PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445765

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445765

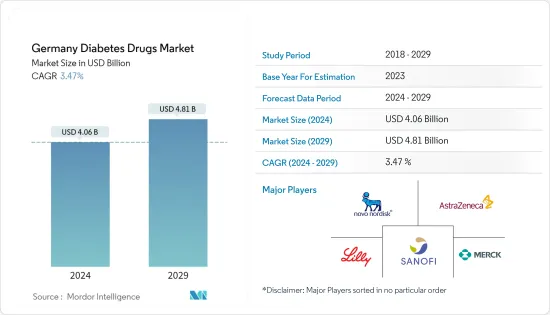

Germany Diabetes Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Germany Diabetes Drugs Market size is estimated at USD 4.06 billion in 2024, and is expected to reach USD 4.81 billion by 2029, growing at a CAGR of 3.47% during the forecast period (2024-2029).

Within the first year since its inception, the COVID-19 pandemic has been responsible for premature deaths, particularly among older individuals. Most people who have died of COVID-19 were affected by the co-occurrence of two or more chronic conditions in the same individual. Several studies have confirmed that chronic diseases like diabetes are associated with adverse outcomes in COVID-19 patients.

People with diabetes have more chances to get into serious complications rather than normal people. The manufacturers of diabetes drugs have taken care during COVID-19 to deliver the medications to diabetes patients with the help of local governments. Novo Nordisk stated on their website that 'Since the start of COVID-19, our commitment to patients, our employees and the communities where we operate has remained unchanged, we continue to supply our medicines and devices to people living with diabetes and other serious chronic diseases, safeguard the health of our employees, and take actions to support doctors and nurses as they work to defeat COVID-19.'

Diabetic drugs are medicines developed to stabilize and control blood glucose levels amongst people with diabetes. Diabetic drugs have been potential candidates for treating diabetic patients affected by SARS-CoV-2 infection during the COVID-19 pandemic. According to the German Diabetes Centre (DDZ), at least 7.2% of the population in Germany currently lives with diabetes which will increase significantly over the next two decades. The rate of newly diagnosed Type 1 and Type 2 diabetes cases is seen to increase, mainly due to obesity, unhealthy diet, and physical inactivity. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic care drugs.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Germany Diabetes Drugs Market Trends

The oral anti-diabetic drugs segment holds the highest market share in the Germany Diabetes Drugs Market in the current year

The oral anti-diabetic drugs segment holds the highest market share of about 59.4% in the Germany Diabetes Drugs Market in the current year.

Oral Anti-Diabetic Drugs are available internationally and are recommended for use when escalation of treatment for type 2 diabetes is required along with lifestyle management. Oral agents are typically the first medications used in treating type 2 diabetes due to their wide range of efficacy, safety, and mechanisms of action. Anti-diabetic drugs help diabetes patients control their condition and lower the risk of diabetes complications. People with diabetes may need to take anti-diabetic drugs for their whole lives to control their blood glucose levels and avoid hypoglycemia and hyperglycemia. Oral anti-diabetic agents present the advantages of easier management and lower cost. So they became an attractive alternative to insulin with better acceptance, which enhances adherence to the treatment.

Germany witnessed an alarming increase in the prevalence of diabetes in recent years. Patients with diabetes require many corrections throughout the day to maintain nominal blood glucose levels, such as oral anti-diabetic medication or ingestion of additional carbohydrates by monitoring their blood glucose levels. The rate of newly diagnosed Type 1 and Type 2 diabetes cases is seen to increase, mainly due to obesity, unhealthy diet, and physical inactivity. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic drugs.

Stringent government policies and favorable regulations by WHO in Germany are encouraging companies to develop innovative products. Penetration of these products in the German market supports local organizations in their clinical research trials and ensures ease of management, facilitating the discovery process.

Owing to the above factors, the market will likely continue to grow.

Sodium-Glucose Cotransport -2 (SGLT-2) Inhibitor segment is expected to register the highest CAGR in the Germany Diabetes Drugs Market over the forecast period

Sodium-Glucose Cotransport -2 (SGLT-2) Inhibitor Segment is expected to dominate the Germany Diabetes Drugs Market and register a CAGR of 9.2% over the forecast period.

SGLT-2 inhibitors, also called gliflozins, are a medicine class used to lower high blood glucose levels in people with type 2 diabetes. SGLT-2 inhibitors act independently of beta-cell function in the pancreas. SGLT-2 drugs significantly manage cardiovascular risk factors, including blood pressure, cardiac function, and antiinflammatory activity. SGLT-2 inhibitors are effective at lowering hemoglobin A1c levels and improving weight loss. They include a low risk of hypoglycemia and are usually well tolerated.

According to European Observatory on Health Systems and Policies 2021, Germany includes the world's oldest social health insurance (SHI) system. Health insurance is compulsory. People with an income above a fixed threshold or belonging to a particular professional group can opt out of SHI coverage and enroll in private health insurance (PHI). About 11 % of the population is covered by PHI and 89 % by SHI. Although coverage is universal for all legal residents, only 0.1 % of the population does not contain health insurance.

Diabetes can be considered a data management disease, and an example of real-world acquisition of health and treatment data informs an integrated and personalized chronic disease management. Both patients and diabetes care providers use continuously collected metabolic, treatment, and lifestyle data in joint decision-making on treatment. Diabetes is a significant health problem and one of the tremendous challenges for healthcare systems all over Germany. The disease's growing incidence, prevalence, and progressive nature encouraged the development of new drugs to provide additional treatment options for diabetic patients. The roll-out of many new products, increasing international research collaborations in technology advancement, and increasing awareness about diabetes among the people are some of the market opportunities for the players in the Germany diabetes drugs market.

Germany Diabetes Drugs Industry Overview

The Germany Diabetes Drugs Market is moderately fragmented, with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, and other generic players, holding a presence in the region. A major share of the market is held by manufacturers concomitant with strategy-based M&A operations and constantly entering the market to generate new revenue streams and boost existing ones.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insulins

- 5.1.1 Basal or Long Acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Basaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast Acting Insulins

- 5.1.2.1 NovoRapid/Novolog (Insulin Aspart)

- 5.1.2.2 Humalog (Insulin Lispro)

- 5.1.2.3 Apidra (Insulin Glulisine)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin/Actrapid/Insulatard

- 5.1.3.2 Humulin

- 5.1.3.3 Insuman

- 5.1.4 Biosimilar Insulins

- 5.1.4.1 Insulin Glargine Biosimilars

- 5.1.4.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long Acting Insulins

- 5.2 Oral Anti-diabetic drugs

- 5.2.1 Biguanides

- 5.2.1.1 Metformin

- 5.2.2 Alpha-Glucosidase Inhibitors

- 5.2.2.1 Alpha-Glucosidase Inhibitors

- 5.2.3 Dopamine D2 receptor agonist

- 5.2.3.1 Bromocriptin

- 5.2.4 SGLT-2 inhibitors

- 5.2.4.1 Invokana (Canagliflozin)

- 5.2.4.2 Jardiance (Empagliflozin)

- 5.2.4.3 Farxiga/Forxiga (Dapagliflozin)

- 5.2.4.4 Suglat (Ipragliflozin)

- 5.2.5 DPP-4 inhibitors

- 5.2.5.1 Onglyza (Saxagliptin)

- 5.2.5.2 Tradjenta (Linagliptin)

- 5.2.5.3 Vipidia/Nesina(Alogliptin)

- 5.2.5.4 Galvus (Vildagliptin)

- 5.2.6 Sulfonylureas

- 5.2.6.1 Sulfonylureas

- 5.2.7 Meglitinides

- 5.2.7.1 Meglitinides

- 5.2.1 Biguanides

- 5.3 Non-Insulin Injectable drugs

- 5.3.1 GLP-1 receptor agonists

- 5.3.1.1 Victoza (Liraglutide)

- 5.3.1.2 Byetta (Exenatide)

- 5.3.1.3 Bydureon (Exenatide)

- 5.3.1.4 Trulicity (Dulaglutide)

- 5.3.1.5 Lyxumia (Lixisenatide)

- 5.3.2 Amylin Analogue

- 5.3.2.1 Symlin (Pramlintide)

- 5.3.1 GLP-1 receptor agonists

- 5.4 Combination drugs

- 5.4.1 Insulin combinations

- 5.4.1.1 NovoMix (Biphasic Insulin Aspart)

- 5.4.1.2 Ryzodeg (Insulin Degludec and Insulin Aspart)

- 5.4.1.3 Xultophy (Insulin Degludec and Liraglutide)

- 5.4.2 Oral Combinations

- 5.4.2.1 Janumet (Sitagliptin and Metformin)

- 5.4.1 Insulin combinations

6 MARKET INDICATORS

- 6.1 Type-1 Diabetic Population

- 6.2 Type-2 Diabetic Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Novo Nordisk A/S

- 7.1.2 Takeda

- 7.1.3 Pfizer

- 7.1.4 Eli Lilly

- 7.1.5 Janssen Pharmaceuticals

- 7.1.6 Astellas

- 7.1.7 Boehringer Ingelheim

- 7.1.8 Merck and Co.

- 7.1.9 AstraZeneca

- 7.1.10 Bristol Myers Squibb

- 7.1.11 Novartis

- 7.1.12 Sanofi Aventis

- 7.2 COMPANY SHARE ANALYSIS

- 7.2.1 Novo Nordisk A/S

- 7.2.2 Sanofi Aventis

- 7.2.3 Eli Lilly

- 7.2.4 Merck and Co.

- 7.2.5 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS