PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849854

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849854

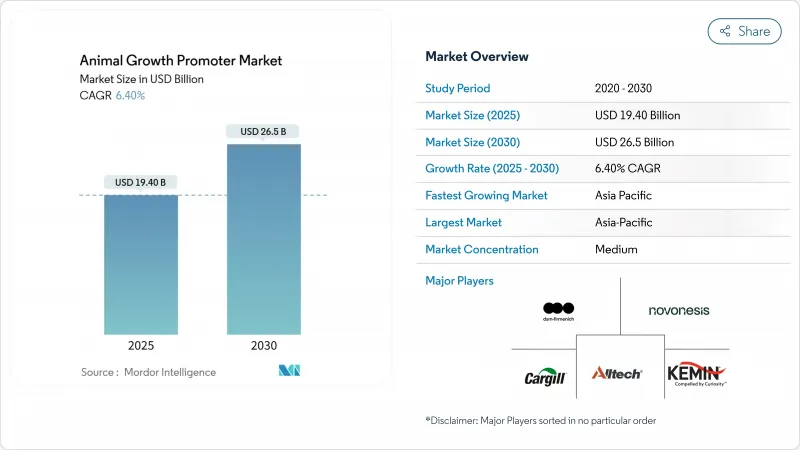

Animal Growth Promoters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Animal Growth Promoter Market size is estimated at USD 19.40 billion in 2025 and is anticipated to reach USD 26.5 billion by 2030, at a CAGR of 6.40% during the forecast period.

This solid trajectory mirrors the livestock sector's transition toward functional nutrition that keeps animals healthy while trimming the environmental impact of production. Rising consumer insistence on antibiotic-free meat, stricter regulations across major export hubs, and sustained protein demand in Asia-Pacific collectively widen commercial headroom for manufacturers. Intensifying price pressure on traditional protein meals amplifies interest in enzymes and probiotics that unlock more nutrients from every kilogram of feed. Digitalization inside mills, especially AI-enabled micro-dosing, reduces waste and aligns additive inclusion rates with real-time animal needs, preserving margins even when raw-material costs swing sharply. Momentum toward carbon-neutral farming further elevates biological solutions such as Bacillus-based probiotics that deliver both performance and sustainability benefits.

Global Animal Growth Promoters Market Trends and Insights

Global Antibiotic-Free Meat Demand Boom

Retailers and quick-service restaurants now stipulate antibiotic-free supply chains, prompting producers worldwide to invest in natural alternatives that preserve growth performance. This trend is especially strong in the poultry and swine sectors, where antibiotic-free labeling boosts marketability. EU prohibitions on antimicrobial growth promoters have already shown a clear template, and North American grocers offer premiums of 15-25% for certified products. The animal growth promoters market, therefore, gains a steady demand floor from both regulation and consumer willingness to pay.

Intensifying Large-Scale Livestock Production and Feed Efficiency Focus

Mega farms in Asia-Pacific and South America aim for ever-lower feed conversion ratios to offset volatile grain prices. Producers now target sub-2.0 FCR in broilers and sub-2.5 in swine by leveraging enzymes that lift nutrient digestibility by 3-5% and targeted probiotic strains that shave 2-4% off feed needs. With global feed output dipping 0.2% to 1.29 billion metric tons in 2024, efficiency gains, not tonnage, will fuel growth. These imperatives reinforce premium demand for advanced solutions and expand the animal growth promoters market in value terms.

Feed-Grade Organic-Acid Price Volatility

Formic-acid costs swung 40-60% in 2024, influenced by natural gas price spikes and unplanned shutdowns at a handful of large plants. Propionic-acid benchmarks climbed to multi-year highs, eroding feed-mill margins and prompting ration cuts or cheaper substitutes. For small mills without long-term contracts, this instability dampens the appetite for premium inclusions and temporarily tempers the animal growth promoters' market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Probiotic Manufacturing Cost-Parity with Ionophores

- Postbiotic Gut-Microbiome Breakthroughs Boosting Growth Performance

- Rapidly Evolving Global AGP Regulatory Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Probiotics generated 34.5% of global revenue in 2024, supported by robust validation of Bacillus and Lactobacillus strains that consistently enhance feed efficiency and gut health. This leadership bolsters the overall animal growth promoters market, as integrated producers increasingly blend multi-strain consortia into every diet phase to offset AGP withdrawal. The sizable installed base encourages Research and Development into spore-forming variants that can withstand pelleting temperatures, further widening use cases. The phytogenic niche, already a USD 500 million category, advances at a forecast 9.4% CAGR, outpacing all other groups thanks to natural coloration, antioxidative, and antimicrobial benefits that dovetail with clean-label demands. Enzymes continue to draw investment because thermostable designs survive high-temperature pelleting, unlocking otherwise lost nutrients in lower-grade grains. Meanwhile, acidifiers hold steady, especially in tropical climates where feed spoilage risk is acute.

Momentum in phytogenics spills into combinatory products that tap the synergistic effects of essential oils plus organic acids, delivering stronger pathogen suppression than either class alone. Adoption is strongest in swine and poultry, where disease pressure and antibiotic curbs converge. Prebiotics gain traction as companion ingredients that nourish resident microbiota and reinforce probiotic colonization. Antibiotics and ionophores retreat but remain present in regions lacking strict rules. The animal growth promoters market continues its pivot toward biological or plant-derived variants. As data accumulate, even conservative ruminant operations adopt phytogenic blends seeking methane mitigation to meet upcoming carbon audits. Commercial players respond by scaling solvent-free extraction methods, ensuring consistent active compound loads while meeting environmental expectations.

Poultry captured 37.5% of 2024 revenue, reflecting the category's global popularity and responsiveness to nutritional fine-tuning. Integrators invest in animal growth promoters to maintain growth despite antibiotic limits, and advanced formulations are credited with lowering flock mortality by 4-6% in large commercial setups. Usage intensity is poised to deepen as AI-assisted broiler management platforms prescribe additive inclusion rates based on sensor data. Aquaculture expands fastest at an 8.6% CAGR, driven by escalating fishmeal costs and the push for sustainable aquatic diets. As shrimp farmers in Southeast Asia integrate probiotic and enzyme blends, they report feed conversion improvements of 6-8%, underlining the segment's commercial payoff.

Swine producers adopt phase-feeding programs where acidifiers curb post-weaning diarrhea, and enzymes unlock energy from high-fiber rations, sustaining a solid share of the animal growth promoters market. Ruminants contribute a stable demand for methane-reducing compounds such as Bovaer, newly cleared for UK use in December 2024. Specialty segments, horses, pets, and niche exotics-consume small volumes yet deliver premium margins because owners seek functional, human-grade ingredients. Across species, integrators demand proof of ROI, spurring suppliers to produce field-data dashboards that link additive regimes to growth and health outcomes.

The Animal Growth Promoters Market Report is Segmented by Type (Probiotics, Prebiotics, Phytogenics, Acidifiers, and More), by Animal Type (Poultry, Swine, Ruminants, Aquaculture, and Others), by Form (Dry and Liquid), by Source (Bacterial, Yeast, and Fungal), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 41.6% of global revenue in 2024 and is projected to grow near 8% CAGR, securing its role as the epicenter of the animal growth promoters market. China's large integrators commit to antibiotic-free pledges aligned with export ambitions, driving steep adoption of probiotics and enzymes. Beijing Scitop Bio-tech alone posted CNY 302.79 million (USD 42.13 million) in probiotic revenue during 2024, underscoring domestic capacity. India's rising middle class promotes chicken and egg demand, while government extension programs teach farmers to curb antibiotic use, creating natural tailwinds for phytogenic and organic-acid categories. Southeast Asian aquaculture unlocks new volumes, with Thailand and Vietnam rapidly installing in-pond sensors that cue adaptive additive dosing, boosting fish survival rates and shading global seafood supplies.

North America remains a technology testbed as stringent customer specifications filter through the meat value chain. AI-linked mills in the United States adjust additive regimens every shift based on incoming corn quality and broiler weight-gain forecasts. Feedlot operators in Canada adopt methane-reduction additives in anticipation of stricter carbon rules, preserving export competitiveness. Although livestock headcounts grow slowly, per-animal additive spending trends upward, reinforcing regional value growth inside the animal growth promoters market.

Europe, a mature but highly regulated arena, continues to ban antimicrobial growth promoters while incentivizing natural solutions. Germany spearheads on-farm sensor usage that links feed conversion gains directly to enzyme cocktails, providing granular proof that fuels repeat purchases. France and Spain champion organic rearing, pushing demand for standardized phytogenic oils free from chemical solvents. Eastern Europe catches up quickly, modernizing feed infrastructure and integrating EU traceability mandates, which embed additive usage as part of compliance protocols. These converging forces keep Europe a steady contributor to the overall animal growth promoters market expansion despite flat livestock numbers.

- DSM-Firmenich

- Cargill, Inc.

- Vetoquinol

- Alltech

- Kemin Industries

- Huvepharma

- Novonesis

- BASF SE

- ADM

- Evonik Industries

- Adisseo

- Phibro Animal Health

- Virbac

- Nutreco

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Global antibiotic-free meat demand boom

- 4.1.2 Intensifying large-scale livestock production and feed efficiency focus

- 4.1.3 Probiotic manufacturing cost-parity with ionophores

- 4.1.4 Postbiotic gut-microbiome breakthroughs boosting growth performance

- 4.1.5 Carbon-neutral bioreactor technologies slashing Bacillus costs

- 4.1.6 AI-driven precision micro-dosing in feed mills

- 4.2 Market Restraints

- 4.2.1 Feed-grade organic-acid price volatility

- 4.2.2 Rapidly evolving global AGP regulatory restrictions

- 4.2.3 Fermentation-grade sugar supply bottlenecks for probiotics

- 4.2.4 Mycotoxin interactions reducing additive efficacy

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Porters Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Type (Value)

- 5.1.1 Probiotics

- 5.1.2 Prebiotics

- 5.1.3 Phytogenics

- 5.1.4 Acidifiers

- 5.1.5 Enzymes

- 5.1.6 Antibiotics

- 5.1.7 Other Types (Ionophores, Hormones)

- 5.2 By Animal Type (Value)

- 5.2.1 Poultry

- 5.2.2 Swine

- 5.2.3 Ruminants

- 5.2.4 Aquaculture

- 5.2.5 Other Animals (Equine, Pets)

- 5.3 By Form (Value)

- 5.3.1 Dry

- 5.3.2 Liquid

- 5.4 By Source (Value)

- 5.4.1 Bacterial

- 5.4.2 Yeast

- 5.4.3 Fungal

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 DSM-Firmenich

- 6.4.2 Cargill, Inc.

- 6.4.3 Vetoquinol

- 6.4.4 Alltech

- 6.4.5 Kemin Industries

- 6.4.6 Huvepharma

- 6.4.7 Novonesis

- 6.4.8 BASF SE

- 6.4.9 ADM

- 6.4.10 Evonik Industries

- 6.4.11 Adisseo

- 6.4.12 Phibro Animal Health

- 6.4.13 Virbac

- 6.4.14 Nutreco

7 Market Opportunities and Future Outlook