PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445723

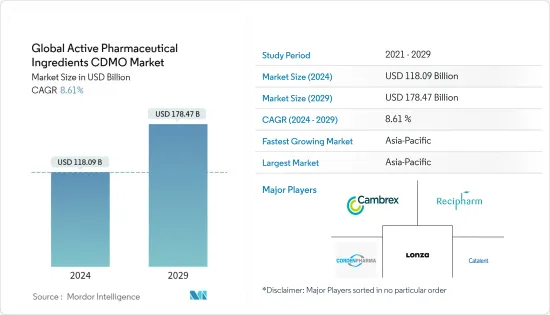

Global Active Pharmaceutical Ingredients CDMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Active Pharmaceutical Ingredients CDMO Market size is estimated at USD 118.09 billion in 2024, and is expected to reach USD 178.47 billion by 2029, growing at a CAGR of 8.61% during the forecast period (2024-2029).

The COVID-19 pandemic had a huge impact on the API CDMO market. As the vaccines and therapeutics for the coronavirus were rolled out globally, the demand for CDMO services skyrocketed. CDMOs went to great lengths to meet the needs of their pharmaceutical customers during the crisis. CDMOs provide a broad range of services to pharmaceutical companies, such as drug development and supply chain, commercial API and drug manufacturing, and packaging. These services permit pharmaceutical firms to reduce their development and manufacturing costs, along with capital investments and timelines, while benefiting from the most advanced technologies.

For instance, in the first half of 2021, there was marked participation of CDMOs in COVID-19 vaccine manufacturing and robust merger acquisition activities. It also highlighted the indispensability of CDMOs in the bio/pharmaceutical industry. This has been vital to the successful launch of vaccines and therapies to combat the COVID-19 virus.

According to the Drug, Chemical & Associated Technologies Association Inc. (DCAT) Value Chain Insights on "Mid-Year CDMO Review: COVID-19 Vaccine Manufacturing and M&A", in the first months of the pandemic, less than 10 CDMOs were known publicly to be working with the bio/pharma companies and government agencies to develop and manufacture vaccines. Contracts were going to CDMOs that had the accessible capacity or could expand it rapidly, including Catalent and Lonza. CDMOs were engaged in producing the vaccine's active ingredients and key excipients. The demand for vaccine capacity elevated the status and profiles of many CDMOs that were earlier dependent on the older products and generics. Some companies, for instance, Rovi Contract Manufacturing, have got both drug substance and drug product contracts.

Besides, the first half of 2021 also saw a high number of merger and acquisition activities as investors sought to buy their way into the industry and incumbents sought to broaden and deepen their capabilities. A total of 32 deals were announced or closed during the first five months of 2021. Out of these, five deals were for small molecule API businesses and four for large molecule API assets.

Outsourcing to CDMOs can also offer companies access to a flexible workforce, including highly-specialized experts. In recent times, increased outsourcing to CDMOs has been seen for drug owners from pharmaceutical to biopharmaceutical companies, from small to large firms, and for early to late-stage development projects.

The quality of APIs has a noteworthy effect on the efficacy and safety of medications. Hence, selecting a CDMO that can provide the precise API at the required strength, purity, and quality is a vital decision for drug development companies.

Active Pharmaceutical Ingredients CDMO Market Trends

The Commercial Segment is Expected to Hold the Major Market Share

The COVID-19 pandemic led to an increase in the demand for pharmaceutical products, and the hoarding of supplies by some nations in the wake of production disruptions boosted exports. When COVID-19 cases rapidly increased, there was a need for new COVID-19 vaccines and therapeutics. Some governments even started considering localization regulations to ensure that sufficient quantities of therapeutics would be produced domestically.

As a result, many pharmaceutical companies started expanding their manufacturing footprint, and some began to rethink their manufacturing footprint to plan for the years ahead. The largest source of additional capacity was CDMOs.

Additionally, pharmaceutical firms reserved and sometimes even double-booked a considerable space with the contract manufacturers. AstraZeneca, Moderna, and Pfizer have declared their partnership agreements with a number of CDMOs, including Lonza, Catalent, and Emergent Biosolutions. Making the most of the opportunity, Cambrex, Catalent, Samsung Biologics, and many other developing country CDMOs have declared a major expansion of their plants.

Asia-Pacific is Expected to Hold a Significant Share in the Market during the Forecast Period

China and India have a significantly low cost of manufacturing compared to the United States and Europe. As per Invest India, the cost of manufacturing in India is approximately 33% lower than that of the United States. While China and India have established themselves as significant providers of API manufacturing services, the United States continues to be the main outsourcing hub for pharmaceutical development. This is due to the combination of enormous amounts of financing and an exclusive concentration of university-affiliated pharmaceutical research hubs.

The expanding importance of traditional pharmaceuticals and the rapidly rising incidence of persistent infections are critical drivers of the Indian API CDMO market's favorable growth. As per an article published in PHRMABIZ.com in 2020, generic APIs are exported to developed countries from India, accounting for 41.6% of the total sales in India versus 24.7% in China. As per the Chemical Pharmaceutical Generic Association Research, India is the second-largest provider of generic API to the US market, with a 24.4% share. The country is also increasing its supply to Western Europe, which accounts for 19.2% of the region's total supply. Also, China accounts for 30% of the global nonexclusive API vendor market. Following China, the United States and India are the leading producers of nonexclusive APIs.

Active Pharmaceutical Ingredients CDMO Industry Overview

The active pharmaceutical ingredients CDMO market is fragmented and consists of several major players. In terms of market share, a few major players dominate the market. A few of them are Cambrex Corporation, Patheon (Themo Fisher Scientific Inc.), Recipharm AB, CordenPharma International, Samsung Biologics, Lonza, Siegfried, Piramal Pharma Solutions, Abbvie Inc., and Catalent Inc.

The role of API manufacturers in the pharmaceutical supply chain is evolving in response to the newfound demands from customers and increasing pressures from global competitors. Traditional generic firms are looking to China and India for bulk activities, while specialty pharmaceutical companies have generated new demands for more specialized capabilities than those required by traditional generics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pharmaceutical R&D Investment

- 4.2.2 Rising Demand for Generic Drugs

- 4.2.3 Complex Manufacturing

- 4.2.4 Patent Expiration

- 4.3 Market Restraints

- 4.3.1 Compliance Issues while Outsourcing

- 4.3.2 Concerns about Data Quality and Security

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Molecule Type

- 5.1.1 Small Molecule

- 5.1.2 Large Molecule

- 5.2 By Synthesis

- 5.2.1 Biotech

- 5.2.2 Synthetic

- 5.3 By Drug Type

- 5.3.1 Innovative

- 5.3.2 Generics

- 5.4 By Workflow

- 5.4.1 Clinical

- 5.4.2 Commercial

- 5.5 By Application

- 5.5.1 Cardiology

- 5.5.2 Oncology

- 5.5.3 Ophthalmology

- 5.5.4 Neurology

- 5.5.5 Orthopedic

- 5.5.6 Other Applications

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cambrex Corporation

- 6.1.2 Patheon (Thermo Fisher Scientific Inc.)

- 6.1.3 Recipharm AB

- 6.1.4 CordenPharma International

- 6.1.5 Samsung Biologics

- 6.1.6 Lonza

- 6.1.7 Siegfried

- 6.1.8 Piramal Pharma Solutions

- 6.1.9 AbbVie Inc.

- 6.1.10 Catalent Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS