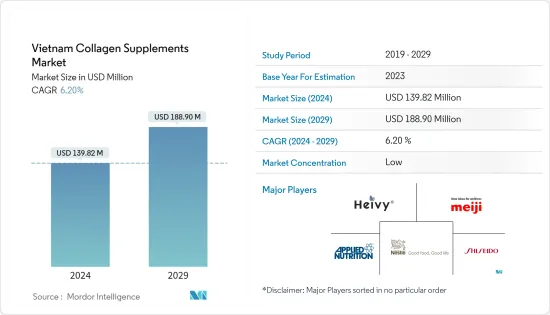

Vietnam Collagen Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Vietnam Collagen Supplements Market size is estimated at USD 139.82 million in 2024, and is expected to reach USD 188.90 million by 2029, growing at a CAGR of 6.20% during the forecast period (2024-2029).

Key Highlights

- Collagen is primarily extracted from animal and marine sources, including bovine, porcine, and poultry, and is considered the finest source of essential nutrients, including protein, carbohydrates, and fibers. Collagen supplements aid in improving bone health. As a result, health-conscious consumers largely opt for collagen peptides supplements to prevent or reduce the onset of osteoporosis.

- Moreover, the impact of the COVID-19 pandemic changed the food consumption pattern of consumers, which, in turn, raised the demand for health-promoting dietary supplements, including collagen supplements. The population in Vietnam is rapidly aging, prompting consumers to seek aids that support skin health, such as collagen supplements, thereby augmenting market growth.

- The demand for clean-label and non-GMO collagen supplements has increased in recent years as consumers are becoming more health-conscious and seeking products with natural and wholesome ingredients. As a result, manufacturers are responding to these demands by developing new collagen supplement products that meet these requirements, such as those made with natural, non-GMO, and sugar-free ingredientMarine-derived collagen peptide is becoming increasingly popular among manufacturers due to its potential environmental sustainability benefits and functional advantages. Marine collagen is derived from the skin, scales, bones, and fins of fish often unused in the fish processing industry, thus reducing waste and promoting sustainability. It also provides enhanced functional benefits, thus gaining consumer traction and making it an emerging opportunity segment in the market.

Vietnam Collagen Supplement Market Trends

Surge in Consumer Spending on Personal Healthcare

- Vietnam is currently undergoing economic and demographic transformations that could provide great potential for its dietary supplements industry. The high expenditure on healthcare indicates the rising health concerns and the extended focus on healthcare by the Vietnamese population. This will have an assured impact on the sales of collagen supplements and drives the market growth.

- Collagen makes up 10% of body muscle tissues which, in turn, collagen peptides consider helpful for people with sarcopenia (a loss of muscle mass). In addition, Several studies suggest that consuming collagen peptides may help treat and prevent osteoporosis. Vietnam has witnessed a population risk of osteoporosis.

- For instance, a study about the burden of osteoporosis in Vietnam published by the National Library of Medicine in 2021 stated that the prevalence of osteoporosis was observed as 27% in women and 13% in men. Thus, the high risk of osteoporosis in the country is anticipated to propel the demand for collagen supplements during the forecast year.

- On the other hand, Geriatrics comprise a share of 9.55% (55-64 years) and 6.91% (65+ years) of the population of Vietnam, with females being more in number. Thus, the increasing aged population in the country is also expected to drive market growth as collagen supplements help increase cartilage density and make joints more flexible.

Powdered Supplements Held the Major Share

- Collagen in the form of powdered supplements has witnessed a growing share of acceptance among consumers owing to its ease of use and convenience. In particular, powder form is the easiest way of mixing collagen supplements in food and beverages, accelerating the uptake of these products.

- Collagen powder has been a more popular form of collagen supplementation than collagen capsules. This is because collagen powder allows for higher dosages of collagen per serving, as it can be easily mixed into beverages or food. Collagen capsules, on the other hand, have a limited size and, therefore, may not contain as much collagen per serving.

- The demand for collagen supplements has been growing steadily in recent years. Many multinational companies have entered the market to offer collagen products in various forms, including powders, capsules, and even gummies. While collagen powder may be more popular, some consumers may still prefer the convenience of capsules, especially for on-the-go use.

- For instance, Vital Proteins, a company owned by Nestle, has made strides in the Vietnamese market through collagen products in powdered form. Moreover, the availability of various flavored collagen powders in the market is also driving market growth as consumers demand flavored functional beverages. Furthermore, the easy accessibility to procure collagen powder supplements in online retail stores and drug stores is strengthening the market growth.

Vietnam Collagen Supplement Industry Overview

The Vietnamese collagen supplements market is fragmented. The major players in the market include Vital Protein, Meiji Holdings, Neocell, and Fujifilm Holdings, among others. The key players in the market are progressively relying on product innovation as the most adopted strategy. Extensive investment in R&D has been witnessed in the past years, which led to the introduction of numerous new products in the market. The growing importance of health as a lifestyle choice during the pandemic also attracted many companies to enter the beauty and health segments of the market. Thus, the extreme focus on preventive healthcare systems, tough endorsements, and lifestyle enhancement product marketing efforts are boosting the collagen supplements market in Vietnam.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Powdered Supplements

- 5.1.2 Capsules

- 5.1.3 Drinks/Shots

- 5.2 Distribution Channel

- 5.2.1 Grocery Retail Stores

- 5.2.2 Pharmacies/Drug Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Specialty Stores

- 5.2.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Key Players

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 Heivy

- 6.3.3 Sheseido Company Limited

- 6.3.4 Applied Nutrition

- 6.3.5 Zint Nutrition

- 6.3.6 Fujifilm Astalift

- 6.3.7 Kinohimits

- 6.3.8 Meiji Holdings Company Ltd (Sakura Collagen)

- 6.3.9 Nucos Cosmetics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS