PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690158

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690158

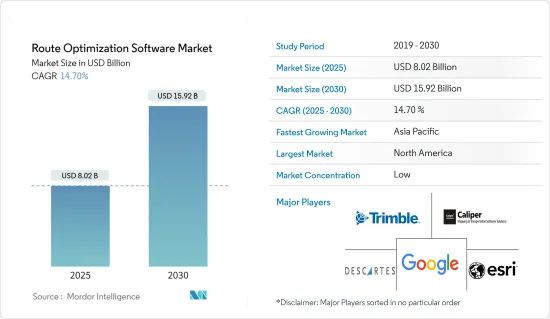

Route Optimization Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Route Optimization Software Market size is estimated at USD 8.02 billion in 2025, and is expected to reach USD 15.92 billion by 2030, at a CAGR of 14.7% during the forecast period (2025-2030).

Route optimization software plans, schedules, and calculates the most efficient vehicle route, saving time and money. Route optimization software comes in handy when there are several stops, client meetings, and product delivery. This software avoids traffic congestion by utilizing scenario testing and historical data to determine which route is the slowest or busiest.

The study's market numbers indicate the revenue generated from various end users, such as on-demand food delivery, retail and FMCG, field services, ride-hailing and taxi services, and other end-user verticals. Several industries, such as food and beverages, retail and e-commerce, and logistics, are increasingly transforming their business processes to provide delivery services, including on-demand food delivery, retail and grocery delivery services, and e-commerce delivery. Such developments are expected to boost route optimization software's increasing demand significantly.

With fuel prices soaring, delivery costs are inevitably rising, impacting demand for goods and causing a drop in revenue and profit for the logistics industry. Businesses emphasize optimizing and managing their fleet routes with a custom logistics route optimization solution, and logistics companies focus on retaining their delivery costs, keeping customers satisfied, and making more profit through reductions in time and mileage.

Traditional logistics systems often require increased hardware investments, leading to scalability constraints. However, with the advent of cloud-based solutions, enterprises can now gain unparalleled flexibility at reduced costs. Logistics providers can scale their operations, accommodating demand fluctuations and business growth. Most cloud solutions operate on a subscription model, making it more affordable than purchasing hardware and software. With declining hardware costs, enterprises can invest in the required servers, storage devices, and networking equipment for high performance.

The accuracy of route optimization software depends on the quality of underlying data. Thus, inaccuracy related to data may lead to suboptimal route decisions, inefficient resource utilization, and customer dissatisfaction with the software. For example, if the route optimization software cannot account for unstructured data patterns, it may lead to inefficient routes, resulting in poor delivery.

The COVID-19 pandemic has had an influence on everyone's lives and businesses throughout the world. During the continuing COVID-19 outbreak, delivery companies confront several obstacles. Due to the lockdown limitations, there has been an increase in internet grocery buying. The growth in internet users has been significant, as indicated in the graph; this increased demand for supermarket delivery poses a significant barrier for e-commerce, online retail, and grocery firms to deliver supplies on time. As a result of these circumstances, the route optimization software sector flourished during the pandemic and the current post-pandemic period.

Route Optimization Software Market Trends

On-demand Food Delivery to Witness Significant Growth

- In the post-COVID era, on-demand food delivery has become one of the fastest-growing industries worldwide. The industry witnessed growth in the emergence of new on-demand food delivery businesses post-pandemic. Evolving customer expectations for fast delivery have necessitated the demand for route optimization software to help food delivery businesses achieve maximum efficiency and ensure timely delivery while minimizing expenses.

- With the dramatic shifts in consumer demand for on-demand food delivery, technologies are becoming critical for food delivery businesses to thrive. Online food ordering has quickly become a major part of the business for fast-food restaurant chains. Therefore, the demand for route optimization software is quickly gaining traction to deliver fast with accurate ETA calculation and communication to improve the end-customer experience.

- The high adoption of smartphones across the world and internet penetration prompted online food ordering. According to the Mobile Economy 2023 of GSMA, North America's smartphone adoption rate accounts for 84% of the total mobile connections, and it is expected to increase to 90% by 2030, along with regions like CIS and Asia-Pacific forecast to register larger growth.

- Along with millennials shifting their inclinations from conventional eat-out to various on-demand food delivery services, food delivery businesses are focusing on on-demand food delivery services, thus creating an opportunity to adopt route optimization software over the forecast period.

Asia-Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is experiencing significant urbanization and population growth, leading to increased congestion and city traffic congestion in major countries such as China, India, and Japan. Due to this, logistic companies such as DHL, FedEx, Bluedart, and others have started using route optimization software that helps businesses navigate urban areas efficiently, reducing delivery times and fuel consumption, which is driving the demand for route optimization software in the region.

- The popularity of on-demand services, including food delivery, grocery delivery, and ride-hailing, is growing rapidly in Asia. Many companies such as Zepto, Blinkit, Zomato, and others that offer on-demand delivery have started in Asia. Hence, these companies are increasingly adopting route optimization solutions. Route optimization solutions are crucial in optimizing routes for on-demand deliveries, improving efficiency, and enhancing customer satisfaction.

- In addition, with increasing globalization, there is a growing demand for efficient cross-border logistics solutions in the Asia-Pacific region. Route optimization solutions assist businesses in planning and optimizing cross-border routes, managing customs procedures, and ensuring timely deliveries.

- Additionally, the surge in e-commerce activities in the region has led to a higher volume of deliveries. Route optimization software helps retailers and FMCG companies manage the complexities of delivering goods to diverse locations, improving delivery speed and reducing costs.

- Therefore, the rising demand for route optimization software in the Asia-Pacific region is driven by the need for businesses to reduce costs, improve efficiency, and meet customers' growing expectations. By utilizing route optimization solutions, businesses can unlock new opportunities, overcome logistical challenges, and position themselves for success in the dynamic and rapidly evolving Asia-Pacific market.

Route Optimization Software Market Overview

The route optimization software market is fragmented and comprises global and regional players in the competitive market space. Although the market poses high barriers to entry for the new players, several new entrants have gained traction: Trimble Inc., Caliper Corporation, The Descartes Systems Group Inc., ESRI Global Inc., Google LLC (Alphabet Inc.)

February 2024 - Descartes Systems Group announced that Arctic Glacier improved its distribution network efficiency, fleet performance, and customer experience by using Descartes' strategic route planning solution to optimize ice distribution from over 100 facilities and 1,000 vehicles to 75,000 customer locations across the United States and Canada.

September 2023 - Trimble introduced Appian Daily Planner, a cloud-based solution for multi-stop, multi-vehicle route optimization that improves on-time deliveries, asset utilization, and customer service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impacts of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Logistics-Specific Solutions

- 5.1.2 Declining Hardware and Connectivity Costs

- 5.2 Market Restraints

- 5.2.1 Handling Structured and Unstructured Data

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 On-Demand Food Delivery

- 6.1.2 Retail and FMCG

- 6.1.3 Field Services

- 6.1.4 Ride Hailing and Taxi Services

- 6.1.5 Other End-user Verticals

- 6.2 By Size of the Organization

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprises

- 6.3 By Deployment Mode

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trimble Inc.

- 7.1.2 Caliper Corporation

- 7.1.3 The Descartes Systems Group Inc.

- 7.1.4 ESRI Global Inc.

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 TrackoBit (InsightGeeks Solutions Pvt. Ltd)

- 7.1.7 Microlise Group PLC

- 7.1.8 Omnitracs LLC

- 7.1.9 Ortec BV

- 7.1.10 Paragon Software Systems PLC

- 7.1.11 PTV Planung Transport Verkehr GMBH

- 7.1.12 Route4me LLC

- 7.1.13 Routific Solutions Inc.

- 7.1.14 Verizon Connect Solutions Inc.

- 7.1.15 WorkWave LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET