PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445788

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445788

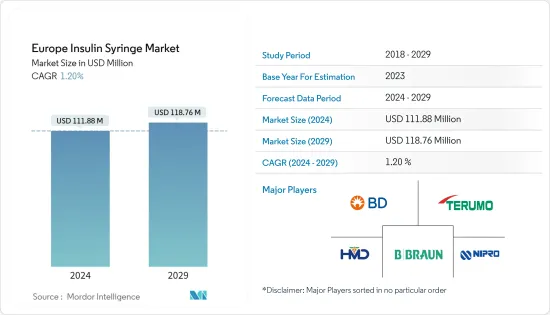

Europe Insulin Syringe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Insulin Syringe Market size is estimated at USD 111.88 million in 2024, and is expected to reach USD 118.76 million by 2029, growing at a CAGR of 1.20% during the forecast period (2024-2029).

The COVID-19 pandemic has substantially impacted the Europe Insulin Syringe Market. People with diabetes have a weak immune system so, with COVID-19, the immune system gets weaker very fast. People with diabetes will have more chances to get into serious complications rather than normal people. The manufacturers of diabetes care devices have taken care during COVID-19 to deliver the diabetes care devices to diabetes patients with the help of local governments. Doctors around the world suggested diabetes patients should monitor and manage their blood glucose levels more often which leads to an increase in the usage of insulin syringes.

According to the diabetes category, the estimated cost per hospital admission during the first wave of COVID-19 in Europe ranged from EUR 25,018 for type 2 diabetes patients in good glycemic control to EUR 57,244 for type 1 diabetes patients in poor glycemic control, reflecting a higher risk of intensive care, ventilator support, and a longer hospital stay. The estimated cost for patients without diabetes was EUR 16,993. The expected total direct expenditures for COVID-19 secondary care in Europe were 13.9 billion euros. Diabetes treatment thus accounted for 23.5% of total expenditures.

European countries are suffering from the burden of high diabetes expenditure due to its rising prevalence. In high-income countries, diabetes is one of the leading causes of cardiovascular diseases, blindness, kidney failure, and lower limb amputation. Technological advancements have increased over the period in Diabetes care devices for safer and more accurate administration of insulin. A needle and syringe are a common and cost-effective way for many people to take insulin. Approximately 10% of the total diabetes population is having type-1 diabetes and approximately out of this 10% of people only 80-90% use Insulin delivery devices but the usage of insulin is rising from time to time, even type-2 diabetes patients are using the insulin devices during COVID-19.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Europe Insulin Syringe Market Trends

Increasing diabetes prevalence

The diabetes population in the European region is expected to rise by more than 5% over the forecast period.

According to the IDF 2021 report, about 1 in 11 adults contain diabetes in Europe, accounting for approximately 61 million. These figures indicate that approximately 19.6% of global expenditure is spent on diabetes in Europe. Every year 21,600 children are added to the type-1 diabetic population pool. The European region witnessed an alarming increase in the prevalence of diabetes in recent years. Patients with diabetes require many corrections throughout the day to maintain nominal blood glucose levels, such as oral anti-diabetic medication or ingestion of additional carbohydrates by monitoring their blood glucose levels.

The rate of newly diagnosed Type 1 and Type 2 diabetes cases is seen to increase, mainly due to obesity, unhealthy diet, and physical inactivity. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of insulin. Type-1 diabetic patients must check their blood glucose levels regularly, monitor their blood glucose levels, and adjust the insulin dosing accordingly. Insulin syringes are designed for self-injection and offer a reliable solution for insulin injection. An insulin syringe is made of three parts, which consist of a needle, a barrel, and a plunger. Needles are usually short and thin to reduce the pain of injection.

Various initiatives by the Government, such as the National Service Framework (NSF) program in the United Kingdom, are improving services by setting national standards to drive up service quality and tackle variations in care. The Association of British HealthTech Industries launched a diabetes section, enabling diabetes technology companies to work together in the first forum of its kind.

Therefore, owing to the factors above, the studied market is anticipated to grow over the analysis period.

Russia holds the highest market share in the Europe Insulin Syringe Market in the current year

Russia holds the highest market share of more than 51% in the Europe Insulin Syringe Market in the current year.

According to Roscongress, Russia ranks fifth in the world regarding the number of patients with diabetes mellitus aged 20 to 79. The World Health Assembly Resolution 2022 recommends the integration of prevention and treatment of diabetes into primary health services, developing pathways for a substantial increase in access to insulin, promoting convergence and harmonizing regulatory requirements for diabetes medicines and technologies, and improving diabetes monitoring and surveillance. Furthermore, it involves the WHO advising the Member States to ensure the uninterrupted treatment of people living with diabetes in humanitarian emergencies. This important milestone provides a global mandate for diabetes efforts for the next decade.

According to IDF, to reduce the diabetes epidemic in the country, the Russian government needs to fully implement a National Diabetes Plan that establishes a state budget and guarantees diabetes care to all Russian citizens. Russia is working towards improving the reimbursement system for all aspects of diabetes care, limiting out-of-pocket payments, and preventing households from incurring catastrophic expenditures. Also, implementing a national screening program to improve the early identification of disturbed carbohydrate metabolism and creating a specialized diabetes health service under the Ministry of Health of the Russian Federation.

The roll-out of many new products, increasing international research collaborations in technology advancement, and increasing awareness about diabetes among people are some market opportunities for the players.

Europe Insulin Syringe Industry Overview

The Europe Insulin Syringe Market is moderately fragmented and driven by constant innovations by manufacturers such as Becton Dickinson, Terumo Corporation, and HMD Healthcare Ltd. It resorts to inorganic market strategies, such as mergers and acquisitions, to establish market dominance while adhering to organic growth strategies. It is evident from the R&D spending of these companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insulin Syringe

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 Germany

- 5.2.3 France

- 5.2.4 Russia

- 5.2.5 Spain

- 5.2.6 Italy

- 5.2.7 Rest of Europe

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Becton Dickinson

- 7.1.2 Terumo Corporation

- 7.1.3 B. Braun Medical Inc.

- 7.1.4 Nipro Corporation

- 7.1.5 HMD Healthcare Ltd.

- 7.1.6 Cardinal Health

- 7.2 Company Share Analysis

- 7.2.1 Becton Dickinson

- 7.2.2 Terumo Corporation

- 7.2.3 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS