PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835649

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835649

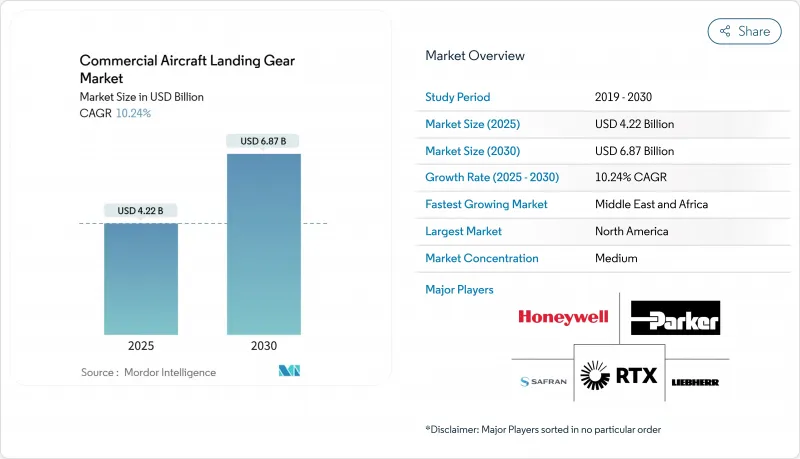

Commercial Aircraft Landing Gear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial aircraft landing gear market size reached USD 4.22 billion in 2025 and is projected to rise to USD 6.87 billion by 2030, translating into a 10.24% CAGR.

Strong demand for fuel-efficient fleets, continued production ramp-up at Boeing and Airbus, and rapid advances in lightweight materials collectively propelled the commercial aircraft landing gear market. Airlines intensified fleet renewal programs to meet carbon-reduction goals. At the same time, integrated health-monitoring systems elevated landing gear from a commodity to a data-rich asset, opening new revenue streams in predictive maintenance. North America preserved its leadership owing to its mature replacement cycle. Still, the Middle East and Africa emerged as the most dynamic regions as governments financed USD 1 trillion in new airport infrastructure that required large fleets of narrowbody and regional aircraft.Supply-chain constraints, notably in forged titanium, kept aftermarket demand elevated and encouraged carriers to sign long-term service agreements. Consolidation among MRO providers and tier-one suppliers added competitive intensity while giving airlines more integrated support options.

Global Commercial Aircraft Landing Gear Market Trends and Insights

Ramp-up of commercial aircraft production post-pandemic

Boeing and Airbus published delivery targets that implied more than 87,000 airplanes through 2043, yet persistent shortages in forgings and fasteners slowed near-term output. A US Government Accountability Office survey showed 60% of component suppliers struggling with timely deliveries, forcing airlines to keep airframes in service longer. That lag boosted long-term service agreements and lifted activity across independent MROs. As build rates recover, unit demand for main and nose gear assemblies will rise because each new aircraft order triggers one complete shipset, shielding the commercial aircraft landing gear market from cyclical turbulence.

Fleet replacement for fuel-efficient models

More restrictive emissions standards and high fuel costs drove carriers to accelerate the retirement of older jets. Boeing estimated 21,100 replacements among the 43,975 deliveries it envisioned through 2043, underscoring a structural pivot toward new-technology fleets. Carbon brakes manufactured by Safran eliminated up to 320 kg per aircraft, fed directly into fuel-burn models, and reduced landing gear overhaul frequency. Airlines began specifying advanced gear options at the point of order rather than retrofitting later, strengthening OEM orderbooks while widening the technology gap with legacy systems.

High cost of advanced materials and processes

Prices for aerospace-grade titanium spiked amid geopolitical tension, stretching budgets for carriers in price-sensitive regions and smaller OEMs that lack purchasing power. Certification hurdles around additive manufacturing also lengthened development cycles and offset projected cost savings. The economic risk of widening the gap between premium products and cost-optimized alternatives, potentially delaying fleet upgrades in developing markets.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight composites and titanium adoption

- Electric taxiing architecture requirements

- Supply-chain bottlenecks in critical forgings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Main landing gear systems represented 64.20% of 2024 revenue, carrying the structural loads defining aircraft take-off weight limits. This sizeable slice of the commercial aircraft landing gear market enabled tier-one suppliers to spread R&D costs across high-value assemblies. Skeletonized beams made of titanium alloys and high-strength steels reduced weight while maintaining fatigue life, generating incremental performance gains valued by airlines.

The nose-gear segment showed a 10.98% CAGR outlook because innovations such as integrated electrical actuation and real-time weight-and-balance sensors concentrated in that part of the gear train. The commercial aircraft landing gear market size for nose systems is expected to expand rapidly, attracting new entrants specializing in electromechanical components. Suppliers leveraged lower technical entry barriers and shorter certification cycles than main assemblies, increasing competition yet accelerating overall technology adoption.

Narrowbody programs, led by the B737 MAX and A320neo families, delivered a 55.45% share of 2024 revenue, underlining their pivotal role in the commercial aircraft landing gear market. Higher build rates translated directly into shipset demand and gave main-gear suppliers predictable volume through the decade.

Regional jets posted a projected 10.54% CAGR to 2030, powered by Embraer's E2 program and new route-optimization strategies in secondary markets. The commercial aircraft landing gear market size for regional jets will close part of the gap with narrowbodies, particularly in Asia-Pacific and North America, where slot-constrained airports favor smaller-gauge aircraft.

The Commercial Aircraft Landing Gear Market Report is Segmented by Landing Gear Type (Main Landing Gear and Nose Landing Gear), Aircraft Type (Narrowbody, Widebody, and Regional Jet), End User (OEM, Aftermarket), Sub-Systems (Actuation System, Steering System, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 38.98% share in 2024, supported by a deep installed base of single-aisle jets and a robust overhaul ecosystem spanning Oklahoma City, Miami, and Montreal. The region's carriers locked in multi-year service agreements to hedge against supply-chain volatility, stabilizing demand for the commercial aircraft landing gear market.

Europe followed with steady mid-single-digit growth. Airbus accelerated gear-shipset orders to feed its A321neo expansion, while sustainability legislation fast-tracked electric taxi programs. EU research funding under Clean Aviation lowered technology-validation risk and broadened supplier participation in the commercial aircraft landing gear market.

The Middle East and Africa are on track for the quickest 12.45% CAGR through 2030 as states invest USD 1 trillion in new airports and carriers such as Ethiopian Airlines, Emirates, and Saudia expand route networks. Boeing predicted Africa's fleet would double, creating a sizeable incremental pool for the commercial aircraft landing gear market.

Asia-Pacific mirrored this expansion pattern, anchored by Indian and Indonesian airport programs. State-backed financing and fast-growing low-cost carriers placed large narrowbody orders, lifting forward demand for landing gear and aftermarket support. South America recorded moderate growth, hindered by macroeconomic headwinds, yet benefited from fleet modernization at Avianca, LATAM, and GOL.

- Safran SA

- Collins Aerospace (RTX Corporation)

- Liebherr Group

- Parker-Hannifin Corporation

- Heroux-Devtek Inc.

- Triumph Group, Inc.

- Sumitomo Precision Products Co., Ltd.

- CIRCOR International, Inc.

- Magellan Aerospace Corporation

- REVIMA Group

- Crane Aerospace & Electronics (Crane Co.)

- GKN Aerospace (GKN plc)

- APPH Limited

- Eaton Corporation plc

- Moog Inc.

- Honeywell International Inc.

- Sika Interplant Systems Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ramp-up of commercial aircraft production post-pandemic

- 4.2.2 Fleet replacement for fuel-efficient models

- 4.2.3 Lightweight composites and titanium adoption

- 4.2.4 Electric taxiing architecture requirements

- 4.2.5 Integrated health-monitoring sensors

- 4.2.6 MRO outsourcing surge for landing gear overhaul

- 4.3 Market Restraints

- 4.3.1 High cost of advanced materials and processes

- 4.3.2 Supply-chain bottlenecks in critical forgings

- 4.3.3 Certification delays for additive-manufactured components

- 4.3.4 Environmental scrutiny of chromium plating

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Landing Gear Type

- 5.1.1 Main Landing Gear

- 5.1.2 Nose Landing Gear

- 5.2 By Aircraft Type

- 5.2.1 Narrowbody

- 5.2.2 Widebody

- 5.2.3 Regional Jet

- 5.3 By End User

- 5.3.1 OEM

- 5.3.2 Aftermarket (MRO, Retrofits)

- 5.4 By Sub-Systems

- 5.4.1 Actuation System

- 5.4.2 Steering System

- 5.4.3 Braking System

- 5.4.4 Strutural System

- 5.4.5 Other Sub-Systems

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Asia-Pacific

- 5.5.2.1 China

- 5.5.2.2 Japan

- 5.5.2.3 India

- 5.5.2.4 South Korea

- 5.5.2.5 Australia

- 5.5.2.6 Rest of Asia-Pacific

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Italy

- 5.5.4.5 Spain

- 5.5.4.6 Russia

- 5.5.4.7 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Safran SA

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 Liebherr Group

- 6.4.4 Parker-Hannifin Corporation

- 6.4.5 Heroux-Devtek Inc.

- 6.4.6 Triumph Group, Inc.

- 6.4.7 Sumitomo Precision Products Co., Ltd.

- 6.4.8 CIRCOR International, Inc.

- 6.4.9 Magellan Aerospace Corporation

- 6.4.10 REVIMA Group

- 6.4.11 Crane Aerospace & Electronics (Crane Co.)

- 6.4.12 GKN Aerospace (GKN plc)

- 6.4.13 APPH Limited

- 6.4.14 Eaton Corporation plc

- 6.4.15 Moog Inc.

- 6.4.16 Honeywell International Inc.

- 6.4.17 Sika Interplant Systems Limited

7 MARKET OPPORTUNITIES ANDFUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment