Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692065

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692065

Asia-Pacific Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 241 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

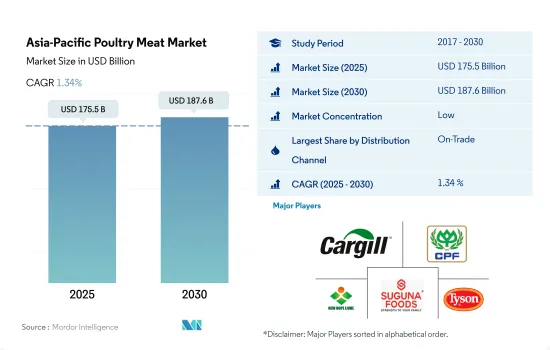

The Asia-Pacific Poultry Meat Market size is estimated at 175.5 billion USD in 2025, and is expected to reach 187.6 billion USD by 2030, growing at a CAGR of 1.34% during the forecast period (2025-2030).

Rising urbanization and internet penetration propelling market sales

- The overall sales of poultry meat through off-trade channels increased by 1.68% from 2021 to 2022. In the Asia-Pacific market, China dominated poultry meat sales by value, accounting for more than 40% of the market in 2022. The demand increased as, in 2018, the African Swine Fever's (ASF) influence on pork pushed people to consume more poultry meat. Imports from Brazil, Thailand, Poland, and Russia also increased by 32% in 2019 compared to 2018, which helped lower poultry prices and increased availability. The sales of poultry meat through foodservice establishments and other off-trade distribution channels have also increased due to increased disposable incomes, which have risen by two times in the past two years.

- In 2022, the on-trade segment was dominating among distribution channels for the sales of poultry meat. It registered a hike of 10.3% in sales value from 2020 to 2022. The Asian market is dominated by a number of hotels, restaurants, and institutions (HRI). China itself accounted for more than 9.3 million catering outlets, recording a 1.2% rise from 2021 to 2022. Due to these factors, the on-trade segment holds the major share value.

- During the forecast period, online channels are projected to witness the fastest-growing CAGR value of 7.43% among off-trade channels. This is due to the increasing number of internet users, which reached around 2.96 billion as of 2021 in Asia-Pacific. Grocery delivery sites like BigBasket and Grofers in India and Amazon have gained popularity due to their advanced delivery systems and payment methods, which are propelling the segment's growth. Even on-trade channels are shifting to hybrid models, including having an online presence, further driving the market.

Consumption of poultry meat rising in the region due to increased production

- In the Asia-Pacific market, the overall sales value of poultry meat registered a CAGR of 4.10% by value during 2017-2022. This increase was primarily due to the rising consumption of meat across the region, especially in Southeast Asia and Oceania. The staple diets in these countries include carbohydrates and protein in the form of meat, primarily poultry. In 2021, 11 Asia-Pacific countries together produced more than a million metric tons of chicken meat, with China leading the way by producing 14.7 million metric tons of chicken meat. Moreover, Asia-Pacific produces smaller birds, with about 40% of chickens being processed.

- China accounted for the largest volume share in the Asia-Pacific poultry meat market in 2022. The chicken industry in China has expanded due to the severe protein shortage caused by the African Swine Fever outbreak. Over the past few years, however, Chinese use of pigs for food dropped precipitously due to the African Swine Fever that ravaged livestock. As a result, the production and consumption of chicken meat in China grew by 12% in 2021. Poultry, which is perceived as a healthier option, ranks number two on China's meat menu, with 25 million tons consumed in 2021.

- India is expected to become the fastest-growing market in Asia-Pacific. It is projected to witness a CAGR of 3.61% in terms of value during the forecast period. The consumption volume of poultry in India increased by 19.8% during the review period. The price of poultry meat is also relatively stable and reasonable compared to other meat types. The increasing number of meat delivery companies in the country, like TenderCuts, Meatigo, and Licious, is largely contributing to the growth of poultry meat consumption.

Asia-Pacific Poultry Meat Market Trends

Producers are focusing on integrated farming with advanced technologies to increase productivity

- Poultry production in the region grew at a moderate rate of 18.66% between 2017 and 2022. With the growing labor problems in the region, manufacturers in the region are investing in automation. While automatic feeding, drinking, and ventilation systems are already common, many have started to invest in automatic nest systems. Manufacturers who already have slaughterhouses are investing in further processing. In 2022, the largest producer of poultry in Asia-Pacific was China, with a share of 48.66%, followed by India and Indonesia with 10.29% and 8.49%, respectively. The production of poultry in China increased by 23.35% in 2022 since 2017. In China, some of the most popular poultry breeds include white broiler, yellow broiler, hybrid, and ex-layer. The share of white feather broilers in chicken production is expected to increase, while yellow feather broiler production is expected to decline.

- India's poultry sector was the second-largest poultry producer in the region, which grew by 30.08% between 2017 and 2022. The majority of Indian poultry production is accounted for by independent and relatively small-scale producers. The market also has integrated large-scale producers accounting for a growing share of output in some regions of the nation. Southeast Asian countries also play a very important role in boosting the market's growth. The outlook for poultry farming in Southeast Asia is optimistic, although prices have risen. In general, around 50% of the poultry production in the region takes place on intensive medium to large-scale commercial farms, and the remaining are raised in back yards of small farmers who keep a few dozen chickens, geese, ducks, or turkeys.

- There was a significant increase in poultry prices, by 3.32%, in 2019. The spread of African swine fever decimates the pig population, driving up the price of pork. As a result, China, the region's largest poultry market, saw a spike in chicken prices due to a supply shortfall as people switched to chicken from more expensive pork. Since 2016, China has had a chicken shortage as a result of a prohibition on chicken imports from the United States and France due to the outbreak of avian flu. Since then, the country has worked hard to offer poultry meat to its consumers at a reasonable price but has been frustrated by the continued scarcity of chickens, which worsened in 2019. Since 2017, China's chicken supply has only risen by 0.34%, making it unable to meet the growing demand.

- On average, the price of poultry increased at a yearly growth rate of 2.48% during the review period. The constant surge in the price of poultry is attributed to the war in Ukraine, bird flu, and inflation. In Malaysia, the cost of imported livestock feed, which has risen by 70% since the war in Ukraine started, is the main factor driving up production costs.

- The rise in poultry demand makes Malaysia the fastest-growing poultry industry in the region. Accordingly, to cater to the surging demand, the Malaysian government planned to ban the export of 3.6 million chickens per month starting on June 1, 2022, with safeguarding local supplies being a key factor. Prior to enacting the export ban, the government made many attempts to regulate the price of chicken, including setting ceiling pricing in February for standard chicken at MYR 8.90/kg and dressed chicken at MYR 9.90/kg.

Asia-Pacific Poultry Meat Industry Overview

The Asia-Pacific Poultry Meat Market is fragmented, with the top five companies occupying 7.65%. The major players in this market are Cargill Inc., Charoen Pokphand Foods Public Co. Ltd, New Hope Liuhe Co. Ltd, Suguna Foods Private Limited and Tyson Foods Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90365

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Poultry

- 3.2 Production Trends

- 3.2.1 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Australia

- 3.3.2 China

- 3.3.3 India

- 3.3.4 Japan

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Canned

- 4.1.2 Fresh / Chilled

- 4.1.3 Frozen

- 4.1.4 Processed

- 4.1.4.1 By Processed Types

- 4.1.4.1.1 Deli Meats

- 4.1.4.1.2 Marinated/ Tenders

- 4.1.4.1.3 Meatballs

- 4.1.4.1.4 Nuggets

- 4.1.4.1.5 Sausages

- 4.1.4.1.6 Other Processed Poultry

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

- 4.3 Country

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Malaysia

- 4.3.7 South Korea

- 4.3.8 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Baiada Poultry Pty Limited

- 5.4.2 BRF S.A.

- 5.4.3 Cargill Inc.

- 5.4.4 Charoen Pokphand Foods Public Co. Ltd

- 5.4.5 Dayong Group

- 5.4.6 Foster Farms Inc.

- 5.4.7 Fujian Sunner Development Co. Ltd

- 5.4.8 Inghams Group Limited

- 5.4.9 New Hope Liuhe Co. Ltd

- 5.4.10 NH Foods Ltd

- 5.4.11 Suguna Foods Private Limited

- 5.4.12 Tyson Foods Inc.

- 5.4.13 Wen's Food Group Co. Ltd

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.