PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835659

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835659

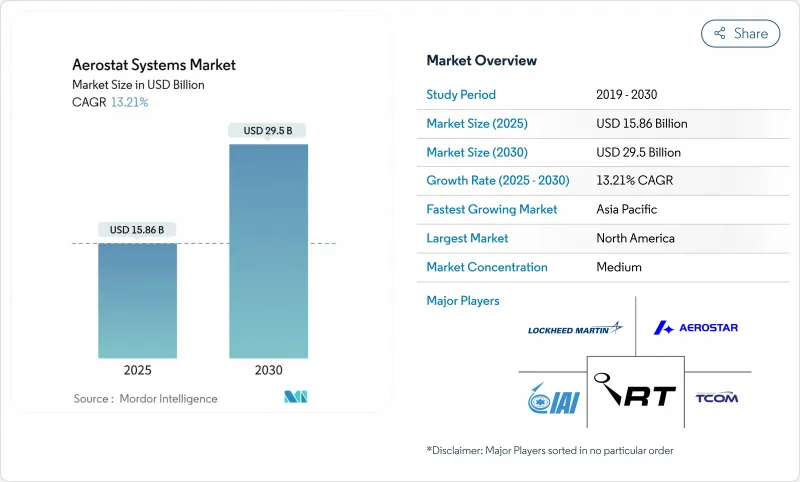

Aerostat Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aerostat systems market size reached USD 15.86 billion in 2025 and is forecasted to expand to USD 29.50 billion by 2030, registering a 13.21% CAGR.

Growing reliance on tethered platforms for persistent surveillance, border security, and temporary communications infrastructure has been the principal growth catalyst. Government procurement programs-such as the USD 170 million Tethered Aerostat Radar System (TARS) award covering eight southern-border sites-validated the technology's value proposition and demonstrated budgetary commitment to long-endurance airborne sensors. Traditional balloon designs continued to dominate because they deliver 30-day endurance without fuel burn, while hybrid and powered variants gained traction by offering heavier payloads and limited station-keeping control. Helium-filled aerostats also found expanding roles in disaster-relief telecom backhaul and rural 5G pilots, drawing in commercial stakeholders seeking low-cost, quickly deployable coverage options. Even so, operators must budget for rising helium input prices, develop robust weather-risk procedures, and navigate evolving air-traffic regulations that govern tethered flights.

Global Aerostat Systems Market Trends and Insights

Persistent Demand for Border-ISR Platforms

Southern-border surveillance contracts awarded to QinetiQ in 2025 cemented aerostats as indispensable for continuous wide-area radar and EO/IR coverage. Elevated to altitudes near 15,000 ft, tethered balloons monitored low-altitude incursions and relayed situational data to command nodes for 30 days without a crewed sortie. Israel's Sky Dew program, built with Israel Aerospace Industries hardware and TCOM envelope expertise, provided another benchmark, enabling early warning against small UAVs and cruise missiles. Increasing cross-border trafficking and unmanned air threats, therefore, sustained procurement pipelines as agencies sought persistent but budget-friendly sensing layers.

Lower Lifecycle Costs Than Satellites and UAVs

A single balloon aerostat operating a month between maintenance cycles delivered radar dwell times that no satellite or multirotor UAV could match at a comparable total cost of ownership. Operators avoided fuel, aircrew, and frequent overhaul expenses because tethered lift required only helium top-offs and small ground crews. QinetiQ's TARS fleet documented predictable cost profiles that simplified multi-year budgeting. Rapid roll-out from trailers or modest pads minimized infrastructure outlays, making aerostats attractive for temporary events, emergency missions, or exploratory telecom coverage without tower builds.

Weather-Related Mission Downtime

Sustained winds above platform limits forced periodic reel-downs that interrupted coverage and raised ground-crew workload. Near-space wind studies showed seasonal velocity peaks that cut effective station time in certain latitudes, pressing operators to adopt stronger tethers, dynamic winches, or powered fins for limited vectoring. Icing and heavy rain added further risk by increasing envelope weight and degrading sensor clarity. Operators, therefore, invested in meteorological forecasting and automated mooring systems to shorten response cycles and protect expensive payloads.

Other drivers and restraints analyzed in the detailed report include:

- Rising Defense Modernization Budgets in Asia and MEA

- Expanding Telecom-Relay Use-Cases for Rural 5G

- Stringent Civil Air-Space Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Balloon aerostats generated 56.25% of 2024 revenue as operators favored their mature design, straightforward ground gear, and stable lift characteristics. The aerostat systems market size for balloon platforms is projected to climb steadily, while hybrid architectures outpace in percentage growth. Agencies ran QinetiQ's TARS balloons at 15,000 ft with EO/IR and L-band radar kits, achieving month-long sorties while incurring only helium and crew stipends.

Hybrid models, blending balloon envelopes with aerodynamic fins or semi-rigid frames, will post an 18.01% CAGR to 2030 by accommodating heavier AESA radars and multi-band telecom payloads without sacrificing tether endurance. TCOM's maritime hybrids showed how detachable sea moorings let naval forces reposition sensors overnight without pier infrastructure. The trajectory suggests hybrid systems will capture incremental mission sets-particularly shipboard overwatch and mobile border caravans-while balloons remain the default for fixed-site, low-maintenance surveillance.

Armed-forces users secured 48.52% of the aerostat systems market share in 2024, thanks to program-of-record spending on long-range airborne radar fences. Border-guard agencies leveraged the same airframes for human-tracking radars and counter-UAS receivers, producing scale economies that broadened sustainment pools. Sensitive missions valued persistent line-of-sight sensors that could not be jammed off-route like small drones or forced ablation like satellites.

Telecom-relay duties will be the fastest 16.24% CAGR niche through 2030. Public-safety departments already treat tethered balloons as pop-up LTE towers when hurricanes disable terrestrial networks. Commercial carriers began proof-of-concept deployments in remote valleys, where a single high-gain antenna under a balloon replaced dozens of microcells. As regulators clear spectrum and simplify operating rules, telecom payloads may become a mainstream revenue line for integrators formerly tied to defense contracts.

The Aerostat Systems Market Report is Segmented by Product Type (Balloon, Airships, and Hybrid), Application (Military ISR, Border and Coastal Surveillance, and More), Class (Compact-Sized, Mid-Sized, and Large-Sized), End-User Industry (Commercial and Military), Propulsion System (Powered and Unpowered) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 45.20% of global revenue in 2024 as integrated border-security concepts promoted multi-sensor aerostat corridors from the Gulf of Mexico to the Pacific. QinetiQ's USD 170 million renewal for TARS coverage underscored the US Government's long-term sustainment posture. Canada adopted complementary tethered balloons for Arctic domain awareness, while Mexico weighed surveillance corridors over remote desert routes, extending value chains for ground stations, tethers, and helium logistics.

Asia-Pacific will post the steepest 14.25% CAGR through 2030. Maritime flashpoints and sprawling Exclusive Economic Zones require enduring radar pickets that do not overextend scarce patrol aircraft inventories. Local integrators in Japan, India, and Indonesia partnered with envelope specialists to localize manufacturing, mitigate import duties, and satisfy sovereign data directives. Hybrid balloons that withstand monsoon wind cycles and salt-laden air have found traction with coast guards and offshore energy operators intent on increasing awareness of the maritime domain.

Europe remained an influential buyer thanks to border-management pressures and NATO readiness mandates. Poland's Airspace and Surface Radar Reconnaissance purchase illustrated Eastern-flank priorities for low-altitude cruise-missile defense. Western European states leveraged aerostats around major airports to host multilateration sensors that improve drone intrusion detection while freeing manned helicopters for other duties. Funding consortia under the European Defence Fund earmarked feasibility studies on high-altitude pseudo-satellite hijinks-projects likely to integrate tether innovations to limit launch-risk profiles.

- TCOM, LP,

- Aerostar LLC

- Lockheed Martin Corporation

- Aeros Corporation

- Israel Aerospace Industries Ltd.

- Allsopp Helikites Ltd.

- ILC Dover, LP

- NPO RosAeroSystems

- Lindstrand Industries

- Icarus Training Systems & Airborne Industries

- RT LTA Systems Ltd.

- Rheinmetall AG

- Altaeros

- Carolina Unmanned Vehicles Inc.

- A-NSE

- QinetiQ Group

- Airstar Aerospace SAS

- Musthane

- Aerobavovna

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Persistent demand for border-ISR platforms

- 4.2.2 Lower lifecycle costs than satellites and UAVs

- 4.2.3 Rising defense modernization budgets in Asia and MEA

- 4.2.4 Expanding telecom-relay use-cases for rural 5G

- 4.2.5 Development of stratospheric pseudo-satellite aerostats

- 4.2.6 ESG-driven environmental monitoring mandates

- 4.3 Market Restraints

- 4.3.1 Weather-related mission downtime

- 4.3.2 Stringent civil air-space regulations

- 4.3.3 Helium supply volatility and price spikes

- 4.3.4 Cyber-security vulnerabilities in data links

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Balloon

- 5.1.2 Airships

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 Military ISR

- 5.2.2 Border and Coastal Surveillance

- 5.2.3 Telecom and Broadband Relay

- 5.2.4 Environmental and Weather Monitoring

- 5.2.5 Disaster Management and Public Safety

- 5.2.6 Scientific Research and Academic

- 5.3 By Class

- 5.3.1 Compact-Sized

- 5.3.2 Mid-Sized

- 5.3.3 Large-Sized

- 5.4 By End-User Industry

- 5.4.1 Commercial

- 5.4.2 Military

- 5.5 By Propulsion System

- 5.5.1 Powered

- 5.5.2 Unpowered

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TCOM, LP,

- 6.4.2 Aerostar LLC

- 6.4.3 Lockheed Martin Corporation

- 6.4.4 Aeros Corporation

- 6.4.5 Israel Aerospace Industries Ltd.

- 6.4.6 Allsopp Helikites Ltd.

- 6.4.7 ILC Dover, LP

- 6.4.8 NPO RosAeroSystems

- 6.4.9 Lindstrand Industries

- 6.4.10 Icarus Training Systems & Airborne Industries

- 6.4.11 RT LTA Systems Ltd.

- 6.4.12 Rheinmetall AG

- 6.4.13 Altaeros

- 6.4.14 Carolina Unmanned Vehicles Inc.

- 6.4.15 A-NSE

- 6.4.16 QinetiQ Group

- 6.4.17 Airstar Aerospace SAS

- 6.4.18 Musthane

- 6.4.19 Aerobavovna

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment