PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445734

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445734

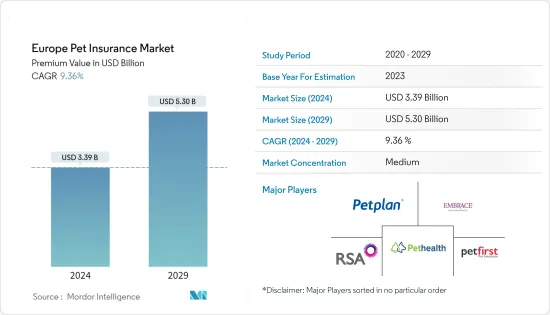

Europe Pet Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Pet Insurance Market size in terms of premium value is expected to grow from USD 3.39 billion in 2024 to USD 5.30 billion by 2029, at a CAGR of 9.36% during the forecast period (2024-2029).

Pet insurance scheme covers veterinary expenses incurred for the treatment of a pet who has endured an injury or is sick. Pet insurance is usually opted by owners to minimize the burden of the cost of availing veterinary services. The policies are offered by various European public and private providers for different animals such as dogs and cats, horses, and others. The Pet Insurance company offers customized policies following tech people's preferences. They focus on the packages as per pet lifetime and per incident. The owner needs to submit a claim to the company regarding treatment activities the pet has received, and then the tech company will reimburse according to the policy.

An increasing number of pet animals being adopted widely for companionship across the European region has increased significantly in the past decade. Pets are largely adopted by people for companionship and there has been a shift in trend from pet owners to pet parents which indicates that pets are considered a part of the family these days.

Surging adoption of pets, soaring veterinary cost, availability of numerous insurance policy options for pets, and rising awareness about the same are expanding Europe pet insurance industry size. Moreover, innovative pet insurance offerings by companies coupled with introduction of beneficial rules and regulations through partnerships between insurance providers and veterinarians are also enhancing the market growth.

The Europe Pet Insurance Market was negatively impacted by COVID-19 . The coronavirus pandemic impacted the proper functioning of various industries in various regions. It affected Europe Pet Insurance Market very badly. Many veterinary hospitals and clinics remained close due to lockdown and restriction on movement. Insurance companies are trying to innovate and modify the policy coverages and policies depending upon the incidences of health conditions. Companies were focussing on providing solutions to the pet owners and spreading awareness regarding the cost reimbursement available in the market. Also, Various companies were taking steps to ensure that pet gets extraordinary care during the COVID-19 outbreak. Also, the companies are innovating multiple solution for their pet owners to enhance their policy process.

Europe Pet Insurance Market Trends

Increasing trend of Dog Insurance Premiums in Europe

Dogs are generally more expensive to insure than cats. The primary driver for changes in dog insurance premiums is often the rising cost of veterinary care. As veterinary technologies and treatments advance, the expenses associated with dog healthcare can increase. An increase in the frequency and cost of claims, either due to more dog health issues or higher costs of treatments, can lead to adjustments in premiums.

Changes in the policies or strategies of insurance companies, such as adjustments to coverage options, benefit limits, or underwriting practices, can affect premiums. General economic conditions and inflation rates can influence the overall cost of doing business for insurance companies, potentially leading to adjustments in premiums. If there's a surge in dog ownership or changes in the demographics of dog owners, it can impact the overall risk profile for insurance companies, potentially affecting premiums.

Increasing Expenditure on Veterinary and Pet Services in the United Kingdom

A rise in pet ownership across the UK has led to an increased demand for veterinary services and other pet-related services. The trend of treating pets as integral family members, often referred to as the "humanization" of pets, has led to a greater willingness to spend on their health and well-being. Advances in veterinary medicine and technology have expanded the range of available services, leading to more sophisticated and specialized treatments.

The popularity of pet insurance has increased, encouraging pet owners to seek veterinary care without significant financial barriers. This, in turn, supports higher spending on veterinary services. The availability of specialized pet services, such as pet grooming, pet daycare, and pet training, contributes to increased overall expenditure on pet-related services. Pet owners are increasingly prioritizing preventive care for their animals, leading to regular veterinary check-ups, vaccinations, and other preventive measures.

Europe Pet Insurance Industry Overview

The European pet insurance market is very competitive and growing across the different countries of Europe owing to increasing pet adoption among the populace and the rising availability of lucrative insurance schemes in countries like Italy, Sweden, France, Germany, Russia, and Poland households at a faster pace. Based on the provider, the market is bifurcated into public providers and private providers, among which the public insurance providers offer innovative medical plans as well as unique insurance schemes and multi-pet insurance policies. Companies are involved in various strategies, such as the launch of new policies, mergers and acquisitions, and regional expansion, to capture a larger share of the market. The European pet insurance market is competitive and consists of a number of major national and international players like PetPlan Insurance, Embrace Pet Insurance Agency, LLC, Royal & Sun Alliance, PetHealth Inc., and PetFirst Healthcare.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Insurance Type

- 5.1.1 Accident & Illness

- 5.1.2 Accident Only

- 5.2 By Policy Type

- 5.2.1 Lifetime Coverage

- 5.2.2 Non-Lifetime Coverage

- 5.3 By Animal Type

- 5.3.1 Dogs

- 5.3.2 Cats

- 5.3.3 Other Animal Types

- 5.4 By Provider

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Distribution Channel

- 5.5.1 Insurance Agency

- 5.5.2 Bancassurance

- 5.5.3 Brokers

- 5.5.4 Direct Sales

- 5.6 By Country

- 5.6.1 Italy

- 5.6.2 France

- 5.6.3 Germany

- 5.6.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Petplan

- 6.2.2 Embrace

- 6.2.3 RSA Insurance

- 6.2.4 Petfirst Healthcare

- 6.2.5 Pethealth Inc

- 6.2.6 Protectapet

- 6.2.7 AGILA

- 6.2.8 Petsecure

- 6.2.9 Hartville Group

- 6.2.10 NSM Insurance Group*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US