PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690112

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690112

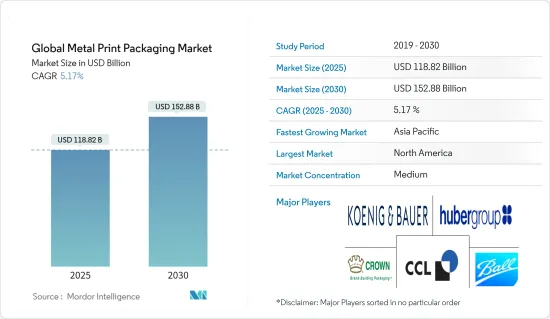

Global Metal Print Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Metal Print Packaging Market size is estimated at USD 118.82 billion in 2025, and is expected to reach USD 152.88 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

Key Highlights

- The global metal print packaging market is on an upward trajectory driven by factors such as customization and premiumization, the growing adoption of metal packaging, and a heightened focus on recycling and reusable materials. Moreover, advancements in printing technologies are providing market vendors with expanded opportunities.

- The rising demand for visually appealing and personalized canned foods and beverages is poised to further propel the growth of the metal print packaging market during the forecast period. Innovations in printing inks, particularly those tailored for metal packaging, are fueling market demand. The increasing digitization of printing facilities has significantly heightened the appetite for metal print packaging.

- Metal packaging's inherent convenience in decoration enables a diverse range of effects and finishes, catering to specific markets or occasions. To expedite product entry, vendors are increasingly adopting state-of-the-art metal printing technologies. This shift is enhancing vendors' in-house production capabilities, enabling them to adeptly manage scheduling challenges and ensure timely market readiness of their metal-packaged products.

- Leading beverage manufacturers are gravitating toward customized packaging to boost shelf visibility and captivate consumers, underscoring the critical importance of metal print packaging. Pioneering this trend, Coca-Cola rolled out several campaigns centered on digitally inkjet-printed metal cans. According to Ball Corp., a prominent aluminum packaging manufacturer, the demand for aluminum cans is expected to rise owing to brands' growing apprehensions about plastic packaging and their pursuit of alternatives.

- The market faces formidable challenges. Rising prices from metal suppliers are compelling ink producers to adjust their pricing strategies. While many ink manufacturers are attempting to absorb these escalating costs, many have resorted to price hikes and surcharges.

Metal Print Packaging Market Trends

Offset Lithography is Expected to Record Significant Growth

- Offset lithography has solidified its position as the dominant method in packaging printing. It is popular for delivering high-quality prints in bulk with minimal upkeep. This efficiency has made it especially favored in developed regions, notably Europe and North America. In these areas, offset lithography is predominantly employed for printing on metal cans, a choice largely influenced by the material's hard and non-absorbent nature.

- Market leaders, such as Crown Holdings Inc., harness offset printing for both 2-piece and 3-piece metal packaging. The process involves transferring ink from a printing plate to a blanket and subsequently applying it to the metal surface. Notably, while 2-piece cans are printed post-formation, 3-piece cans are printed on sheets beforehand. Crown Food Europe caters to a variety of clients in the snacks industry, producing 100% recyclable metal containers for Bier Nuts' crunchy, coated peanuts and delivering print packaging for Satisfied Snacks' Salad Crisp concept in metal tins.

- Despite its reputation for high-quality output, offset printing faces stiff competition from cutting-edge methods like rotogravure and photogravure. Additionally, the anodized aluminum printing plates, susceptible to rust from oxidation, demand careful maintenance. Such challenges could hinder the expansion of the segment.

- Companies like Metal-Print, specializing in high-quality protective lacquering and vibrant lithography on tinplate or aluminum sheets, address a wide array of metal packaging demands. Metal-Print's offerings span from food and beverage cans to chemical containers and decorative tins. A prominent trend is the organic food industry's preference for lightweight metal cans, lauded for their excellent barrier properties and eco-friendliness.

- According to a report by the Organic Trade Association, the US organic packaged food market witnessed significant growth. The consumption value was USD 18,441.8 million in 2019, which is expected to increase to USD 25,060.4 million by 2025. This increase in demand for organic packaged food is poised to boost the reliance on offset printing in the food packaging industry.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific commands a significant share of the global metal printing packaging market, primarily due to manufacturers' emphasis on cost-effective packaging solutions. While mature markets in established nations see the digital printing packaging market plateauing, China and India are gearing up for vigorous expansion in the coming seven to eight years. Bolstered by a surge in e-retail sales and a growing appetite for convenient food packaging, the region is on track to experience the most pronounced growth during the forecast period.

- Key factors driving the metal print packaging market in Asia-Pacific include rising sales of packaged foods (encompassing frozen and chilled items), growing disposable incomes, shifting lifestyles, consistent economic growth, and an uptick in beverage consumption, both alcoholic and non-alcoholic.

- Beer packaging predominantly favors metal cans, attributed to their superior ability to preserve taste. Projections from Agriculture and Agri-Food Canada indicate a leap in India's beer consumption from 1.63 billion liters in 2020 to a staggering 3.4 billion liters by 2025. This is expected to increase the demand for printed metal cans.

- With digital printing technology automating the entire printing process, 3D printing is emerging as the next frontier. Countries like Japan, India, China, and Vietnam are witnessing a surge driven by advancements in digital printing technologies. Notably, Mitsubishi Electric recently launched two new AZ600 digital wire-laser metal 3D printer models.

- Asia-Pacific countries have ramped up their efforts on efficient metalworking techniques in recent years, aiming to slash CO2 emissions in the metal fabrication industry. This pivot seeks to curtail energy consumption and safeguard dwindling natural resources. Consequently, there is an anticipated uptick in demand for metal 3D printers, which can craft objects from 3D shape data. These printers not only significantly expedite traditional manufacturing processes but also minimize waste and boost design flexibility, allowing the integration of multiple parts and a reduction in overall weight.

Metal Print Packaging Industry Overview

The global metal print packaging market is fragmented in nature, with the presence of both small and large players. Major players holding significant market shares are actively working to broaden their global consumer base. Key players include Toyo Seihan Co. Ltd, Ball Corporation, Hubergroup Deutschland GmbH, Envases Group, CCL Container (a division of CCL Industries Inc.), and Koenig & Bauer AG. These companies are bolstering their market presence through strategic partnerships, investments in innovative solutions, and new product launches, all aimed at gaining a competitive edge during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Evolution of Digital Print Technology

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Prices of Printing Inks

- 5.2.2 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Printing Process

- 6.1.1 Offset Lithography

- 6.1.2 Gravure

- 6.1.3 Flexography

- 6.1.4 Digital

- 6.1.5 Other Printing Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hubergroup Deutschland GmbH

- 7.1.2 Crown Holdings Inc.

- 7.1.3 CCL Container (CCL Industries Inc.)

- 7.1.4 Ball Corporation

- 7.1.5 Koenig & Bauer AG

- 7.1.6 Toyo Seikan Group Holdings, Ltd

- 7.1.7 Envases Group

- 7.1.8 Real Pad Printer

- 7.1.9 Ardagh Metal Packaging (AMP)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET