Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692021

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692021

India Animal Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 205 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

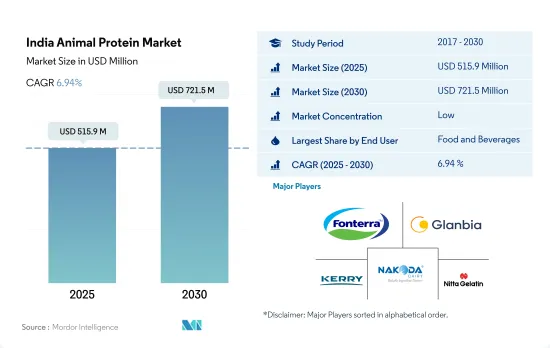

The India Animal Protein Market size is estimated at 515.9 million USD in 2025, and is expected to reach 721.5 million USD by 2030, growing at a CAGR of 6.94% during the forecast period (2025-2030).

Consumer inclination towards protein-based meals dominates the F&B sector across the country

- By end user, the F&B sector remained the largest, and it is anticipated to register a CAGR of 6.33%, by volume, in the forecast period. The demand was majorly led by the snacks industry owing to the increasing number of working professionals and their widening inclination toward healthy, on-the-go meal options. About 70% of Indians are willing to focus on improving their overall health and immunity and reducing stress and anxiety by prioritizing dietary changes.

- The COVID-19 pandemic exposed the vulnerability of the regional foodservice sector, which further drove consumers toward the retail sector. This trend largely benefitted the RTE/RTC foods sub-segment, which saw double-digit growth of 19.60% by volume in 2020 compared to the previous year. The pandemic further bolstered the demand for ready-to-cook food products, such as frozen meals and pizzas, directly positioned to compensate for consumers' eating out. The demand for protein is expected to continue due to the growing consumption of ready-to-eat foods in the country. Thus, the RTE/RTC foods sub-segment is projected to record a CAGR of 6.71% during the forecast period.

- The personal care and cosmetics segment is expected to grow the fastest and record a CAGR of 9.59% during the forecast period. The need for all-natural components in the Indian cosmetics sector is driving applications of animal protein. The increasing functions of whey protein, such as skin smoothening and hair conditioning, are also boosting demand in the market. With the rise in demand for bioactive ingredients from Indian consumers, manufacturers are attempting to include these ingredients in the sector.

India Animal Protein Market Trends

Increase in per capita animal protein consumption to create a favorable environment for whey protein and collagen suppliers

- The country's food industry has tripled in the past decade and is expected to follow the same trend over the coming years. Functional foods, beverages, and protein products are becoming widely popular due to their health benefits. The demand for personal care products containing whey protein has also increased in the country. Due to the country's increasing awareness of fitness, the demand for whey protein powder among bodybuilders and young Indians is increasing. About 33% of urban Indians have easy access to a gym. Meanwhile, 25% of the population in India who had never joined a gym or taken a lesson from a fitness teacher began going to the gym for the first time in the first half of 2022.

- The market is driven by factors such as a growing inclination toward beauty and health supplements and increased R&D activities. The spectrum of applications of collagen is broad, with leading pharmaceutical and biotechnological companies incorporating collagen-based products for better drug delivery systems. However, there is a strong preference for natural and ayurvedic products, boosting the market for natural ingredients such as animal proteins.

- In 2020, the yield of animal byproducts ranged between 50% and 60% of the live weight. Hides and skins are typically among the most valuable animal byproducts, producing end products like edible gelatin. The weight of the hides ranges from 4% to 11% of the live animal's weight. Increased usage of gelatin as a viable biodegradable food packaging material and a boost in fortified confectionery and sports nutrition products may lead to new prospects for the Indian market from 2024 to 2029.

India Animal Protein Industry Overview

The India Animal Protein Market is fragmented, with the top five companies occupying 6.01%. The major players in this market are Fonterra Co-operative Group Limited, Glanbia PLC, Kerry Group PLC, Nakoda Dairy Private Limited and Nitta Gelatin Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90196

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 India

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Protein Type

- 4.1.1 Casein and Caseinates

- 4.1.2 Collagen

- 4.1.3 Egg Protein

- 4.1.4 Gelatin

- 4.1.5 Insect Protein

- 4.1.6 Milk Protein

- 4.1.7 Whey Protein

- 4.1.8 Other Animal Protein

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 RTE/RTC Food Products

- 4.2.2.1.8 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 EnNutrica

- 5.4.2 Fonterra Co-operative Group Limited

- 5.4.3 Glanbia PLC

- 5.4.4 Hilmar Cheese Company Inc.

- 5.4.5 Jellice Pioneer Private Limited

- 5.4.6 Kerry Group PLC

- 5.4.7 Nakoda Dairy Private Limited

- 5.4.8 Nitta Gelatin Inc.

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.