Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693445

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693445

Sunflower Seed (seed For Sowing) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 385 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

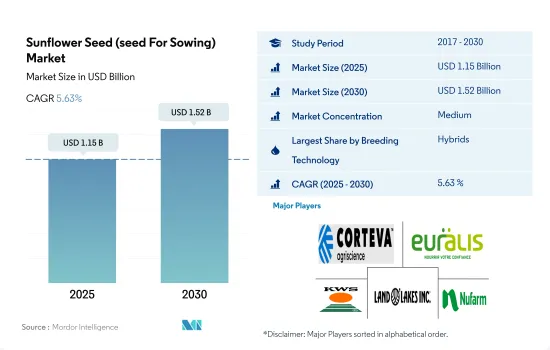

The Sunflower Seed (seed For Sowing) Market size is estimated at 1.15 billion USD in 2025, and is expected to reach 1.52 billion USD by 2030, growing at a CAGR of 5.63% during the forecast period (2025-2030).

Hybrids held the major share due to higher yield, pest resistance, and high oil content

- In 2022, hybrid seeds had more share than open-pollinated seed varieties because hybrid seeds are drought resistant, have wider adaptability to different regions and weather conditions, and high-quality oil seeds are produced by using hybrid seeds.

- During the forecast period, the hybrid segment is projected to register a CAGR of 5.7% due to its ability to provide higher yield and pest resistance. Globally, in 2022, the non-transgenic hybrid sunflower seed market was about 100% of the sunflower hybrid seed market. Transgenic sunflowers are not cultivated commercially, and the awareness among people about the benefits of consuming non-GMO food is increasing. Thus, the demand for non-transgenic hybrids is increasing.

- In most regions, open-pollinated seed varieties are used less compared to hybrid seed varieties because open-pollinated seed varieties are not resistant to diseases and can be attacked easily by both biotic and abiotic factors. Therefore, to minimize crop loss due to weeds and insects, growers use hybrid seed traits such as disease tolerance and insect resistance.

- Open-pollinated seed varieties are anticipated to register a CAGR of 3.4% during the forecast period owing to a steady increase in sowing under OPVs because small-scale growers prefer to use open-pollinated seed varieties as they are less expensive than hybrid seeds and easily adapt to local conditions.

- Therefore, the benefits, such as higher yield and resistance to diseases, will help drive the hybrid seed segment, but open-pollinated seed varieties will be used by small-scale farmers for higher profit by minimizing crop input costs.

Hybrids are the fastest-growing segment in the global sunflower seed market due to their ability to resist inclined climatic conditions and provide high yields

- South America is one of the top producers of sunflowers globally. In 2022, it held a market share of 29.1% in the global sunflower seed market value. This is because sunflowers produced in South America have high export value and are processed for oil and oil mixes. Additionally, the seed companies in the region have released new seed hybrids that are focused on high oil content and suiting processing industries.

- In South America, the cultivated area for sunflowers was 1.9 million hectares in 2022, which increased by 8.7% between 2020 and 2022 due to an increase in demand for oil and processed foods.

- There is a growing production demand for sunflower and its oil in Argentina due to the Russia-Ukraine War, as they are the largest producers and exporters of sunflower products globally.

- Europe is a region that is estimated to witness growth, registering a CAGR of about 6.2% during the forecast period due to the availability of advanced technology. According to the USDA, Europe has ideal weather conditions, due to which the production of sunflowers is expected to increase during the forecast period.

- Asia-Pacific has the second-largest cultivated area of sunflowers across the world, with 2.5 million ha in 2022, which is estimated to increase further due to rising prices and demand for sunflower seeds.

- Hybrid seeds used for the cultivation of sunflowers are expected to register a CAGR of 5.7% during the forecast period, as the sunflower crop is more vulnerable to climatic conditions, and hybrid varieties have the ability to resist inclined climatic conditions such as drought and flood.

- Therefore, the increasing cultivation areas and the high demand for sunflower oil may help boost the growth of the sunflower segment during the forecast period.

Global Sunflower Seed (seed For Sowing) Market Trends

There is an increased area under sunflower cultivation due to increased demand for sunflower seeds, with Europe being the major region

- Sunflower is one of the major oilseed crops cultivated all over the world. Globally, the total sunflower acreage increased by 15.6% between 2016 and 2022, with Europe being the major region with the highest cultivated acreage (23.0 million hectares), accounted for 75.5% of the global area in 2022. This is due to the favorable climatic conditions and increased demand for edible oil globally. Russia had the highest cultivated area in Europe, with 10.2 million hectares, accounting for 33.4% of the global area in 2022. The area in the country increased by 39.6% during 2016-2022. The increased area is due to high domestic demand and export potential. It is the largest country in terms of sunflower seed production globally.

- Asia-Pacific is the second-largest region, accounting for 8.4% of the world's sunflower acreage in 2022. However, the area decreased by 10.9% between 2016 and 2022, mainly due to farmers' shift to other crops like corn and cotton in countries like India. For instance, in India, from 2016 to 2022, 44.3% of the acreage declined. China is the major producer in the region, accounting for 37.3% of the area in Asia-Pacific. China ranks fourth in terms of global production, with 4.7% of total sunflower seed production in 2021.

- In 2022, Africa held 7.8% of the world's sunflower acreage, which increased by 4.1% since 2016. Tanzania is the major country cultivating sunflower in the region, accounting for 44.9% of the total sunflower acreage in the region in 2022. North America and South America held 1.8% and 6.2% share of the global sunflower area in 2022, respectively. In North America, sunflower acreage decreased by 14.5% between 2016 and 2022, mainly due to the impact of drought in sunflower-growing regions.

Prevalence of diseases, including downy mildew and Fusarium, and high demand for oil led to a surge in demand for disease resistance, high oleic and linoleic content traits

- Sunflower is one of the major oilseed crops that is widely cultivated. In the US, 10%-20% of sunflower production was used in shelled kernels, whole seeds, and nut and fruit mixes containing sunflower seed in 2017. Kernels are used in processed foods, such as granola bars and bread. The demand for seed varieties with improved traits is expected to increase during the forecast period. Moreover, high oil content (major yield attribute character), with oleic and linoleic content (based upon the need), have significant demand. The demand for sunflower oil is increasing after an increase in the prices of soybean oil and a ban on palm oil. Thus, the high oil content increases the demand for crops such as sunflower and increases the higher income returns. Products such as 65A25, P62LL109, LG 50760 CL, and Xi Arko by Corteva Agriscience, Groupe Limagrain, and Syngenta AG contain high oleic content traits.

- Disease-resistant traits are widely used by growers, and resistance to downy mildew, Fusarium, Verticillium, Sclerotinia, Plasmophora, and other diseases are very popular and widely cultivated. As these diseases cause significant yield losses during field conditions, resistant varieties avoid the diseases and increase their productivity. For instance, MG 360 and CP432E are the products that are resistant to downy mildew.

- Other traits, such as tolerance to drought, lodging, wider adaptability, early-medium maturity, tolerance to methyl herbicides, and tolerance to moisture stress, with high-yielding characteristics, are used globally. The introduction of new hybrid seed varieties by companies with higher resistance to viruses and high demand by processing industries are the factors expected to help in the growth of the sunflower seed market during the forecast period.

Sunflower Seed (seed For Sowing) Industry Overview

The Sunflower Seed (seed For Sowing) Market is moderately consolidated, with the top five companies occupying 58.58%. The major players in this market are Corteva Agriscience, Euralis Semences, KWS SAAT SE & Co. KGaA, Land O'Lakes Inc. and Nufarm (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92507

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Breeding Technology

- 5.2.1.2 By Country

- 5.2.1.2.1 Egypt

- 5.2.1.2.2 Ethiopia

- 5.2.1.2.3 Ghana

- 5.2.1.2.4 Kenya

- 5.2.1.2.5 Nigeria

- 5.2.1.2.6 South Africa

- 5.2.1.2.7 Tanzania

- 5.2.1.2.8 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Breeding Technology

- 5.2.2.2 By Country

- 5.2.2.2.1 Australia

- 5.2.2.2.2 Bangladesh

- 5.2.2.2.3 China

- 5.2.2.2.4 India

- 5.2.2.2.5 Indonesia

- 5.2.2.2.6 Myanmar

- 5.2.2.2.7 Pakistan

- 5.2.2.2.8 Thailand

- 5.2.2.2.9 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Breeding Technology

- 5.2.3.2 By Country

- 5.2.3.2.1 France

- 5.2.3.2.2 Germany

- 5.2.3.2.3 Italy

- 5.2.3.2.4 Netherlands

- 5.2.3.2.5 Poland

- 5.2.3.2.6 Romania

- 5.2.3.2.7 Russia

- 5.2.3.2.8 Spain

- 5.2.3.2.9 Turkey

- 5.2.3.2.10 Ukraine

- 5.2.3.2.11 United Kingdom

- 5.2.3.2.12 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Breeding Technology

- 5.2.4.2 By Country

- 5.2.4.2.1 Iran

- 5.2.4.2.2 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Breeding Technology

- 5.2.5.2 By Country

- 5.2.5.2.1 Canada

- 5.2.5.2.2 Mexico

- 5.2.5.2.3 United States

- 5.2.6 South America

- 5.2.6.1 By Breeding Technology

- 5.2.6.2 By Country

- 5.2.6.2.1 Argentina

- 5.2.6.2.2 Brazil

- 5.2.6.2.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Corteva Agriscience

- 6.4.3 Euralis Semences

- 6.4.4 KWS SAAT SE & Co. KGaA

- 6.4.5 Land O'Lakes Inc.

- 6.4.6 Nufarm

- 6.4.7 RAGT Group

- 6.4.8 Royal Barenbrug Group

- 6.4.9 S&W Seed Co.

- 6.4.10 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.