Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693697

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693697

Asia-Pacific Pea Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 243 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

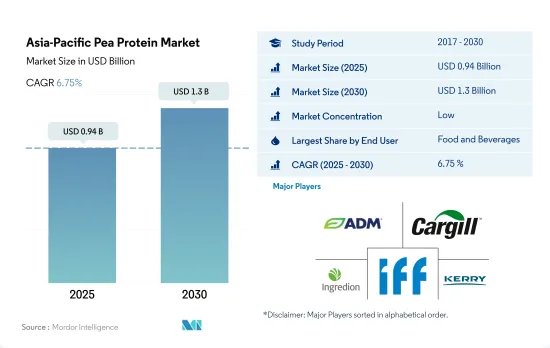

The Asia-Pacific Pea Protein Market size is estimated at 0.94 billion USD in 2025, and is expected to reach 1.3 billion USD by 2030, growing at a CAGR of 6.75% during the forecast period (2025-2030).

F&B segment accounted for a major share in 2022 due to strong demand for meat alternative products; the segment is expected to register Y-o-Y growth of 5.38% from 2023 to 2024

- Pea protein demand is highly dominated by the food and beverage segment, which is anticipated to record a CAGR of 6.77% by volume during the forecast period. Growth is mainly observed from meat alternative products, which held a share of 70.34% by volume in 2023. They are anticipated to record a CAGR of 7.07% by volume during the forecast period. This increase can be due to its hypoallergenic quality and similar amino acid profile to that of meat.

- Pea protein is proven to fuel athletic performance by improving strength, increasing lean muscle mass, and optimizing recovery. Protein ingredients obtained from peas contain 50% to 85% of proteins and are particularly rich in essential branched-chain amino acids (BCAA; leucine, isoleucine, and valine), known to play an important role in muscle protein synthesis. As a result, the sports and nutrition sub-segment accounted for a leading market volume share of 74.15% in the supplements segment in 2023. Increasing adoption of active lifestyles to support physical fitness is estimated to create lucrative market opportunities as health-conscious consumers are shifting toward clean-label supplements made with plant-based ingredients like pea protein.

- The sales of pea protein in the animal feed segment are estimated to register the fastest CAGR of 8.77% in value during the forecast period. Pea protein can be considered a high-quality vegetable protein source in premium pet food because it is non-GMO, grain-free, hypoallergenic, and sustainable. Investment by major pet food companies like Nestle Purina PetCare is estimated to offer potential growth opportunities in the region's animal feed segment. In April 2022, the company announced over USD 60 million in investment to upgrade its manufacturing plant in Blayney, Australia.

China and India collectively accounted for a major share in 2022, owing to the rising trend of plant-based food products among the population

- China remained the dominant country in the Asia-Pacific pea protein ingredients market. It is also expected to register the fastest CAGR of 9.36% by volume during the forecast period. This can be attributed to the country's growing plant-based market and allergen challenges associated with mainstream ingredients, such as soy and wheat proteins. The evolving regulatory landscape to support the vegan food industry is estimated to promote the demand for pea protein ingredients in China. In 2023, the China Vegan Society introduced the China Vegan Food Certification (CVFC), the first program of its kind in China, with the aim of standardizing the vegan claims made by products and increasing consumer trust.

- In India, the market was driven by high demand from the F&B segment. It is expected to record a CAGR of 6.68% by value during the forecast period. Bakery and snacks are projected to obtain the fastest growth, supported by the surging demand for bakery products with clean ingredients like pea protein. The sales of pea protein ingredients in the bakery segment are estimated to register a CAGR of 10.95% during the forecast period, reaching USD 3.5 million in 2029.

- Australia is the second-fastest growing country in the pea protein market, as it is projected to register a CAGR of 7.71% by value during the forecast period. The increasing shift toward plant-protein ingredients to meet the dietary requirements of vegan consumers is identified as the key market driving factor in the Australian pea protein market. The sustainable farming practices to cultivate grains and pulses, including dry peas, demonstrate the availability of quality raw materials for the production of pea protein ingredients.

Asia-Pacific Pea Protein Market Trends

The consumption growth of plant protein fuels opportunities for key players in the plant protein ingredients segment

- Plant proteins are gaining interest in the Asia-Pacific market as awareness and proof of their benefits are rising in the region. Among all plant proteins, soy proteins occupy the market share with the increased acceptability of the ingredients in different foods and their increased production. The volume of soybean meal consumption in China in 2020-21 was 72.68 MMT, which was around 9% more than in 2018. High investments in research, rapid technological advancements, and advanced innovation techniques are some of the major factors resulting in the use of developed protein ingredients, including soy proteins.

- Major drivers of allergen-free plant proteins such as soy, pea, hemp, and potato are the rising adoption of a vegetarian lifestyle, increasing demand for lactose-free and gluten-free products, and growing concerns about health-related problems. Around 81% of Indian consumers restrained meat from their diet in 2021. Major benefits of plant protein ingredients over animal proteins include high nutritional value, being a good source of several vitamins and minerals, technological advancements in various food industries, and increasing demand for natural and organic substitutes, which are expected to change consumer preferences.

- The increasing consumption of plant proteins and consumer acceptance in the region are driving manufacturers to innovate products fortified with these ingredients. Major grains consumed in Japan are soybeans, rice, and wheat, along with some other types like corn and peas. The rise in plant-based protein is expected to continue to provide opportunities for food manufacturers in the coming years.

China is the largest producer of dry peas in Asia-Pacific

- Dry peas are considered the major raw material source for pea protein extraction, and the production data mentioned above is for dry peas only. The above graph represents the total production of dry peas in countries including China, India, Japan, Australia, New Zealand, and South Korea. China is the largest producer of dry peas in Asia-Pacific. There are two major dried pea-producing areas in China: the Northern Dried Pea Producing Area and the Southern Dried Pea Producing Area. Ningxia, Gansu, Yunnan, and Qinghai provinces are China's major dried pea-producing areas, accounting for over 70% of total dried pea production.

- India is the second-largest producer of peas in Asia-Pacific, after China, and the largest producer of chickpeas in the world. Yellow, green, Dum, and Kaspa are the four types of peas grown in the country. The production of dry peas in the country amounted to 1,004,402 tons in 2022, an increase of around 23.72% from 811,810 tons in 2019. Uttar Pradesh, Madhya Pradesh, and Punjab are the major pea-producing states and accounted for about 70% of the country's total pea production in 2022.

- In Australia, several types of field pea are grown, including dun pea, yellow pea, and maple pea. Victoria and South Australia have historically been the largest Australian field pea producers, but production has recently expanded considerably in Western Australia as a result of better varieties and improved production technology.

- The volume of legumes produced by Japanese agriculture is small, but their presence is significant in Japanese traditional food culture. The production of green peas is also very low in the region. Dried pea production is very low and limited, mainly in Hokkaido.

Asia-Pacific Pea Protein Industry Overview

The Asia-Pacific Pea Protein Market is fragmented, with the top five companies occupying 11.55%. The major players in this market are Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, International Flavors & Fragrances Inc. and Kerry Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93494

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Plant

- 3.3 Production Trends

- 3.3.1 Plant

- 3.4 Regulatory Framework

- 3.4.1 China

- 3.4.2 India

- 3.4.3 Japan

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Concentrates

- 4.1.2 Isolates

- 4.1.3 Textured/Hydrolyzed

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 Meat/Poultry/Seafood and Meat Alternative Products

- 4.2.2.1.8 RTE/RTC Food Products

- 4.2.2.1.9 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

- 4.3 Country

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Malaysia

- 4.3.7 New Zealand

- 4.3.8 South Korea

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.3.11 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Archer Daniels Midland Company

- 5.4.2 Cargill, Incorporated

- 5.4.3 Foodchem International Corporation

- 5.4.4 Ingredion Incorporated

- 5.4.5 International Flavors & Fragrances Inc.

- 5.4.6 Kerry Group PLC

- 5.4.7 Roquette Freres

- 5.4.8 Shandong Jianyuan Bioengineering Co. Ltd

- 5.4.9 Yantai Shuangta Food Co. Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.