PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445854

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445854

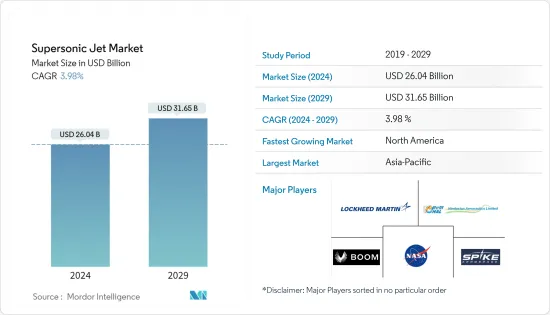

Supersonic Jet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Supersonic Jet Market size is estimated at USD 26.04 billion in 2024, and is expected to reach USD 31.65 billion by 2029, growing at a CAGR of 3.98% during the forecast period (2024-2029).

The onset of the COVID-19 pandemic had a moderate impact on the R&D programs of supersonic aircraft, as companies had to reassess their cost structures to stay economically viable. This led to temporary cost escalations for several ongoing programs, both in the commercial and defense sectors. Post-pandemic, the investments made toward the procurement of new combat aircraft and the development of commercial supersonic jets also increased significantly, resulting in a sharp recovery of the market.

As the commercial supersonic flight is banned in many countries, the market relies on a very small segment of customers, which restricts the growth of the commercial segment of the market. However, plans to re-commercialize supersonic travel are in the pipeline, which may trigger rapid growth during the forecast period.

Supersonic Jet Market Trends

Passenger Segment of the market is expected to grow during the forecast period

The passenger segment of the market is expected to witness profound growth during the forecast period as countries like the US are looking to commercialize supersonic jet travel. On this note, NASA is currently working on a civilian supersonic aircraft. The US Federal Aviation Administration has established a special corridor over Kansas City for testing civilian supersonic aircraft. A rapid growth spurt in air passenger traffic has also encouraged airlines to reduce their flight times and provide faster commutes for their passengers. In August 2022, American Airlines signed an agreement with Boom Supersonic for the purchase of 20 Boom Supersonic Overture Passenger Jets. The contract also includes an additional option for 40 aircraft in the future. Similarly, United Airlines also signed a contract with Boom Supersonic for the purchase of 15 Overture Airliners from the company, with an option for an additional 35 aircraft. The airline is expected to start supersonic passenger travel in 2029.

Asia-Pacific Region is expected to grow during the forecast period

Even though North America has the largest market share right now because of the investments and R&D efforts made by aviation companies in the region to promote supersonic travel, Asia-Pacific is expected to grow its market share over the next few years because of its large user base.One of the main things that would push people in the region to use supersonic jets is the number of people who fly. For example, Japan Airlines Limited, which is the national airline of Japan, has put USD 10 million into making supersonic planes. The airline has placed an order for 20 Boom Supersonic Overture jets, with an option for an additional 40 aircraft in the future. In 2021, a China-based company, Space Transportation, announced that it had raised USD 46.3 million for its supersonic space plane and claimed that the jet is about six times faster than the usual aircraft. The company aims to conduct ground testing for the jet by 2023, and the flight test is expected to take place in 2024.

In the defense sector, countries from outside the region have also started collaborating to work on supersonic jet projects with the countries in the region. For instance, in July 2022, the UK Government announced that it would work alongside Japan on the development of a next-generation supersonic Tempest fighter jet. The first flight test for the Tempest aircraft is expected within the next five years. The Tempest aircraft has been designed as a replacement for the Typhoon fighter.

Supersonic Jet Industry Overview

The supersonic jet market is highly consolidated. NASA, Lockheed Martin Corporation, Boom Supersonic, Hindustan Aeronautics Limited, and Spike Aerospace Inc. are some of the prominent players in the market. Existing performance limitations such as sonic boom are seen as adoptions as the companies try to make the supersonic jet available to the public and, for that, try to advance the technology. NASA is working on an experimental aircraft, the X-59 Quiet SuperSonic Technology (OueSST), with the goal of making quiet commercial supersonic travel possible. And according to NASA, the first community flight of the X-59 QueSST will take place in 2025. Such innovative technologies will result in the growth of the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Size

- 5.1.1 Light

- 5.1.2 Medium

- 5.1.3 Heavy

- 5.2 Type

- 5.2.1 Fighter

- 5.2.2 Passenger

- 5.3 Speed

- 5.3.1 Mach 1.0

- 5.3.2 Mach 2.0

- 5.3.3 Mach 3.0

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Boom Supersonic

- 6.2.2 Lockheed Martin Corporation

- 6.2.3 Hindustan Aeronautics Limited

- 6.2.4 NASA

- 6.2.5 Spike Aerospace, inc.

- 6.2.6 Exosonic

- 6.2.7 Japan Aerospace Exploration Agency

- 6.2.8 Aviation Industry Corporation of China

- 6.2.9 Virgin Galactic

- 6.2.10 EON Aerospace, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS