PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687759

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687759

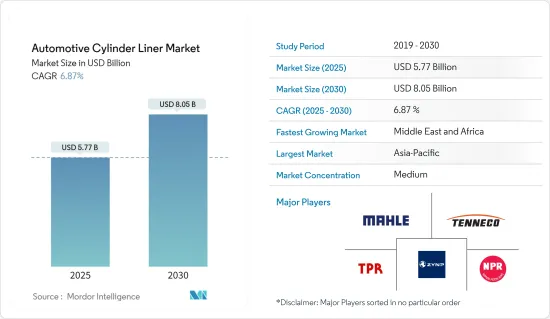

Automotive Cylinder Liner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Cylinder Liner Market size is estimated at USD 5.77 billion in 2025, and is expected to reach USD 8.05 billion by 2030, at a CAGR of 6.87% during the forecast period (2025-2030).

The rising sales of commercial vehicles and increasing vehicle parc globally serve as major determinants for the growth of the automotive industry across the world, which, in turn, is positively impacting the demand for automotive cylinder liners. Commercial vehicle growth is primarily influenced by the expansion of e-commerce and the increasing use of commercial vehicles for transportation. Aside from that, rising industrialization and infrastructure development, which support advancement and development in the automotive industry, are driving market growth for commercial vehicles.

According to the International Organization of Motor Vehicle Manufacturers, the global sales of new commercial vehicles touched 24.1 million units in 2022.

Furthermore, rising demand for hydrogen electric commercial vehicles across major regions is pushing cylinder liner manufacturers to develop advanced technology. Several key players are introducing cylinder liner technology for hydrogen-electric trucks, boosting market growth. Vehicle scrappage programs and stringent regulatory norms for vehicle length and loading limits, among other parameters, are also expected to drive the growth of the market.

Asia-Pacific is expected to dominate the consumption of automotive cylinder liners, owing to the increased potential of the automotive industry in India and China. Many countries across the world, such as the United States, source their raw materials and engine components from China, Japan, and other economies to assemble them under complete engine chambers. With rising automotive sales and production, the region's demand for cylinder liners is expected to remain high.

Automotive Cylinder Liner Market Trends

The Passenger Car Segment of the Market to Gain Traction During the Forecast Period

Passenger cars are the most common form of transport in emerging countries. The number of passenger cars is increasing in developing countries with the rise in per capita income, and such factors are likely to impact the automotive cylinder liner market positively. Emerging countries, such as India, are looking for better fuels, like ethanol, for their passenger cars, which may positively impact the market growth.

For instance, in August 2023, Toyota Innova became the world's first flexible fuel vehicle that can run entirely on ethanol. Toyota Motor is projected to become the first automaker in the world to introduce cars powered by 100% ethanol. In August 2023, the Union Minister of India launched a vehicle based on Toyota's most popular passenger car, Innova. Innova became the first model in the world to feature a Bharat Phase VI vehicle with a flexible fuel electric certificate. The launch came a year after the Japanese auto giant introduced Mirai, which uses hydrogen fuel cells.

Increasing emission regulations, penetration of electric vehicles, and lack of fossil fuel reserves due to the toxic impact of internal combustion engine (ICE) vehicles on the environment could challenge the growth of the market. However, in emerging countries, there needs to be more infrastructure for electric vehicles, and charging facilities are expected to facilitate the expansion of the internal combustion engine market during the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), global new passenger car sales touched 57.4 million in 2022, recording a Y-o-Y growth of 1.9% compared to 2021. Countries such as South Africa and Thailand recorded 19.5% and 10.0% Y-o-Y growth, respectively, in new passenger car sales in 2022 compared to the previous year.

The rising urbanization rate and the shifting preference of consumers toward availing private transportation mediums are anticipated to drive the automotive industry across the world, which, in turn, is expected to drive the demand for the advanced automotive cylinder liner market. According to the World Bank, the urbanization rate in India stood at 36% in 2022, compared to 34% in 2018. As more consumers migrate to urban areas in developing nations, there will be a preference for personal mobility, which, in turn, may lead to the growth of the automotive cylinder liner market across the world.

Asia-Pacific to Hold the Largest Market Share During Forecast Period

The Asia-Pacific automotive cylinder liner market is witnessing elevated sales of cylinder liner products owing to the expanding auto sector of China and India. Both countries are fuelling vehicle sales, generating significant engine demand.

India is one of the major automobile exporters in the region, and strong export growth is expected shortly, seeing its present mobility expansion projects. Furthermore, favorable initiatives by the Indian government to support the automotive industry and the presence of major automakers in its market are assisting in developing the country into one of the major automobile exporters. The automotive industry in the country received a cumulative FDI inflow of approximately USD 33.77 billion between April 2000 and September 2022. The government expects to double the size of the automotive industry to USD 18 billion by 2024. Furthermore, China holds the dominant hand in Asia-Pacific in terms of auto industry throughput and engine production.

In 2022, the total number of vehicles sold in China stood at 26.8 million units, compared to 26.27 million units in 2021, registering a year-on-year growth of 2.2%. The region is witnessing extended investment, expansion, and development, proliferated by key engine manufacturers and original equipment manufacturers (OEMs). This is expected to mitigate the demand for cylinder liners over the forecast period.

For instance, in March 2022, Harbin Dongan Auto Engine Co. Ltd unveiled its investment plan for 2022 for building a production line for high-efficiency extended-range engines, which was expected to involve machining center, marking machines, tightening machines, gluing machines, and other equipment. The project was planned to be jointly maintained by Harbin Dongan Automotive Engine Manufacturing Co. Ltd, the subsidiary of Harbin Dongan Auto Engine, with a total investment of CNY 72.33 million (USD 10.85 million).

Therefore, with the region's expanding passenger car and commercial vehicle industry, the demand for the automotive cylinder liner market will showcase a rapid surge in the coming years. However, shifting the government's focus to promote the adoption of electric vehicles could act as a major deterrent to the growth of these products in the long run in Asia-Pacific. However, a competitive shift toward electrification of vehicle fleets in the short run is a major challenge for these governments. Therefore, the demand for automotive cylinder liners is expected to remain strong during the forecast period.

Automotive Cylinder Liner Industry Overview

The automotive cylinder liner market exhibits moderate fragmentation, with a mix of organized and unorganized players shaping the industry landscape. Among the key contenders in the cylinder liner market, notable players include Mahle GmBH, Tenneco Inc., TPR Co. Ltd, Nippon Piston Ring Co. Ltd, and ZYNP. Significant manufacturers are channeling substantial investments into the research and development of automotive cylinder liners to enhance profitability and product efficiency.

To mitigate the risks associated with raw material procurement, companies have adopted a proactive approach, maintaining extended relationships with their primary raw material suppliers. This strategy has proven successful in ensuring a consistent and uninterrupted supply of materials necessary for cylinder liner production.

October 2022: Rheinmetall AG's Castings business unit, a joint venture between Rheinmetall and HUAYU Automotive Systems Co. Ltd, secured a significant order to supply a V8 engine block to a renowned English sports car manufacturer. Notably, the V8 engines boast an impressive horsepower output, approaching four figures.

April 2022: Toyota Motor North America disclosed its intention to invest USD 383 million in four US-based plants. This investment is aimed at preparing to produce a new four-cylinder engine variant tailored for hybrid and conventional powertrains. The scope of engine production encompasses end-to-end assembly, encompassing engine heads, liners, and various other components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Sales of Commercial Vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Rapid Adoption of Electric Vehicles

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material Type

- 5.1.1 Cast Iron

- 5.1.2 Stainless Steel

- 5.1.3 Aluminum

- 5.1.4 Titanium

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.3 By Contact

- 5.3.1 Wet Cylinder Liner

- 5.3.2 Dry Cylinder Liner

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commerical Vehicles

- 5.4.3 Medium and Heavy-duty Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mahle GmbH

- 6.2.2 Tenneco Inc.

- 6.2.3 GKN Zhongyuan Cylinder Liner Company Limited

- 6.2.4 Melling Cylinder Sleeves

- 6.2.5 TPR Co. Ltd

- 6.2.6 Westwood Cylinder Liners Ltd

- 6.2.7 Darton International Inc.

- 6.2.8 ZYNP International Corporation

- 6.2.9 Laystall Engineering Co. Ltd

- 6.2.10 India Pistons Ltd

- 6.2.11 Nippon Piston Ring Co. Ltd

- 6.2.12 Motordetal

- 6.2.13 Kusalava International

- 6.2.14 Cooper Corp.

- 6.2.15 Yoosung Enterprise Co. Ltd

- 6.2.16 Yangzhou Wutingqiao Cylinder Liner Co. Ltd

- 6.2.17 Chengdu Galaxy Power Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Hybrid Liners