PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835648

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835648

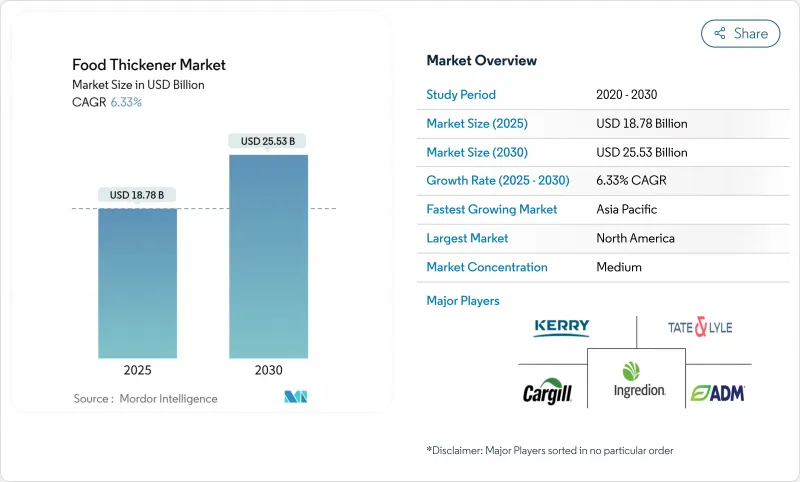

Food Thickener - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The food thickener market is forecasted at market size of USD 18.78 billion in 2025 and is forecasted to reach USD 25.53 billion by 2030, advancing at a 6.33% CAGR.

The steady rise reflects the ingredient's role in delivering stable texture across premium beverages, gluten-free lines and emerging plant-based foods. The versatility of food thickeners in these applications has led to increased adoption by manufacturers seeking to improve product mouthfeel and stability. Clean-label positioning, supported by wider GRAS recognition, raises adoption in North America, while Asia-Pacific processing capacity and regulatory alignment accelerate regional uptake. This trend is further strengthened by consumers' growing preference for natural and recognizable ingredients on product labels. Hydrocolloid blending now delivers dairy-like creaminess in vegan products, and precision fermentation reduces reliance on weather-sensitive crops. These technological advancements have enabled manufacturers to create plant-based alternatives that closely mimic traditional dairy products. At the same time, supply constraints for locust bean gum and heightened scrutiny of E-numbers push manufacturers toward familiar botanical names and alternative microbial sources. The shift towards botanical alternatives has opened new opportunities for ingredient suppliers to develop innovative natural solutions. A moderate level of market fragmentation allows both global suppliers and niche innovators to pursue differentiated strategies. This market structure has fostered healthy competition and continuous product development, benefiting both manufacturers and end-users.

Global Food Thickener Market Trends and Insights

Rising Demand for Texture-Enhanced Processed Food

Texture engineering has progressed from simple viscosity control to precise mouthfeel design, enabling manufacturers to create products with specific textural attributes that meet consumer preferences. The development of sophisticated texture analysis tools and methods has further enhanced the ability to measure and replicate desired mouthfeel characteristics. FDA recognition of modified starches under 21 CFR Part 172 allows cross-linked variants to hold viscosity during thermal processing, while also ensuring product stability and shelf-life extension through improved heat and shear resistance. Sensory studies show that particle size in pea- and potato-based drinks determines perceived chalkiness, giving formulators clear targets for consumer acceptance, with research indicating that particles below 50 microns significantly reduce detection of graininess. Advanced hydrocolloid blends now mimic dairy creaminess in vegan items, opening premium pricing opportunities, as these innovative solutions address the growing demand for plant-based alternatives that maintain traditional dairy textures. Manufacturers that couple regulatory compliance with sensory science secure a competitive edge, boosting volume in convenience meals and ready-to-drink beverages, while also benefiting from increased consumer trust and market differentiation. Robust demand in these categories keeps the food thickener market on its upward course, with particular growth observed in clean-label and naturally-derived thickening agents.

Growth in Gluten-Free and Allergen-Free Product Lines

Gluten-free producers need thickening systems that replace wheat protein structure yet avoid cross-contamination. The absence of gluten necessitates specialized thickening agents that can replicate the binding and structural properties of wheat proteins. Research combining high-acyl gellan gum and low-methoxyl pectin improves fibrous texture in soy-based meats, helping brands satisfy celiac and allergen-free claims. These innovative combinations have demonstrated superior performance in maintaining product integrity and mouthfeel compared to traditional alternatives. EU Regulation EC 1333/2008 imposes stringent labeling, concentrating innovation among suppliers with regulatory expertise. The regulation has led to increased investment in research and development of compliant thickening solutions. Hydrocolloids providing freeze-thaw stability are gaining traction as brands seek shelf-life parity with gluten-containing products. These specialized hydrocolloids have proven essential in maintaining product quality throughout the distribution chain and storage period. Demand has spread from North America to Asia-Pacific, inflating the food thickener market in bakery mixes, snacks and meat analogues. The expansion has been particularly notable in emerging economies where awareness of gluten-free diets is rapidly increasing.

Stringent Food Additive Regulation

Jurisdictional differences elevate compliance costs across global markets. Japanese regulations list 472 designated additives, with approval processes taking nearly a year, significantly slowing the rollout of novel thickening systems. The stringent Japanese framework also requires extensive stability testing, local safety assessments, and detailed manufacturing process documentation. EFSA dossiers can exceed USD 1 million per ingredient, tilting advantage to multinationals able to fund comprehensive safety studies. The European approval process demands thorough toxicological data, clinical trials, and extensive documentation of production methods. Additionally, manufacturers must conduct regular audits and maintain detailed traceability records. China's GB 2760 mandates dosage caps that oblige separate SKUs for different regions, fragmenting inventories. The Chinese regulatory environment further necessitates regional testing facilities, local partnerships, and market-specific formulation adjustments. While consumer confidence rises, smaller firms struggle to absorb documentation costs, slightly restraining the food thickener market's pace. The burden of maintaining multiple certifications, conducting ongoing safety assessments, and adapting to evolving regulatory requirements particularly impacts emerging market players. The complexity of international compliance also creates barriers for new entrants seeking to expand their geographical presence.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Popularity of Plant-Based Dairy and Meat Alternatives

- Rising Use of Clean-Label Ingredients

- Negative Consumer Perception of E-Numbers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The bakery and confectionery segment maintains market leadership with 28.93% share in 2024, leveraging established formulation expertise and consumer acceptance of thickening agents in traditional baked goods applications. However, the beverages segment demonstrates the highest growth at 8.18% CAGR, driven by functional drink innovation and plant-based milk alternatives that require sophisticated stabilization systems. Beverage applications demand thickeners that maintain stability across temperature fluctuations, pH variations, and extended shelf life requirements while delivering clean taste profiles that don't interfere with flavor systems.

Sauces, dressings, and marinades represent mature applications where thickening performance is well-understood, creating competitive pressure based on cost efficiency rather than innovation. The snacks and savory segment benefits from texture innovation trends that use thickening agents to create novel mouthfeel experiences in processed snack foods. Dairy and frozen desserts require thickeners that perform across freeze-thaw cycles while maintaining creamy textures that justify premium pricing in competitive categories. The "Others" category includes emerging applications in meat alternatives, nutraceuticals, and specialty dietary products where thickening agents serve both functional and nutritional roles. Application diversification reduces supplier dependence on any single food category while creating opportunities for specialized thickening systems that command premium pricing through superior performance in specific use cases.

Hydrocolloids maintain market leadership with 46.83% share in 2024, leveraging decades of application development and regulatory approval across global jurisdictions. However, protein-based thickeners demonstrate the highest growth velocity at 7.35% CAGR, indicating fundamental market evolution toward multifunctional ingredients that provide both thickening and nutritional benefits. The protein segment's growth reflects consumer demand for ingredients that contribute to daily protein intake while delivering functional performance, particularly relevant in sports nutrition and elderly care applications where texture modification addresses swallowing difficulties.

Starch-based thickeners occupy the middle ground between hydrocolloids and proteins, offering cost advantages in bulk applications while lacking the premium positioning of either category. The "Others" category includes emerging alternatives like bacterial nanocellulose and extremophilic exopolysaccharides that demonstrate superior performance characteristics but require additional regulatory approval and consumer acceptance. Hydrocolloid suppliers face supply chain challenges, particularly for locust bean gum where agricultural limitations drive price volatility, creating opportunities for protein and microbial alternatives to gain market share through consistent availability and pricing.

The Food Thickener Market is Segmented by Category (Natural and Synthetic), Type (Hydrocolloids, Protein, Starch, and Others), Source (Plant-Based, Animal-Based, Microbial-Based, and Others), Application (Bakery and Confectionery, Snacks and Savory, Beverages, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 38.55% of global revenue in 2024. FDA clarity under 21 CFR Part 170 accelerates GRAS ingredient launches, giving incumbents predictable pathways while limiting low-cost imports fda.gov. The region's robust regulatory framework promotes innovation while maintaining strict quality standards, ensuring product safety and consumer trust. Ingredion's 2023 results showed specialty texturizers delivering 34% of USD 8.2 billion net sales, highlighting scale advantages. Clean-label demand keeps natural starches and citrus fibers in the spotlight, anchoring the region's leadership in the food thickener market. The increasing consumer preference for clean-label products has prompted manufacturers to invest heavily in natural ingredient research and development.

Asia-Pacific is projected to grow at an 8.92% CAGR. China's GB 2760 update, recognizing 215 new additives, aligns local standards with Codex references, lowering barriers for global suppliers according to CIRS Group. The harmonization of regulations has created a more accessible market for international manufacturers, fostering increased competition and innovation. Investments in precision fermentation infrastructure in Singapore and rising disposable income in Southeast Asia multiply opportunities. Localization of supply chains mitigates import dependence, sustaining rapid expansion across beverage and ready-meal categories within the food thickener market. The region's growing middle class and increasing urbanization continue to drive demand for processed and convenience foods.

Europe remains a mature but sizable contributor. Strict safety assessments under Regulation 1333/2008 uphold consumer confidence, though compliance costs favor large enterprises. The region's commitment to food safety has established it as a benchmark for global quality standards in food additives. Public avoidance of E-numbers motivates reformulation toward pantry-friendly labels, rewarding pectin and starch suppliers with transparent sourcing. The continent's starch sector manufactures 10.5 million tonnes per year, half for food use, ensuring stable supply to the regional food thickener market according to the European Starch Industry. The strong focus on sustainability and traceability in European food production continues to shape product development and sourcing strategies.

- Cargill, Incorporated

- Archer Daniels Midland Co.

- Ingredion Inc.

- Kerry Group plc

- International Flavors & Fragrances, Inc.

- Tate and Lyle plc

- Darling Ingredients

- Taiyo Kagaku Co.,Ltd.

- Ashland

- DSM-Firmenich

- RIKEN VITAMIN CO., LTD.

- AVEBE

- CEAMSA

- Revada Group (Fufeng Group)

- Givaudan

- Jungbunzlauer Suisse AG

- Shandong Zhongxuan Corporation Ltd. (Deosen Biochemical (Ordos) Ltd)

- Meihua Holdings Group Co., Ltd.

- DR. Alexander Wacker Familiengesellschaft mbH (Wacker Chemie AG)

- FMC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Texture-Enhanced Processed Food

- 4.2.2 Growth in Gluten-Free and Allergen-Free Product Lines

- 4.2.3 Increaing Popularity of Plant-Based Dairy and Meat Alternatives

- 4.2.4 Rising Use of Clean Label Ingredients

- 4.2.5 Surging Demand from the Bakery and Confectionery Industry

- 4.2.6 Amplifying in Premium and Artisanal Beverage

- 4.3 Market Restraints

- 4.3.1 Stringent Food Additive Regulation

- 4.3.2 Breakdown or Instability of Thickeners Over Shelf Life

- 4.3.3 Labeling Restrictions in Organic and Natural-Certified Products

- 4.3.4 Negative Consumer Perception of E-Numbers and Chemical-Sounding Ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Type

- 5.2.1 Hydrocolloids

- 5.2.1.1 Gelatin

- 5.2.1.2 Xanthan Gum

- 5.2.1.3 Agar

- 5.2.1.4 Pectin

- 5.2.1.5 Others

- 5.2.2 Protein

- 5.2.3 Starch

- 5.2.4 Others

- 5.2.1 Hydrocolloids

- 5.3 By Source

- 5.3.1 Plant-based

- 5.3.2 Animal-based

- 5.3.3 Microbial-based

- 5.3.4 Others

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Sauces, Dressings, and Marinades

- 5.4.3 Snacks and Savory

- 5.4.4 Beverages

- 5.4.5 Dairy and Frozen Desserts

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Poland

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Archer Daniels Midland Co.

- 6.4.3 Ingredion Inc.

- 6.4.4 Kerry Group plc

- 6.4.5 International Flavors & Fragrances, Inc.

- 6.4.6 Tate and Lyle plc

- 6.4.7 Darling Ingredients

- 6.4.8 Taiyo Kagaku Co.,Ltd.

- 6.4.9 Ashland

- 6.4.10 DSM-Firmenich

- 6.4.11 RIKEN VITAMIN CO., LTD.

- 6.4.12 AVEBE

- 6.4.13 CEAMSA

- 6.4.14 Revada Group (Fufeng Group)

- 6.4.15 Givaudan

- 6.4.16 Jungbunzlauer Suisse AG

- 6.4.17 Shandong Zhongxuan Corporation Ltd. (Deosen Biochemical (Ordos) Ltd)

- 6.4.18 Meihua Holdings Group Co., Ltd.

- 6.4.19 DR. Alexander Wacker Familiengesellschaft mbH (Wacker Chemie AG)

- 6.4.20 FMC Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK