PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851143

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851143

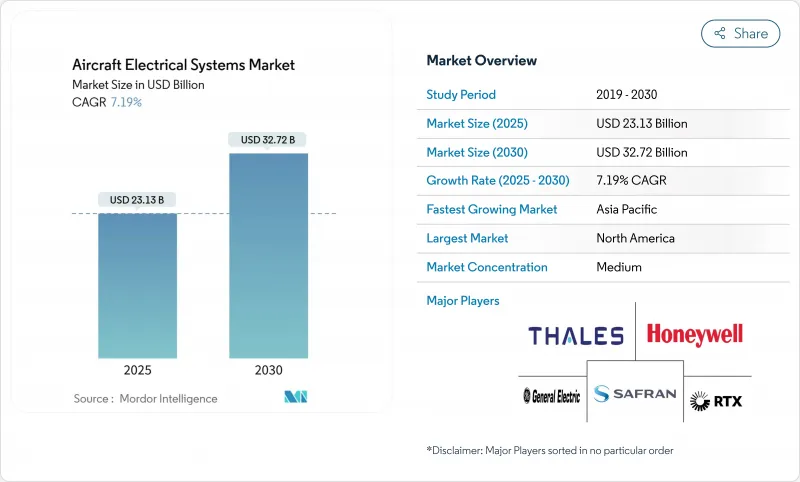

Aircraft Electrical Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft electrical systems market size is valued at USD 23.13 billion in 2025 and is forecasted to advance to USD 32.72 billion by 2030, translating to a 7.19% CAGR.

Adopting More-Electric Aircraft (MEA) architectures, rising single-aisle production, and accelerating retrofit demand for cabin electrification collectively expand the addressable revenue pool. High-voltage direct current (HVDC) distribution, silicon-carbide (SiC) power electronics, and modular battery packs are pivoting the competitive agenda toward energy density and thermal efficiency. Sustained order backlogs at Airbus, The Boeing Company, and COMAC, and early production runs of several eVTOL platforms anchor baseline demand even as supply-chain constraints shift delivery profiles. Parallel investment in cybersecurity and electromagnetic protection reinforces the need for integrated electrical architectures that can scale across civil and defense programs.

Global Aircraft Electrical Systems Market Trends and Insights

Increasing adoption of More-Electric Aircraft (MEA) architectures to reduce mechanical complexity and improve efficiency

MEA deployment removes bleed-air lines and hydraulic pumps, replacing them with power-dense electrical substitutes that cut weight and streamline maintenance. The +-270 V DC framework on the B787 has demonstrated improved reliability and lower lifecycle cost versus hydraulics. Airlines estimate 38% operating cost savings from MEA integration through lower fuel burn and fewer line-replaceable unit failures. F-35 power management modules echo the civil trend, confirming dual-use applicability. As systems converge, OEMs embed layered cyber-protection into distribution units, ensuring fault isolation without manual intervention.

Rising aircraft production volumes and sustained order backlogs driving demand for advanced electrical systems

COMAC intends to raise C919 output to 50 units in 2025, leveraging a pipeline of more than 1,000 firm commitments. Despite shifting its A320neo ramp-up to 2027, Airbus still targets 720-plus deliveries in 2025, locking multiyear visibility for electrical integrators. Since single-aisle jets comprise the bulk of additions, each frame adds incremental demand for power generation, conversion, and cabin systems. Suppliers are dual-sourcing printed-circuit assemblies and harnesses across regions to buffer against raw-material shocks.

Challenges in managing heat and wiring complexity as system voltage levels increase

Voltage escalation pushes conductor surface temperatures up to 180 °C, prompting the adoption of annealed pyrolytic graphite heat pipes under the EU ICOPE initiative. EMI shielding requirements enlarge harness bundles, increasing installation labor and adding parasitic mass that can subtract 2 % from payload. Liquid-cooled busbars solve many thermal bottlenecks yet introduce extra pumps, coolant, and leak-detection logic. Space-limited eVTOL cabins face acute packaging conflicts, compelling multidisciplinary optimization between structural and electrical teams.

Other drivers and restraints analyzed in the detailed report include:

- Implementation of high-voltage direct current (HVDC) distribution systems to support next-generation power architectures

- Growing need for lightweight and compact electrical systems tailored to unmanned aerial platforms

- High certification costs associated with advanced aerospace battery technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy Storage revenue is projected to advance at a 9.21% CAGR to 2030, boosted by modular lithium-ion packs and emerging solid-state options that underpin eVTOL range targets. The aircraft electrical systems market size for Energy Storage is expected to exceed USD 6.4 billion by the end of the forecast window, reflecting its centrality to hybrid-electric propulsion. Power Distribution remains the backbone, controlling 36.78% of 2024 revenue, with smart contactor arrays and software-defined switching units ensuring load prioritization during abnormal operations.

HVDC adoption is reshaping component roadmaps, shifting converter design from 115 V AC to multi-level DC-DC topologies that exploit silicon-carbide switches operating at 200 kHz switching frequencies. Battery suppliers such as Safran-Saft unveiled a 1,200 V pack in 2025 that supports 60C burst discharges, signaling the maturation of avionics-grade high-voltage standards. Long-haul platforms seek combined cycle architectures pairing fuel-cell range extenders with battery buffers, expanding lifecycle revenue for integrated power management suites.

Battery Packs and BMS expand at 9.56% CAGR, reflecting their role in balancing energy density, cell longevity, and safety. Smart BMS algorithms now interface directly with flight-deck avionics, broadcasting remaining useful life and predicting pack swap intervals, thereby reducing unscheduled maintenance. Generators and Starter-Generators, holding 21.19% of the aircraft electrical systems market share in 2024, continue to migrate toward higher power ratings in the 600-800 kW class to support inflight galley electrification and envelope-protection loads.

Connectors rated to 1,000 V DC and 500 A are entering qualification, featuring touch-safe geometries and arc-suppression springs. Wiring harness suppliers develop aluminum-core replacements with nanoparticle coatings to maintain conductivity while trimming mass by 30%. Embedded power-distribution software harnesses machine-learning routines that recalculate load-shed hierarchies every 50 ms, improving resilience against arc-faults.

The Aircraft Electrical Systems Market Report is Segmented by System (Power Generation, Power Distribution, and More), Component (Generators and Starter-Generators, Converters, and More), Platform (Commercial Aviation, Military Aviation, and More), Application (Power Generation Management, Cabin Systems, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 40.92% of 2024 revenue, driven by the United States' defense budget and a deep supplier base that spans generators, actuators, and thermal-management hardware. The regional outlook is reinforced by FAA cybersecurity directives mandating authenticated data buses, which spur avionics and power-conversion upgrades across existing fleets. Consolidation deals such as Honeywell's USD 1.9 billion CAES purchase bolster electromagnetic protection portfolios, making North America the largest buyer and a technology incubator.

Asia-Pacific registers the fastest growth at 7.85% CAGR through 2030. COMAC's C919 production climb and India's forecast requirement for up to 1,000 jets over 20 years anchor demand for generators, converters, and harnesses. Local tier-1s in Japan and South Korea expand build-to-print work packages for Boeing and Airbus, embedding regional content into global programs. Government-backed MRO corridors in Singapore and Malaysia attract retrofit programs focusing on cabin electrification and mission-system enhancements.

Europe remains pivotal owing to Clean Aviation funding, stringent emissions policy, and an expansive research network. Safran leads European efforts in high-voltage batteries and electric propulsors, while Collins Aerospace's Toulouse lab spearheads megawatt-class inverter validation. EASA's lightning-protection harmonization under CS-25/Amdt 26 enforces wide-band testing, compelling OEMs to certify enhanced shielding solutions. The continent also hosts multiple demonstrators tackling heat-pipe cooling, validating next-gen thermal architectures for long-range hybrids.

- RTX Corporation

- Honeywell International Inc.

- General Electric Company

- Safran SA

- Thales Group

- Amphenol Aerospace

- Astronics Corporation

- Crane Aerospace and Electronics (Crane Company)

- AMETEK Inc.

- Nabtesco Corporation

- Hartzell Engine Tech LLC

- PBS AEROSPACE Inc.

- Acme Aerospace Inc. & Avionic Instruments, LLC

- BAE Systems plc

- Moog, Inc.

- Parker-Hannifin Corporation

- Rolls-Royce plc

- Vicor Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of More-Electric Aircraft (MEA) architectures to reduce mechanical complexity and improve efficiency

- 4.2.2 Rising aircraft production volumes and sustained order backlogs driving demand for advanced electrical systems

- 4.2.3 Implementation of high-voltage direct current (HVDC) distribution systems to support next-generation power architectures

- 4.2.4 Growing need for lightweight and compact electrical systems tailored to unmanned aerial platforms

- 4.2.5 Silicon-carbide power electronics enable higher temperature limits

- 4.2.6 Retrofit-driven upgrades focused on cabin electrification, including in-seat power and galley modernization

- 4.3 Market Restraints

- 4.3.1 Challenges in managing heat and wiring complexity as system voltage levels increase

- 4.3.2 High certification costs associated with advanced aerospace battery technologies

- 4.3.3 Limited availability of qualified semiconductors meeting aerospace-grade performance and reliability standards

- 4.3.4 Delays in regulatory approvals for software-driven power distribution units due to cybersecurity concerns

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By System

- 5.1.1 Power Generation

- 5.1.2 Power Distribution

- 5.1.3 Power Conversion

- 5.1.4 Energy Storage

- 5.2 By Component

- 5.2.1 Generators and Starter-Generators

- 5.2.2 Power Distribution Units

- 5.2.3 Converters

- 5.2.4 Battery Packs and BMS

- 5.2.5 Wiring and Cables

- 5.2.6 Connectors and Contactors

- 5.2.7 Power-distribution Software

- 5.3 By Platform

- 5.3.1 Commercial Aviation

- 5.3.1.1 Narrow-body

- 5.3.1.2 Wide-body

- 5.3.1.3 Regional Jets

- 5.3.1.4 Freighters

- 5.3.2 Military Aviation

- 5.3.2.1 Fighter Jets

- 5.3.2.2 Transport Aircraft

- 5.3.2.3 UAVs

- 5.3.2.4 Trainer Aircraft

- 5.3.3 General Aviation

- 5.3.3.1 Business Jets

- 5.3.3.2 Helicopters

- 5.3.3.3 eVTOL/AAM

- 5.3.1 Commercial Aviation

- 5.4 By Application

- 5.4.1 Power Generation Management

- 5.4.2 Flight Control and Operation

- 5.4.3 Cabin Systems

- 5.4.4 Configuration Management

- 5.4.5 Air Pressurization and Conditioning

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 RTX Corporation

- 6.4.2 Honeywell International Inc.

- 6.4.3 General Electric Company

- 6.4.4 Safran SA

- 6.4.5 Thales Group

- 6.4.6 Amphenol Aerospace

- 6.4.7 Astronics Corporation

- 6.4.8 Crane Aerospace and Electronics (Crane Company)

- 6.4.9 AMETEK Inc.

- 6.4.10 Nabtesco Corporation

- 6.4.11 Hartzell Engine Tech LLC

- 6.4.12 PBS AEROSPACE Inc.

- 6.4.13 Acme Aerospace Inc. & Avionic Instruments, LLC

- 6.4.14 BAE Systems plc

- 6.4.15 Moog, Inc.

- 6.4.16 Parker-Hannifin Corporation

- 6.4.17 Rolls-Royce plc

- 6.4.18 Vicor Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment