PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550205

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550205

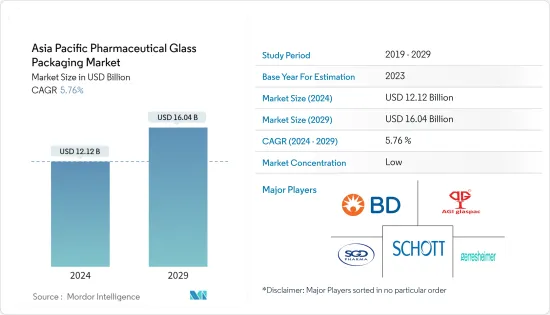

Asia Pacific Pharmaceutical Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific Pharmaceutical Glass Packaging Market size is estimated at USD 12.12 billion in 2024, and is expected to reach USD 16.04 billion by 2029, growing at a CAGR of 5.76% during the forecast period (2024-2029).

The surge in demand for glass packaging to curb product contamination is the primary driver propelling the Asia-Pacific pharmaceutical glass packaging market. This momentum is primarily attributed to the pharmaceutical sector's rapid expansion, fueled by a burgeoning population, increased public healthcare expenditures, and heightened health awareness.

Key Highlights

- The Asia-Pacific pharmaceutical sector is expanding, and this growth has led to heightened demand for top-tier packaging solutions. These solutions are crucial for maintaining pharmaceuticals' efficacy and safety, and glass packaging has emerged as the go-to choice in this landscape.

- Glass packaging's inert properties significantly reduce the risk of chemical reactions with the contents, while its superior barrier capabilities shield drugs from oxygen, moisture, and other destabilizing factors. Notably, its eco-friendly and recyclable nature resonates with the prevailing sustainability ethos.

- The demand for glass packaging in developing countries such as India is expected to increase as the country is a prominent and expanding player in the global pharmaceuticals market. According to data published on the India Brand Equity Foundation website, India is one of the world's largest providers of generic pharmaceuticals, accounting for 20% of the global supply and meeting over 60% of global vaccine demand.

- Notably, countries like China, India, and Japan are witnessing a surge in their pharmaceutical industries, increasing the demand for glass packaging solutions. China, renowned as the largest exporter of glasses and glassware, sees widespread applications for its products. Furthermore, as pivotal players in the regional pharmaceutical landscape, China and India are witnessing a notable uptick in drug production and consumption.

- However, glass packaging faces fierce competition from other forms of packaging in the region. The pharma industry is also looking for various alternative materials for commercial reasons. Multiple reasons for pharma companies to switch are loadability, breakages, and unit cost. Glass manufacturers are developing lightweight and durable bottles for pharma to compete with other alternatives.

Asia Pacific Pharmaceutical Glass Packaging Market Trends

China is Expected to have a Significant Share During the Forecast Period

- China's pharmaceutical glass packaging market is expected to grow as the country has built a standard system for the pharmaceutical industry over the years. The country pays increasing attention to the stability of pharmaceutical packaging materials during the drug storage period and their safety when used.

- The Chinese pharmaceutical sector has grown remarkably, propelling it from a manufacturing hub to a pivotal R&D center. This evolution has firmly established China as a critical global pharmaceutical player, a significant consumer, and a burgeoning R&D epicenter. EqualOcean reports that in 2022, China's pharmaceutical R&D expenditure stood at approximately USD 285 billion. Projections suggest this figure is set to surge, with expectations that by 2023, the nation's total pharmaceutical R&D spending will soar to USD 342 billion.

- The country also witnesses various events and exhibitions to promote glass packaging. In April 2024, China Glass, held at the Shanghai New International Expo Centre, focused on the glass industry's high-end, innovative, and green development. Companies such as Fives Group showcased their full range of solar glass technology and dedicated services at the China Glass exhibition.

- Additionally, Fives Group has forged partnerships with PV glass manufacturers in China for over two decades. It specializes in crafting and delivering cutting-edge rolling machines, catering to local and global markets. The company's prowess lies in deploying patented technologies, guaranteeing peak performance, superior quality, and heightened energy efficiency in green glass manufacturing.

The Ampoules Segment Held a Significant Share in the Market

- Due to its alkaline and hydrolytic properties, glass is a widely used packaging material for pharmaceutical and personal care products. It provides high transparency, allowing for easy inspection of contents, increased protection due to its relatively impermeable properties to air and moisture, and chemical resistance to most medicinal products.

- Companies operating in the region are focused on expanding their business by innovating new products and expanding capacity. In March 2023, players such as Schott began manufacturing amber pharmaceutical glass domestically in India to meet the increasing demand for pharmaceutical packaging, including ampoules, syringes, vials, and other drugs in Asia.

- Ampoules are an essential component of parenteral pharmaceutical packaging. The increasing geriatric population, the prevalence of chronic conditions, and the preference for injectable treatments have led to a surge in demand for ampoules. Furthermore, players in the ampoule glass packaging market are introducing high-speed fill lines to enhance the functionalities of glasses with high dimensional stability, thus augmenting their manufacturing capabilities.

- The need for vaccine storage for diseases like hepatitis B, tuberculosis, chickenpox, and polio drives the market's growth. Additionally, Pharmaceutical sales in Asian countries have grown in recent years. According to CPhI South East Asia, pharmaceutical sales in South Asia, where Indonesia is projected to reach USD 16.05 billion in 2024, followed by Vietnam with USD 9.84 billion, are expected to fuel glass packaging in the pharmaceutical market during the forecast period.

- The rise of chronic ailments, such as cancer and diabetes, has highlighted the necessity for advanced drug delivery technologies. Healthcare professionals are increasingly advocating for injectables, particularly in specific scenarios. Furthermore, the utilization of premium injectables has bolstered patient confidence. Consequently, the expansion of the injectable drug delivery market hinges significantly on the widespread adoption of these invasive techniques. The advocacy and expertise of trained medical personnel have further amplified the demand for ampoules.

Asia Pacific Pharmaceutical Glass Packaging Industry Overview

The Asia-Pacific glass packaging market is fragmented, with increasing investments and the launch of injectables and other medicines opening opportunities in the sector. Rivalry among competitors such as Becton, Dickinson and Company, SGD SA, Gerresheimer AG, Schott AG, and AGI glaspac -AGI Greenpac Limited is high. Horizontal and vertical integration of companies in the pharmaceutical industry is anticipated to fuel the demand for glass packaging.

- June 2024 - BD (Becton, Dickinson, and Company), a global medical technology company, and Edwards Lifesciences announced an agreement under which BD will acquire Edwards' Critical Care product group, one of the global leaders in advanced monitoring solutions, for USD 4.2 billion. This will unlock new value-creation opportunities and enhance BD's innovative connected care solutions portfolio.

- October 2023 - SCHOTT AG is constantly enhancing its materials while making them more sustainable. With its borosilicate glass being the gold standard for storing lifesaving medications for over a century, the company is taking the following steps by introducing improved glass tubing to the global pharmaceutical market. FIOLAX Pro is a new type I borosilicate glass developed to address three significant trends in increasingly complex pharmaceuticals: sustainable products, circular economy, and digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Spending in R&D and Capacity Expansion

- 4.4.2 Rising Preference for Environment-friendly Packaging is Expected to have a Positive Impact on Pharmaceutical Glass Packaging

- 4.5 Market Restraints

- 4.5.1 Fierce Competition from Other Forms of Packaging in the Region

5 MARKET SEGMENTATION

- 5.1 By Products

- 5.1.1 Bottles

- 5.1.2 Vials

- 5.1.3 Ampoules

- 5.1.4 Cartridges and Syringes

- 5.1.5 Other Products

- 5.2 By Country

- 5.2.1 China

- 5.2.2 Japan

- 5.2.3 India

- 5.2.4 Australia and New Zealand

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Shandong Pharmaceutical Glass Co.

- 6.1.2 Anhui BBCA Pharmaceutical Co. Ltd

- 6.1.3 China Jianyin Investment Ltd

- 6.1.4 Guizhou Chienyeh Pharmaceutical Packaging Co. Ltd

- 6.1.5 Becton, Dickinson, and Company

- 6.1.6 Gerresheimer AG

- 6.1.7 Schott AG

- 6.1.8 AGI glaspac - AGI Greenpac Limited

- 6.1.9 Ningbo Zhengli Pharmaceutical Packaging

- 6.1.10 Baotou KONRE Pharma Glass Packaging Co. Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS