PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693725

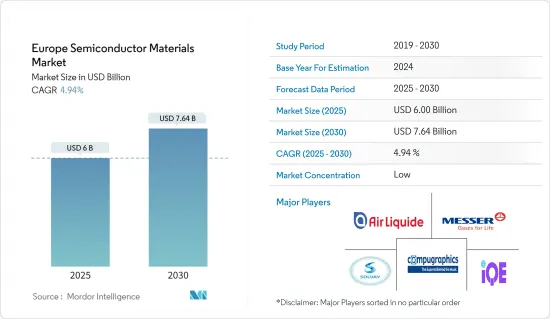

Europe Semiconductor Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Semiconductor Materials Market size is estimated at USD 6.00 billion in 2025, and is expected to reach USD 7.64 billion by 2030, at a CAGR of 4.94% during the forecast period (2025-2030).

Semiconductor materials represent one of the significant innovations in the electronics industry. By employing materials such as silicon (Si), germanium (Ge), and gallium arsenide (GaAs), electronics manufacturers have been able to replace traditional thermal devices that made electronic items heavy and non-portable.

Key Highlights

- Silicon is the most popular semiconductor element available in the current market scenario. However, the increasing demand for ever-smaller, faster-integrated circuits has pushed the efficiency of the material to its limits, with many industry experts fearing silicon will soon reach the limits of Moore's Law. In the meantime, various research initiatives are being undertaken to develop new materials, driving innovation in the studied market.

- Moreover, with the miniaturization trend gaining momentum in the semiconductor industry, the demand for semiconductor materials is also expected to grow as manufacturing advanced node ICs, heterogeneous integration, and 3D memory architectures require more processing steps, driving higher wafer fabrication and packaging materials consumption as a result.

- Higher energy efficiency and resulting lower losses in all electronic operations is a general trend in the industry. As such, the demand for energy-efficient components is expected to grow strongly, especially in energy-intensive applications, from electric vehicle drives to charging stations and power supplies.

- The semiconductor industry is considered one of the most complex industries. This is because more than several processing steps and various products are involved in their manufacturing and the harsh environment it faces, e.g., the volatile electronic market and the unpredictable demand.

- The outbreak of the COVID-19 pandemic worldwide, including in Europe, significantly disrupted the supply chain and production of the market studied. Many end-user industries of the market were also affected by the pandemic, which, in turn, had a negative impact on the market.

Europe Semiconductor Materials Market Trends

Technical Advancement and Product Innovation of the Semiconductor Materials

- Semiconductors are moving away from rigid substrates, cut or formed into thin discs or wafers, to more flexible plastic material and paper, all due to new material and fabrication discoveries. The trend toward more flexible substrates has led to numerous devices, from light-emitting diodes to solar cells and transistors.

- Moreover, in December 2022, Pragmatic Semiconductor Ltd, a UK-based startup developing a new approach to chip production, raised USD 35 million from investors. The company operates a chip fabrication facility, or fab, that manufactures flexible processors that bend without breaking. Most notably, the processors do not contain silicon. In 2022, Pragmatic and Arm Ltd demonstrated a flexible processor, PlasticArm, which consists of metal-oxide transistors implemented on a plastic substrate.

- Moore's law has been driving advances in computing devices as they keep getting smaller, faster, and cheaper. Thus, the semiconductor industry needs to address the challenge of how to migrate processes that were once developed for a few microns to be able to form junctions that are a few nanometers in scale.

- Within the project FACIT (fast annealing of compound semiconductors for integration of new technologies), which is funded by the European Union, scientists have successfully combined III-V materials, indium, gallium, and arsenide (InGaAs), with silicon germanium (SiGe) technology to create CMOS chips. The newly developed process is compatible with high-volume chip fabrication, which makes it a viable option for chip manufacturers. Using the same large-sized Si wafer of 350-400 mm, the project team has developed a process that allows the integration of InGaAs, SiGeand Si CMOS layers. Scientists have considered this method as a way of further shrinking and scaling CMOS technology at a nanometer level.

Consumer Electronics to Witness the Growth

- The creation of semiconductor materials is one of the most significant technological advances in the electronics industry. Because of its high electron mobility, wide operating temperature range, and low energy need, the material is well-liked. Semiconductors are used in the majority of consumer electronics. Mobile phones, computers, game consoles, microwaves, and refrigerators all employ semiconductor components, including integrated circuits, diodes, and transistors.

- Power electronics use semiconductor materials, which directly impact system efficiency. Power electronics systems are used by mobile phones and home appliances to convert electrical power from one form to another and regulate its energy level. One of these is silicon carbide (SiC), which has characteristics that, among other things, enable operation at higher temperatures and higher electrical potential, resulting in smaller components and greater power conversion efficiency. Thus, advancements in this area immediately raise the need for materials like SiC.

- The requirement for electronic makers to extend battery life is fuelling the demand for SiCmaterial semiconductors. Manufacturers of consumer gadgets are upgrading the batteries in their products. The market expansion of this sector is driven by consumer desire for low-charging gadgets. The primary consumers of SiC semiconductors in this market are the manufacturers of smartphones, wearable devices, and other major consumer electronics.

- Manufacturers and governments are creating smartphone chargers that can charge the device in a relatively short period. Therefore, the current rating for these has increased from 0.5 milliamps to 5 milliamps. The USB-C and On Board adapters' SiC semiconductors are essential for sustaining the necessary current and voltage levels. The wearable device and PC markets have both followed a similar trajectory. GaNand SiC Devices in the future generation of onboard chargers and USB-C adapters provide ultra-high power density. The distribution of these fast-charging adapters by producers like OPPO, One Plus, Motorola, Samsung, and Apple is the cornerstone of their marketing tactics.

Europe Semiconductor Materials Industry Overview

The European semiconductor materials market is reasonably competitive and consists of several major players. The market appears to be moderately concentrated. The market poses high barriers to entry for new firms. New entrants must be content with high capital requirements, while the technology-intensive nature of the market makes it imperative for market players to closely track technological developments.

- October 2022 - IQE (International Quantum Epitaxy) PLC entered into a strategic collaboration agreement with SK silicon to develop and commercialize compound semiconductor products. IQE and SK Ultron will focus on developing and delivering innovative epi wafers based upon GaN (Gallium Nitride) on SiC (Silicon Carbide) for radio frequency applications in the wireless communications market and GaN on Silicon (Si) for power electronics applications across various markets.

- July 2022 - BASF and Toda Kogyo Corp. (TODA) announced that they would further expand the production capacity of BASF TODA Battery Materials LLC (BTBM) at the Onoda site in Japan. This expansion increases the supply of high nickel cathode active materials for up to 45 GWh cell capacity per year. This expansion would increase benefits for the semiconductor manufacturers in manufacturing rechargeable batteries and alloys across industrial and consumer industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technical Advancement and Product Innovation of the Semiconductor Materials

- 5.1.2 Rising Demand for Consumer Electronics Goods

- 5.1.3 Increased Demand from OSAT/Packaging Companies

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Fabrication

- 6.1.1.1 Process Chemicals

- 6.1.1.2 Photomasks

- 6.1.1.3 Electronic Gases

- 6.1.1.4 Photoresists Ancillaries

- 6.1.1.5 Sputtering Targets

- 6.1.1.6 Silicon

- 6.1.1.7 Other Fabrication Applications

- 6.1.2 Packaging

- 6.1.2.1 Substrates

- 6.1.2.2 Lead Frames

- 6.1.2.3 Ceramic Packages

- 6.1.2.4 Bonding Wire

- 6.1.2.5 Encapsulation Resins (Liquid)

- 6.1.2.6 Die Attach Materials

- 6.1.2.7 Other Packaging Applications

- 6.1.1 Fabrication

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecommunication

- 6.2.3 Manufacturing

- 6.2.4 Automotive

- 6.2.5 Energy and Utility

- 6.2.6 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Solvay SA

- 7.1.2 Messer SE & Co. KGaA

- 7.1.3 Air Liquide SA

- 7.1.4 Compugraphics (MacDermid Alpha Electronics Solutions)

- 7.1.5 International Quantum Epitaxy PLC (IQE PLC)

- 7.1.6 BASF SE

- 7.1.7 Henkel AG & Co. KGaA

- 7.1.8 Caplinq Europe BV

8 MARKET OUTLOOK