PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445939

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445939

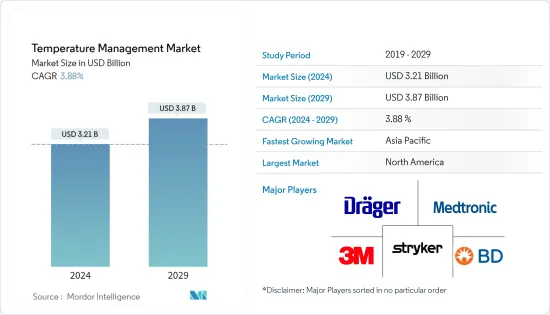

Temperature Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Temperature Management Market size is estimated at USD 3.21 billion in 2024, and is expected to reach USD 3.87 billion by 2029, growing at a CAGR of 3.88% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic impacted the temperature management market. During the initial phase of the pandemic, many surgical procedures were canceled or postponed, which reduced the demand for temperature management systems as it is one of the essential requirements of post-surgery. For instance, according to the NCBI research study published in 2021, a large number of surgical procedures were canceled or postponed during COVID-19 for an indefinite period. Thus, such a scenario imposed a slight adverse impact on the market during the initial phase of the pandemic. However, many healthcare organizations across the globe published recommendations or guidelines emphasizing the importance of maintaining a normothermia environment to avoid COVID-19 contamination. For instance, as per the research article published by 3M in 2021, AORN (Association of periOperative Registered Nurses) has recommended using forced air warmers during surgical procedures in COVID-19-positive patients to decrease the risk of hypothermia. Therefore, owing to such guidelines and with the resumption of surgical procedures, the market started to gain traction and is expected to continue the upward trend over the forecast period.

The increasing prevalence of cancer, infectious diseases, and cardiovascular diseases, the rising number of surgical procedures, and the development of technologically advanced intravascular systems are the major drivers for the market. For instance, according to the WHO 2022, the WHO GISRS laboratories tested more than 317198 specimens from December 2021 to January 2022. 16862 people were positive for influenza viruses, of which 10744 (63.7%) were typed as influenza A and 6118 (36.3%) as influenza B. Of the sub-typed influenzaA viruses, 224 (4.3%) were influenza A(H1N1) pdm09, and 4930 (95.7%) were influenza A(H3N2). Similarly, according to the report published by the European CDC in March 2021, it was reported that every year around 500,000 sexually transmitted infections detected in the European Union, European Economic Area (EEA), and the United Kingdom. Furthermore, according to the GLOBOCAN Report 2020, globally, around 19,292,789 new cancer cases have been reported, and 9,958,133 reported cancer deaths. The majorly affecting cancers are breast cancer, lung cancer, colorectum cancer, and prostate cancer. Hyperthermia is an essential treatment for cancer and infectious diseases, which can be attained by using temperature management systems. Therefore, increasing cases of cancer and infectious diseases across the globe is anticipated to propel market growth over the forecast period.

The increasing number of surgical procedures and product launches by the key players are also surging the market growth. For instance, according to the report published by the Department of Health & Family Welfare and Ministry of Health & Family Welfare in 2021-2022, till September 2021, about 8.29 lakh people visited OPDs, and around 33,830 surgeries were performed in Safdarjung Hospital, India. The same source also reported that around 25,101 minor surgeries were performed, and about 9,327 major surgeries were performed in India for the year 2020-21. Maintaining normal body temperature provides valuable benefits to surgical patients, including risk reduction of surgical site infection, reduced mortality, fewer post-operative cardiac events, reduced blood loss, faster recovery times, and shorter patient hospitalizations. Temperature management systems offer hospitals and clinicians with a safe and effective method of keeping patients warm before, during, and after surgery. Since temperature management systems are one of the essential requirements, thus increasing the number of surgical procedures is expected to boost the market growth.

Furthermore, the launch of new product lines by the key players are also anticipated to create new opportunities in the market. For instance, in April 2021, Danish medtech company MEQU launched an in-hospital solution, M Station, for its blood and IV fluid warming device, M Warmer System. M Warmer System is a portable blood and IV fluid warming device that is adopted in the pre-hospital and military sectors. Using a patented warming technology, the M Warmer is able to warm infusion fluids from cold to body temperature in under 10 seconds. Thus, increasing product launches and a rising number of surgical procedures are anticipated to propel the market growth over the forecast period.

However, the high cost of temperature management systems and product recalls may restrain the market growth over the forecast period.

Temperature Management Market Trends

Conventional Warming System Segment is Expected to Witness Considerable Growth Over the Forecast Period

Conventional warming system helps to prevent hypothermia in surgical patients and is considered standard and effective care. Conventional warming systems offers forced air, which essentially blows warm air through a cover that surrounds the patient. Many studies show that patients warmed with forced air have a normal body temperature at the end of surgery. Conventional warming systems can create significant temperature gradients within the operating room that have the potential to disrupt laminar airflow patterns and contaminate the surgical site with floor-level air mobilized by convection currents. Thus, owing to several advantages, conventional warming systems are widely used across the globe.

The increasing number of surgical procedures is one of the major drivers for the segment. For instance, according to the research journal published by the Journal of Surgery and Surgical Research published in October 2021, in India, more than 1,88,82,734 surgeries were carried out in 2021 in public health facilities, and of them, around 48,51,788 and 1,40,30,946 were major and minor surgeries, respectively. The same source also reported that around 14,43,913 surgeries were performed in Andhra Pradesh, around 59,08,59 surgeries were performed in Madhya Pradesh, about 82,55,90 surgeries were performed in Maharashtra, around 30,47,973 surgeries were performed in Tamil Nadu, and about 12,25,766 surgeries were performed in Delhi in 2020. A total of 18,88,2734 surgeries were performed in India in 2021. Conventional warming systems generally help maintain warm temperatures during pre and post-surgeries; thus, increasing the number of surgical procedures is expected to propel the segment growth.

The increasing number of cases of infectious diseases is also propelling the segment's growth over the forecast period. For instance, according to the report published by the WHO in November 2021, more than 1.0 million sexually transmitted infections were acquired globally, most of which are asymptomatic. It also reported that every year there are an estimated 374.0 million new infections, with 1 out of 4 sexually transmitted infections: gonorrhea, chlamydia, trichomoniasis, and syphilis. Similarly, as per the report published by the CDC in April 2022, around 677,769 cases of gonorrhea were reported in 2020, around a 5.7% increase from 2016. Gonorrhea also emerged as the second most common noticeable sexually transmitted infection in the United States in 2021. Temperature management is one of the essential parts of the treatment of infectious diseases; therefore, increasing cases of infectious diseases may boost segment growth over the forecast period.

North America is Expected to Witness Significant Growth Over the Forecast Period

North America is expected to witness significant growth over the forecast period. The growth is due to factors such as the rising cases of infectious diseases, cancer and increasing surgical procedures in the region. For instance, according to the Epidemiological Surveillance and Disease Control Center and the HIV/AIDS/STI Department at the Health Institute of the State of Mexico (ISEM), as of 2021, more than 6 cases of acquired syphilis, more than 9 cases of gonococcal infection, more than 483 cases of trichomoniasis, more than 15 cases of genital herpes, more than 1,042 cases of candidiasis (yeast infection), more than 5,585 cases of vulvovaginitis, and more than 136 new cases of asymptomatic HIV infection have already been reported in Mexico. As per the data published by UNAIDS 2021, more than 230,000 Mexican population was living with HIV. Thus, the increasing number of infectious diseases may increase the demand for temperature management systems, thereby driving market growth in the North American region.

Key product launches, high concentration of market players or manufacturer's presence, acquisitions and partnerships among major players, and a rising number of surgical procedures and diseases in the United States are some of the factors driving the growth of the temperature management market in the country. For instance, the CDC reported in May 2022 that 30,635 people in the United States and dependent territories acquired an HIV in 2021. The same source also stated that, by the end of 2022, the number of Americans living with HIV was predicted to be 1,189,700. Furthermore, innovative product approvals may also surge the market growth in the United States. For instance, in October 2020, Gentherm announced that it has received 510(k) clearance from the U.S. FDA and has launched the ASTOPADTM Patient Warming System in the United States. The ASTOPAD system can be utilized in all surgical procedures and helps prevent and treat hypothermia in patients throughout the perioperative procedures. Therefore, owing to the high prevalence of infectious diseases and product approvals, the market is anticipated to grow over the forecast period in the United States.

Temperature Management Industry Overview

The Temperature Management Market is moderately fragmented due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold significant market shares and are well known, including 3M, Atom Medical Corporation, Becton, Dickinson and Company, Cincinnati Sub-Zero Products, Dragerwerk AG & Co. KGaA, Geratherm Medical, Medtronic PLC, Smith Medical, and Stryker Corporation among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Cancer, Infectious Diseases, and Cardiovascular Diseases

- 4.2.2 Rising Number of Surgical Procedures

- 4.2.3 Development of Technologically Advanced Intravascular Systems

- 4.3 Market Restraints

- 4.3.1 High Cost of Temperature Management Systems

- 4.3.2 Products Recalls & Failures

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product Type

- 5.1.1 Patient Warming Systems

- 5.1.1.1 Conventional Warming System

- 5.1.1.2 Surface Warming System

- 5.1.1.3 Intravascular Warming System

- 5.1.2 Patient Cooling Systems

- 5.1.2.1 Conventional Cooling System

- 5.1.2.2 Intravascular Cooling System

- 5.1.2.3 Surface Cooling System

- 5.1.1 Patient Warming Systems

- 5.2 By Application

- 5.2.1 Cardiology

- 5.2.2 Orthopedics

- 5.2.3 Neurology

- 5.2.4 Other

- 5.3 By End User

- 5.3.1 Operating Rooms

- 5.3.2 Intensive Care Units

- 5.3.3 Emergency Rooms

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Atom Medical Corporation

- 6.1.3 Becton, Dickinson and Company

- 6.1.4 Cincinnati Sub-Zero Products, LLC

- 6.1.5 Dragerwerk AG & Co. KGaA

- 6.1.6 Geratherm Medical AG

- 6.1.7 Medtronic PLC

- 6.1.8 Smith Medical Inc.

- 6.1.9 Stryker Corporation

- 6.1.10 Zoll Medical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS