PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445774

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445774

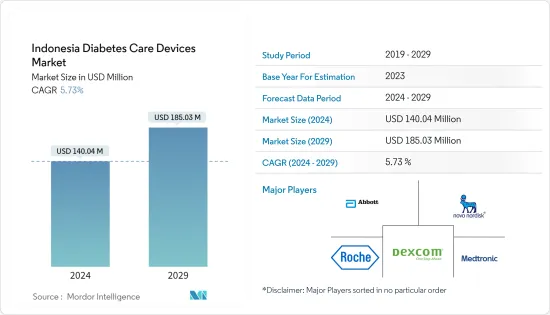

Indonesia Diabetes Care Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia Diabetes Care Devices Market size is estimated at USD 140.04 million in 2024, and is expected to reach USD 185.03 million by 2029, growing at a CAGR of 5.73% during the forecast period (2024-2029).

The coronavirus disease 2019 (COVID-19) pandemic is a massive worldwide public health disaster caused by the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) virus. COVID-19 has a wide clinical range, with symptoms ranging from asymptomatic to severe disease, including fever and deadly pneumonia in those with comorbidities. The COVID-19 pandemic unfolds in 2020, as the fight to build a responsive healthcare system in diabetic care continues. SARS CoV-2 infected 1 736 670 persons as of May 18, 2021, with 2.76% of cases (47 976 people) dying. As a result, Indonesia was the worst-affected country in Southeast Asia by COVID-19. PWD was also severely impacted by these situations. Diabetes patients are at a higher risk of being extremely unwell if they catch the virus. According to research conducted by the deputy of health in Jakarta, about 11.1% of COVID-19 patients hospitalized had diabetes, and 26.9% of the cases were fatal. 5 When compared to general populations, the risk of death for those with disabilities was 1.26 times higher.

Diabetes in Indonesia is considered a major health problem and has been a concern. Diabetes specialists have created recommendations for preventing and controlling diabetes to address the growing number of diabetics in Indonesia. Diabetes management is critical to preventing serious consequences such as neuropathy, nephropathy, retinopathy, microvascular disease, and cardiovascular disease. Pharmacologic therapy such as oral medicines and insulin, as well as non-pharmacologic therapies such as lifestyle changes, are still considered modern approaches for diabetes management. These therapies are only possible through diabetes teaching programs that promote self-care management. Diabetes education programs are provided by healthcare providers in Indonesia. In Indonesia, the availability of certified diabetic educators is restricted, resulting in a scarcity of qualified health care professionals (HCPs) to educate persons with diabetes.

Indonesia Diabetes Care Devices Market Trends

Management Devices Hold Highest Market Share in Indonesia Diabetes Care Devices Market

Patients with Type 1 diabetes (T1D) must maintain healthy lifestyle conditions, which are impacted by t person's personality traits, social interactions, socioeconomic circumstances, and environmental living factors. TContinuousglucose monitoring (CGM) with multiple daily injections (MDI) has shown a reduction in nonsevere and severe hypoglycemia in people with T1D prone to this adverse event. Patients with T1D at a high risk of hypoglycemia may control their blood sugar levels even amid the harsh living circumstances imposed by the COVID-19 pandemic crisis' severe lockdown, thanks to standalone continuous glucose monitoring. A little improvement in glucometric markers, particularly those connected to glucose exposure, was linked to the lockdown time. The Spanish hospitals are ordering CGM devices to limit staff contact with many diabetic patients infected with COVID-19.

Indonesian Diabetes Association and the Ministry of Health Indonesia were actively monitoring the Coronavirus issue in collaboration with the Indonesian local governments and management devices manufacturers to remain available for all Indonesians and stated that based on the information from diabetes device manufacturers, there had been no COVID-19 related shortages reported in Indonesia. Since people with diabetes are at an increased risk of severe illness from COVID-19 infection, the Indonesian government is ensuring an adequate supply of required monitoring device supplies in the market to ensure the well-being of Indonesian diabetes patients.

Increasing Type -1 Diabetes Population in Indonesia

In terms of the number of people with diabetes, Indonesia ranks seventh in the world. In Indonesia, people's health is primarily covered by national government insurance. Government insurance covers medical requirements such as consultation, hospitalization, insulin, and needles through designated clinics, hospitals, and licensed pharmacies. However, due to a lack of knowledge and information on Type 1 diabetes, a misunderstanding occurred, resulting in insulin access limits. The amount of insulin made available through government insurance was limited. For example, a child with Type 1 diabetes who is supposed to receive eight insulin pens per month was only given five insulin pens per month, requiring the parents to purchase the remaining three pens at their own expense. They could not meet their child's insulin needs if they did not have the money. One of the world's most populous nations, Indonesia has about 10.7 million diabetics, or 6.2% of the population. As a result, Indonesia ranks among the nations with the highest proportion of people with diabetes. Diabetes is one of Indonesia's leading causes of death, according to WHO data from 2016. Diabetes management strategies in Indonesia include pharmacological treatment, education, physical activity, and dietary management.

The COVID-19 pandemic and the related social restriction policy implemented by the Indonesian government to reduce transmissions have affected diabetes management and increased diabetes-related complications in a nation with a large diabetes population.

As a result, the diabetes care devices market in Indonesia is predicted to expand gradually in the coming years.

Indonesia Diabetes Care Devices Industry Overview

The new technologies in diabetes devices, like continuous glucose monitoring, increased the market for monitoring devices. The mergers and acquisitions between the players, like the acquisition of TypeZero Technologies by Dexcom, are paving the way for automated insulin delivery. The acquisition has sent Dexcom ahead on its way in the race to create an artificial pancreas system rather than merely offering a boost to the continuous glucose monitoring devices market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Monitoring Devices

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.1.1.1 Glucometer Devices

- 5.1.1.2 Test Strips

- 5.1.1.3 Lancets

- 5.1.2 Continuous Blood Glucose Monitoring

- 5.1.2.1 Sensors

- 5.1.2.2 Durables

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.2 Management Devices

- 5.2.1 Insulin Pump

- 5.2.1.1 Insulin Pump Device

- 5.2.1.2 Insulin Pump Reservoir

- 5.2.1.3 Infusion Set

- 5.2.2 Insulin Syringes

- 5.2.3 Insulin Cartridges

- 5.2.4 Disposable Pens

- 5.2.1 Insulin Pump

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes population

- 6.2 Type-2 Diabetes population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Becton and Dickenson

- 7.1.2 Medtronic

- 7.1.3 Insulet

- 7.1.4 Tandem

- 7.1.5 Ypsomed

- 7.1.6 Novo Nordisk

- 7.1.7 Sanofi

- 7.1.8 Eli Lilly

- 7.1.9 Abbottt

- 7.1.10 Roche

- 7.1.11 Lifescan (Johnson &Johnson)

- 7.1.12 Dexcom

- 7.2 Company Share Analysis

8 MARKET OPPORTUNITIES AND FUTURE TRENDS