PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640491

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640491

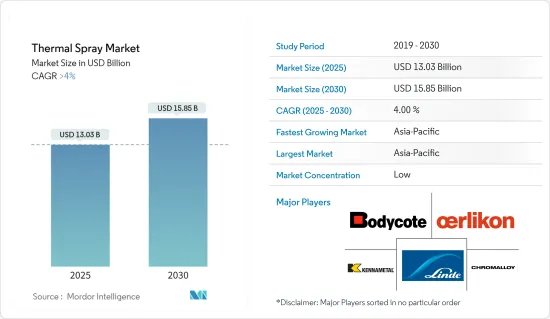

Thermal Spray - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Thermal Spray Market size is estimated at USD 13.03 billion in 2025, and is expected to reach USD 15.85 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The thermal spray market was negatively affected by the COVID-19 pandemic. Initially, there was a slowdown in manufacturing activities due to lockdowns and supply chain disruptions, leading to a temporary decrease in demand for thermal spray coatings. However, as industries adopted new norms and increased their emphasis on hygiene and protection, there was a growing demand for thermal spray coatings in industries such as healthcare, automotive, and aerospace.

Key Highlights

- The increasing popularity of thermal spray ceramic coatings due to their usage in medical devices, the rising use of thermal spray coatings in the aerospace industry, and the replacement of hard chrome coatings are some factors driving the demand for the thermal spray market.

- However, issues regarding process reliability and consistency and the emergence of hard trivalent chrome coatings in recent years are likely to hinder the market's growth.

- The increasing demand for thermal spray from the oil and gas industry, recycling of thermal spray processing materials, and advancements in spraying technology (cold spray process) are expected to provide lucrative growth opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the thermal spray market over the forecast period.

Thermal Spray Market Trends

The Aerospace Industry is Expected to Dominate the Market

- Aerospace components are often exposed to harsh environments, including high temperatures, corrosive chemicals, and extreme weather conditions. Thermal spray coatings provide an effective barrier against corrosion, extending the lifespan of critical components such as turbine blades, engine parts, and airframes.

- Thermal spray coatings offer lightweight solutions for aerospace components, contributing to fuel efficiency and overall aircraft performance. Coatings with tailored properties can replace heavier materials while maintaining structural integrity.

- The aerospace industry is undergoing rapid technological advancements and innovation, creating upswings for aircraft manufacturing. According to the Boeing Commercial Outlook 2023-2042, with a resurgence in international traffic and domestic air travel back to pre-pandemic levels, the company has projected global demand for 48,575 new commercial jets by 2042.

- According to the International Air Travel Association, domestic commercial aircraft passenger traffic increased by 9.2% over the pre-pandemic timeline in August 2023. Increased air traffic may raise the demand for commercial aircraft and propel the demand for adhesives during the forecast period.

- Airbus, a major aircraft manufacturer worldwide, delivered 735 commercial aircraft in 2023, an increase of 11% compared to the previous year.

- The factors mentioned above are expected to boost the demand for thermal spray in the aerospace industry during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is experiencing rapid industrialization, particularly in countries like China, India, Japan, and South Korea. The region's booming manufacturing sector, including the automotive, aerospace, electronics, and energy industries, is driving significant demand for thermal spray coatings to enhance component performance and durability.

- Governments in Asia-Pacific are investing heavily in infrastructure projects, including transportation, energy, and construction. Thermal spray coatings protect critical infrastructure components from corrosion, wear, and erosion, thereby extending their lifespan and reducing maintenance costs.

- China is one of the world's biggest aircraft manufacturers and a market for domestic air passengers, as stated by the Chinese Civil Aviation Administration. In addition, with more than 200 small aircraft component manufacturers, there has been rapid growth in the parts and assembly industry.

- China is the largest electronics manufacturing base in the world. Electronic products such as smartphones, televisions, cables, mobile computers, gaming systems, and other consumer electronic equipment are being produced in China on an active basis. According to the CEIC, in December 2023, the export value of Chinese electronics products was USD 21.63 billion.

- In 2023, South Korea received a total of USD 18.8 billion in investments from abroad, marking a 3.4% increase from the previous year. Specifically, the electronics industry saw the largest share of this investment, with USD 3 billion allocated, standing out as the top sub-industry.

- China is one of the largest producers of steel globally. According to official figures, the nation's primary steel production reached 952.14 million tons during the initial 11 months of 2023, marking a 1.5% increase compared to the same period in the previous year.

- The automotive industry in India plays a crucial role in technological advancements and macroeconomic expansion. According to the Society of Indian Automobile Manufacturers (SIAM), the number of vehicles sold from April 2023 to March 2024 reached 23,853,463, marking an increase of 12.5% from the 21,204,846 units sold in the same timeframe during FY 2023.

- Due to the above-mentioned factors, the region is projected to dominate the market during the forecast period.

Thermal Spray Industry Overview

The thermal spray market is fragmented in nature. The major players (not in any particular order) include OC Oerlikon Management AG, Linde PLC (Praxair ST Technologies Inc.), Chromalloy Gas Turbine LLC, Bodycote, and Kennametal Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Thermal Spray Coatings in Medical Devices

- 4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

- 4.1.3 Replacement of Hard Chrome Coating

- 4.1.4 Rising Use of Thermal Spray Coatings in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Emergence of Hard Trivalent Chrome Coatings

- 4.2.2 Issues Regarding Process Reliability and Consistency

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Coatings Materials

- 5.1.1.1 Powders

- 5.1.1.1.1 Ceramics

- 5.1.1.1.2 Metal

- 5.1.1.1.3 Polymers and Other Powders

- 5.1.1.2 Wires/Rods

- 5.1.1.3 Other Coating Materials (Auxiliary Material)

- 5.1.2 Thermal Spray Equipment

- 5.1.2.1 Thermal Spray Coating System

- 5.1.2.2 Dust Collection Equipment

- 5.1.2.3 Spray Gun and Nozzle

- 5.1.2.4 Feeder Equipment

- 5.1.2.5 Spare Parts

- 5.1.2.6 Noise-reducing Enclosures

- 5.1.2.7 Other Thermal Spray Equipment

- 5.1.1 Coatings Materials

- 5.2 Thermal Spray Coatings and Finishes

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Medical Devices

- 5.3.7 Energy and Power

- 5.3.8 Steel Making

- 5.3.9 Textile

- 5.3.10 Printing and Paper

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Thermal Spray Material Companies

- 6.4.1.1 Aimtek Inc.

- 6.4.1.2 AISher APM LLC

- 6.4.1.3 AMETEK Inc.

- 6.4.1.4 C&M Technologies GmbH

- 6.4.1.5 CASTOLIN EUTECTIC

- 6.4.1.6 CenterLine (Windsor) Limited (Supersonic Spray Technologies Division)

- 6.4.1.7 CRS Holdings LLC

- 6.4.1.8 Fisher Barton

- 6.4.1.9 Global Tungsten & Powders

- 6.4.1.10 H.C. Starck Inc.

- 6.4.1.11 HAI Inc

- 6.4.1.12 Hoganas AB

- 6.4.1.13 Hunter Chemical LLC

- 6.4.1.14 Kennametal Inc.

- 6.4.1.15 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.1.16 LSN Diffusion Limited

- 6.4.1.17 Metallisation Limited

- 6.4.1.18 Metallizing Equipment Co. Pvt. Ltd

- 6.4.1.19 OC Oerlikon Management AG

- 6.4.1.20 Polymet

- 6.4.1.21 Powder Alloy Corporation

- 6.4.1.22 Saint-Gobain

- 6.4.1.23 Sandvik AB

- 6.4.1.24 Thermion

- 6.4.2 Thermal Spray Coatings Companies

- 6.4.2.1 APS Materials Inc.

- 6.4.2.2 Bodycote

- 6.4.2.3 Chromalloy Gas Turbine LLC

- 6.4.2.4 Curtiss-Wright Corporation (FW Gartner)

- 6.4.2.5 Fisher Barton

- 6.4.2.6 FM Industries

- 6.4.2.7 Hannecard Roller Coatings, Inc (ASB Industries Inc.)

- 6.4.2.8 Lincotek Trento SpA

- 6.4.2.9 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.2.10 OC Oerlikon Management AG

- 6.4.2.11 Thermion

- 6.4.2.12 TOCALO Co. Ltd

- 6.4.3 Thermal Spray Equipment Companies

- 6.4.3.1 Air Products and Chemicals Inc.

- 6.4.3.2 Arzell Inc.

- 6.4.3.3 ASB Industries Inc. (Hannecard Roller Coatings Inc.)

- 6.4.3.4 Bay State Surface Technologies Inc. (Aimtek Inc.)

- 6.4.3.5 Camfil Air Pollution Control (APC)

- 6.4.3.6 CASTOLIN EUTECTIC

- 6.4.3.7 Centerline (Windsor) Ltd (SUPERSONIC SPRAY TECHNOLOGIES)

- 6.4.3.8 Donaldson Company Inc.

- 6.4.3.9 Flame Spray Technologies BV

- 6.4.3.10 GTV Verschleibschutz GmbH

- 6.4.3.11 HAI Inc.

- 6.4.3.12 Imperial Systems Inc.

- 6.4.3.13 Kennametal Inc.

- 6.4.3.14 Lincotek Equipment SpA

- 6.4.3.15 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.3.16 Metallisation Limited

- 6.4.3.17 Metallizing Equipment Co. Pvt. Ltd

- 6.4.3.18 OC Oerlikon Management AG

- 6.4.3.19 Plasma Powders

- 6.4.3.20 Powder Feed Dynamics Inc.

- 6.4.3.21 Progressive Surface

- 6.4.3.22 Saint-Gobain

- 6.4.3.23 Thermion

- 6.4.1 Thermal Spray Material Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Spraying Technology (Cold Spray Process)

- 7.2 Recycling of Thermal Spray Processing Materials

- 7.3 Increasing Demand From The Oil and Gas Industry