Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645119

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645119

Middle East And Africa Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

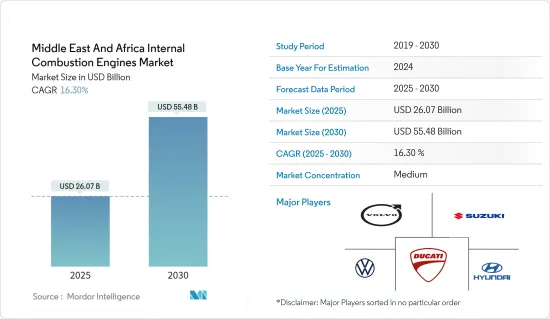

The Middle East And Africa Internal Combustion Engines Market size is estimated at USD 26.07 billion in 2025, and is expected to reach USD 55.48 billion by 2030, at a CAGR of 16.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as increasing demand for two-wheelers and rising demand for power production in the regions are expected to drive the market during the forecasted period.

- The rising demand for non-GHG (greenhouse gas) emitting vehicles is expected to hinder the market's growth.

- Technological advancements in hybrid internal combustion engines, hybrid electric powertrains, and specialized vehicles are expected to create several future market opportunities.

- Saudi Arabia is expected to be a major market in the forecast period (2024-2029).

Middle East And Africa Internal Combustion Engines Market Trends

The Diesel Fuel Type Segment to Witness Significant Growth

- Diesel fuel vehicles have internal combustion engines and a compression-ignited injection engine system, unlike the spark-ignited method used in most gasoline vehicles. Diesel fuel, often known as diesel oil or previously heavy oil, refers to any liquid fuel intended primarily for use in a diesel engine. The most prevalent type of diesel fuel is a distinct fractional distillation of petroleum fuel oil.

- The number of diesel fuel internal combustion engine type vehicles increased in the past few years in several African and Middle Eastern countries. The countries in the region are more dependent on imports due to a need for more reserves to fulfill the demand for diesel oil in the region. In June 2023, Saudi Arabia emerged as Kenya's primary source of petroleum product imports, including diesel oil, contributing significantly to the nation's trade deficit.

- According to data issued by the Kenya National Bureau of Statistics, the number of goods imported from the largest economy in the Middle East grew by nearly three times to KES 32.27 billion (USD 231.82 million) in March due to higher orders of diesel oil, which were worth KES 8.44 billion (USD 60.63 million) a month earlier. All these trades are likely to fulfill the demand for diesel oil during the forecast period.

- The demand for diesel oil in African countries is also on record high, and countries are now focusing on building the infrastructure for refining crude oil and cutting down the price of importing diesel oil. In October 2023, a deal was signed by Sonangol and the China National Chemical Engineering Company (CNCEC) toward the development of the Lobito Refinery in Angola. The two parties' memorandum of understanding is followed by the final agreement, which covers construction, technical assistance, and supervision. The refinery will be able to process up to 200,000 barrels of crude oil per day (bopd) of crude oil. All these types of development are likely to increase the diesel oil production during the forecast period.

- The crude oil consumption in the region is increasing on a yearly basis. According to the Statistical Review of World Energy Data, the daily consumption was reported to be 13,879 thousand barrels in 2023, an increase of around 2.6 % as compared to the previous year. The number is likely to increase due to the recent projects of hybrid vehicles across the region. For instance, in November 2023, Ford Motor South African division announced an investment of ZAR 5.2 billion (USD 281 million) to manufacture a hybrid vehicle in the country. This significant investment will increase the demand for IC engines in the manufacturing of hybrid engines in the coming years.

- Hence, driven by high domestic demand, recent developments, and upcoming diesel oil refinery projects, the market is expected to grow in the region during the forecast period.

Saudi Arabia is Expected to Witness Significant Growth

- Saudi Arabia is one of the critical automobile industries in the Middle East and Africa. According to the Ministry of Transport statistics, as of 2018, the country had more than 12 million vehicles that consume about 910,000 barrels of fuel and diesel. This number of vehicles is likely to increase by 26 million by 2030, and daily consumption of fuel and diesel will be around 1.86 million barrels per day.

- Crude oil consumption is increasing on a yearly basis in the region. According to the Statistical Review of World Energy Data, the daily consumption was reported to be 4052 thousand barrels in 2023, an increase of 5.1% as compared to the previous year. The competition is likely to increase in the coming years across Saudi Arabia.

- The country is focusing on increasing the number of internal combustion engine (ICE) automobiles and supporting industries to improve infrastructure across the country. For instance, in October 2023, the country aimed to manufacture more than 300,000 cars annually by 2030, including internal combustion engine automobiles. Hyundai is likely to build the plant for ICE cars. The plant is likely to start operations in 2024, and production is expected to begin in 2026.

- Companies in Saudi Arabia are focusing on developing ICE engines for hybrid and gasoline vehicles at a higher rate. In March 2023, Saudi Aramco, a significant oil company in Saudi Arabia, signed a new joint venture with Geely and Renault to produce internal combustion engines (ICE) and hybrid cars. Companies jointly develop and manufacture internal combustion engines, gearboxes, and other components for hybrid, gasoline, and diesel vehicles. All these types of developments and agreements are likely to increase the demand for ICE engine automobiles during the forecast period.

- Hence, driven by high domestic demand, recent developments, and upcoming manufacturing plants, the market is expected to grow in the region during the forecast period.

Middle East And Africa Internal Combustion Engines Industry Overview

The Middle East and Africa internal combustion engines market is semi-fragmented. Some major players include Volvo ab, Suzuki Motor Corp, Volkswagen Group, Hyundai Motor Company, and Ducati Motor Holding SpA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002236

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for for Two-wheelers

- 4.5.1.2 Rising Demand for Power Production

- 4.5.2 Restraints

- 4.5.2.1 Rising Demand for Non-GHG

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 By Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 United Arab Emirates

- 5.3.2 Kuwait

- 5.3.3 Qatar

- 5.3.4 Nigeria

- 5.3.5 Egypt

- 5.3.6 Saudi Arabia

- 5.3.7 Rest of the Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Volvo AB

- 6.3.2 Man SE

- 6.3.3 Yamaha Motor Co. Ltd

- 6.3.4 Ford Motor Company

- 6.3.5 Suzuki Motor Corp

- 6.3.6 Fiat Chrysler Automobiles NV

- 6.3.7 Hyundai Motor Company

- 6.3.8 Ducati Motor Holding SpA

- 6.3.9 Toyota Motor Corporation

- 6.3.10 Volkswagen Group

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Hybrid Internal Combustion Engines

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.