PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686251

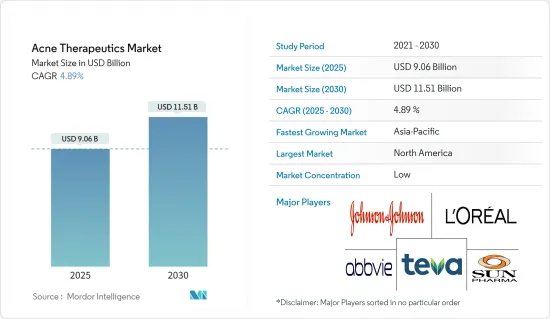

Acne Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Acne Therapeutics Market size is estimated at USD 9.06 billion in 2025, and is expected to reach USD 11.51 billion by 2030, at a CAGR of 4.89% during the forecast period (2025-2030).

The key factors propelling the growth of the acne therapeutics market are increasing sedentary lifestyles, the rise in disposable incomes of consumers, rising awareness about upcoming trends in acne treatments, and the high prevalence of acne globally.

Acne is the most common skin condition affecting late adolescents worldwide. Acne vulgaris is a common heath problem affecting adolescents, with a considerable impact on their quality of life. For instance, the data published by ClickPharmacy in May 2022 reported that 34% of UK adults have suffered from acne at some point in their lives. The same source mentioned that 6.1% of men were suffering from acne compared to 2.5% of women in 2022. Also, according to a report published by the Journal of Clinical Medicine in June 2023, the prevalence of acne among adolescents is about 80% worldwide; however, moderate to severe acne accounts for 20% of all acne sufferers. Adult acne is an increasing problem and is currently estimated to affect 40% of the population. Thus, the rising incidence of acne will lead to increased adoption of acne therapeutics, thereby driving the market's growth.

Furthermore, in September 2023, CeraVe organized an awareness campaign for its new Clear It Up Like a Derm campaign, which helped educate consumers on preventing and treating acne. Such initiatives provide insight into the upcoming treatments for acne. These campaigns are expected to boost the growth of the market during the forecast period.

Thus, the high prevalence of acne among the global population and the rise in awareness of acne treatments are expected to drive the market during the forecast period. However, safety issues related to acne products and the entry of generics into the acne market are expected to hinder market growth.

Acne Therapeutics Market Trends

Retinoid Segment Expected to Hold a Significant Market Share Over the Forecast Period

The retinoid segment is expected to hold a significant share of the acne therapeutics market over the forecast period. Retinoid creams and gels are very effective at stopping or reducing mild to moderate acne, which has led to an increasing demand for retinoids, thereby contributing to the growth of the market. They can also be used as maintenance therapy to keep skin clear after successful treatment. Additionally, market players frequently launch novel and generic versions of retinoids to gain a competitive edge in the market. For instance, in February 2022, Stryke Club launched retinoid acne treatment with its Knockout Adapalene Gel that prevents pimples, blackheads, whiteheads, and clogged pores. The FDA-approved prescription-strength retinoid acne treatment is available without a prescription. The rising product launches for retinoid treatment will lead to increased adoption due to its benefits in treating acne, which is expected to drive the growth of this segment over the forecast period.

Furthermore, an increase in research and development for retired acne therapies will also contribute to the growth of this market over the forecast period. For instance, in October 2023, Bausch Health Companies Inc. received approval from the US Food and Drug Administration (FDA) for a New Drug Application for CABTREOTM (clindamycin phosphate, adapalene, and benzoyl peroxide) Topical Gel, indicated for the topical treatment of acne vulgaris. Such product approvals and increasing research around the combination of retinoids are expected to boost their sales and manufacturing, thereby boosting the segment's growth.

Owing to the abovementioned factors, such as increasing product development and launches and increasing adoption of retinoids, the retinol segment is expected to register a significant share during the forecast period.

North America Expected to Continue Holding a Significant Market Share Over the Forecast Period

North America is expected to hold a notable share in the market over the forecast period owing to the increasing awareness among the population and the presence of major market players. The growing burden of acne in the region and recent product launches are also crucial factors driving the growth of the acne therapeutics market in North America. As per MDAcne's data published in November 2023, 85% of people have experienced acne in some form at some point in their lives in the United States. The report also mentioned that 50 million people in the United States have acne of some kind. Similarly, the survey report published by the Canadian Skin Patient Alliance (CSPA) in September 2022 mentioned that 37% of the respondents in the survey reported having mild acne, 47% reported moderate acne, and 16% indicated severe acne in Canada in 2022.

Additionally, rising product approvals and product launches for acne treatment are also expected to drive the growth of this segment over the forecast period. For instance, in August 2022, Cutera received clearance from HealthCanada for the product AviClear for the treatment of mild, moderate, and severe acne and acne scars. Moreover, in September 2023, Sun Pharma Canada Inc. launched PRWINLEVI in Canada. WINLEVI is one of the first and only androgen receptor inhibitors indicated for the topical treatment of acne vulgaris (acne) in patients 12 years of age and older.

Moreover, in March 2022, Galderma launched TWYNEO Cream in the United States to treat facial acne at the American Academy of Dermatology's Annual Meeting. The rising product launches in developed countries will lead to increased adoption, which is expected to drive growth across the North American market.

Thus, frequent product launches and product approvals for the development of novel acne therapies are expected to drive the North American market.

Acne Therapeutics Industry Overview

The acne therapeutics market is highly competitive and consists of several major and local players. The market is expected to grow due to the rise in research on acne treatment and increasing product approvals for acne treatment. Some major players in this market include Abbvie Inc. (Allergan PLC), Johnson & Johnson, L'Oreal SA (La Roche-Posay Laboratoire Dermatologique), Teva Pharmaceuticals, and Sun Pharmaceutical Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Sedentary Lifestyles and Unhealthy Food Habits

- 4.2.2 Increasing Awareness About Current and Upcoming Acne Treatments

- 4.2.3 High Global Acne Prevalence

- 4.3 Market Restraints

- 4.3.1 Safety Issues Regarding the Products

- 4.3.2 Entry of Generics in the Market

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Treatment

- 5.1.1 Therapeutics

- 5.1.1.1 Retinoid

- 5.1.1.2 Antibiotics

- 5.1.1.3 Hormonal Agents

- 5.1.1.4 Anti-inflammatory

- 5.1.1.5 Other Therapeutics

- 5.1.2 Other Treatments

- 5.1.1 Therapeutics

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Topical

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cipher Pharmaceuticals

- 6.1.2 GlaxoSmithKline PLC

- 6.1.3 L'Oreal SA (La Roche-Posay Laboratoire Dermatologique)

- 6.1.4 Teva Pharmaceuticals

- 6.1.5 Sun Pharmaceuticals (Ranbaxy)

- 6.1.6 Abbvie Inc (Allergan PLC)

- 6.1.7 F. Hoffmann-la Roche Ltd

- 6.1.8 Viatris Inc. (MYLAN)

- 6.1.9 Johnson & Johnson

- 6.1.10 Bausch Health Companies Inc.

- 6.1.11 Galderma SA

- 6.1.12 Journey Medical Corporation

- 6.1.13 Boston Pharmaceuticals Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS