PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836429

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836429

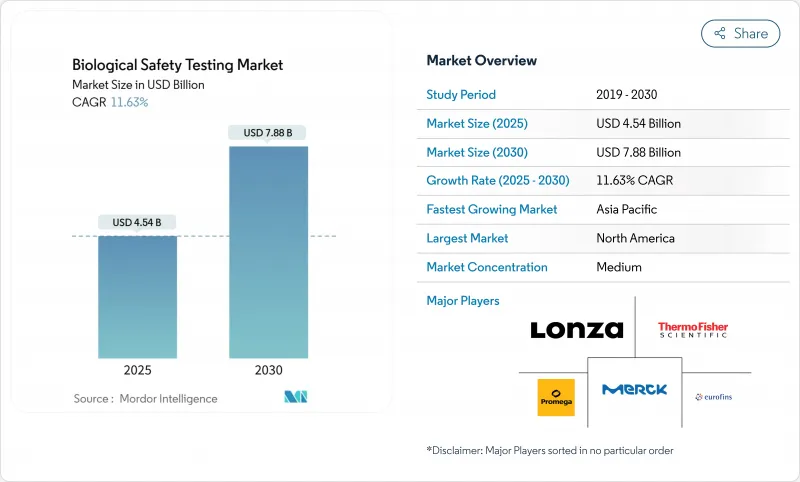

Biological Safety Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biological Safety Testing Market size is estimated at USD 4.54 billion in 2025, and is expected to reach USD 7.88 billion by 2030, at a CAGR of 11.63% during the forecast period (2025-2030).

Regulatory agencies now demand richer viral- and mycoplasma-safety datasets, while manufacturers scale up advanced therapy medicinal products (ATMPs) that require intensive contamination control. AI-enabled in-silico biosafety modelling is increasingly embedded in quality-control workflows, reducing batch-failure rates and trimming release times. Biothreat-preparedness spending from BARDA and EU-HERA has broadened demand beyond the traditional biopharma customer base. Outsourced quality control to Asia-based CDMOs, especially in China, is reshaping supply chains as laboratories there gain international accreditation.

Global Biological Safety Testing Market Trends and Insights

Growth in Global Pharma-Biotech Pipeline & Venture Funding

Deal flow across oncology, immunology, and gene therapy is setting record highs. Larger round sizes fund richer pre-clinical datasets, which in turn require extended biosafety test panels. Several start-ups, such as Aclid, raise seed capital earmarked for DNA-synthesis screening platforms that ease contamination risk, pushing volumes toward contract testing firms. The pipeline expansion particularly benefits contract testing organizations, as pharmaceutical companies increasingly outsource safety testing to specialized providers rather than maintaining in-house capabilities.

Scale-Up of Advanced Therapy Medicinal Products (ATMPs) Manufacturing

Guidance updates from the European Medicines Agency in 2024 and parallel FDA drafts are drawing ATMP producers toward expanded adventitious virus and cell-line authentication assays. Lonza's USD 1.2 billion site acquisition in Vacaville exemplifies the capital intensity needed to house such high-grade QC suites. The unique testing requirements for ATMPs, including adventitious virus detection and cellular characterization, create specialized market segments with higher margins and technical barriers to entry.

Lengthy Validation Cycles for Novel Rapid-Micro Methods

Despite FDA encouragement under its Process Analytical Technology framework, global validation still demands 18-24 months of side-by-side testing against compendial methods. Suppliers such as Rapid Micro Biosystems demonstrate 1- to 3-day sterility reads, yet sponsors maintain parallel legacy assays until regulatory comfort is proven.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Tightening on Viral & Mycoplasma Contamination

- Outsourcing Surge To Asia-Based CDMOs for Cost-Effective QC Services

- Shortage of Qualified Biosafety Personnel & High Training Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and kits captured 45.12% revenue in 2024, reflecting their consumable pull-through as test volumes expand across sterile injectables and ATMP release lots. The biological safety testing market size attributed to reagents grows in tandem with heightened contamination-screening frequency. Single-use filters and recombinant Factor C endotoxin vials dominate purchase orders, although PFAS-driven PVDF-filter phase-outs are spurring redesigns. Instrument sales advance at a 12.12% CAGR, powered by automated plate-reading systems, ddPCR analytics, and real-time incubation chambers. Vendors integrate AI modules that flag anomalies and pre-empt false positives, shrinking deviation investigations. Service revenues climb as pharma sponsors outsource sterility, endotoxin, and cell-line authentication to specialist labs, using bundled contracts that include sample logistics and data-integrity auditing. Rising ATMP pipelines further tilt spending toward bespoke adventitious-virus panels, which carry premium pricing.

Sterility assays accounted for a 32.69% biological safety testing market share in 2024, remaining a release-critical step for every parenteral batch. Incubation-based protocols still dominate submissions, yet continuous-monitoring systems such as BACT/ALERT shorten final approval windows. Mycoplasma detection logs the highest 11.71% CAGR as PCR-based kits and combined RNA-sequencing workflows replace 28-day culture waits. Regulatory convergence around PCR acceptance accelerates adoption, especially for cell-therapy intermediates. Endotoxin testing is migrating to recombinant Factor C, decoupling supply from horseshoe-crab lysate shortages and enhancing sustainability. Adventitious-virus detection relies increasingly on next-generation sequencing, allowing sponsors to widen pathogen panels without extending timelines.

The Biological Safety Testing Market Report Segments the Industry Into by Product & Service (Products [Reagents & Kits, and More], Services [Sterility Testing Services, and More]), Test Type (Sterility Tests, Bioburden Tests, and More), Application, End User, and Geography (North America, Europe, Asia-Pacific, Middle-East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 46.25% of global revenue in 2024, supported by FDA regulatory rigor, BARDA procurement, and the presence of major monoclonal-antibody producers. Sponsors in the region increasingly pilot AI-driven contamination-risk algorithms, propelling demand for software-integrated incubators. Europe follows, benefitting from ATMP science clusters across Germany and the United Kingdom and from pharmacopoeial acceptance of rFC, which accelerates endotoxin-method shifts. Supply-chain stress does arise, as PFAS-regulated consumables face looming phase-outs that compel EU labs to re-qualify alternatives.

Asia-Pacific posts the highest 17.24% CAGR to 2030, propelled by China's vast CDMO build-out, Singapore's cell-therapy innovation hubs, and Japan's ISO-aligned PMDA rules that ease export barriers. Local labs secure FDA multi-regional inspections, validating reliability at lower cost points. Still, geopolitical tensions and the pending BIOSECURE Act introduce uncertainty, pushing some sponsors to split QC placement between Asia and domestic sites for redundancy.

Middle East & Africa and South America remain nascent but strategic. National vaccine institutes in Brazil and Saudi Arabia invest in GMP-grade sterility and mycoplasma suites, supported by World Bank health-security grants. Limited skilled-personnel pools and intermittent power supply constrain pace, yet long-term commitments to regional manufacturing autonomy sustain incremental QC demand.

- Charles River

- Lonza Group

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Eurofins

- WuXi App Tec

- SGS

- bioMerieux

- Avance Biosciences

- Cytovance Biologics

- Toxikon (Labcorp)

- Nelson Labs

- Pacific BioLabs

- STERIS

- Pall Corporation (Danaher)

- Sartorius

- Promega

- Creative BioLabs

- Microbac Laboratories

- Alcami

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Global Pharma-Biotech Pipeline & Venture Funding

- 4.2.2 Scale-Up of Advanced Therapy Medicinal Products (ATMPs) Manufacturing

- 4.2.3 Regulatory Tightening on Viral & Mycoplasma Contamination

- 4.2.4 Outsourcing Surge To Asia-Based CDMOs for Cost-Effective QC Services

- 4.2.5 AI-Enabled In-Silico Biosafety Modelling Reduces Batch-Failure Risk

- 4.2.6 Biothreat Preparedness Programs (BARDA, EU-HERA) Elevating Testing Demand

- 4.3 Market Restraints

- 4.3.1 Lengthy Validation Cycles for Novel Rapid-Micro Methods

- 4.3.2 Shortage of Qualified Biosafety Personnel & High Training Costs

- 4.3.3 Price Pressure from Large Pharma Driving Margin Compression for CROs

- 4.3.4 Supply-Chain Fragility for Single-Use Reagents (HEPA, LAL)

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product & Service

- 5.1.1 Products

- 5.1.1.1 Reagents & Kits

- 5.1.1.2 Instruments

- 5.1.1.3 Single-use Consumables

- 5.1.2 Services

- 5.1.2.1 Sterility Testing Services

- 5.1.2.2 Endotoxin & Pyrogen Testing Services

- 5.1.2.3 Cell Line Authentication & Characterisation

- 5.1.1 Products

- 5.2 By Test Type

- 5.2.1 Sterility Tests

- 5.2.2 Bioburden Tests

- 5.2.3 Endotoxin/LAL Tests

- 5.2.4 Mycoplasma Detection

- 5.2.5 Adventitious Virus Detection

- 5.3 By Application

- 5.3.1 Recombinant Protein/Monoclonal Antibodies

- 5.3.2 Vaccine and Therapeutics

- 5.3.3 Cellular and Gene Therapy

- 5.3.4 Blood and Blood-based Therapy

- 5.3.5 Other Application

- 5.4 By End User

- 5.4.1 Biopharma & Biotech Companies

- 5.4.2 Contract Development & Manufacturing Organisations

- 5.4.3 Academic & Research Institutes

- 5.4.4 Medical Device Manufacturers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Charles River Laboratories

- 6.3.2 Lonza Group

- 6.3.3 Thermo Fisher Scientific

- 6.3.4 Merck KGaA (MilliporeSigma)

- 6.3.5 Eurofins Scientific

- 6.3.6 WuXi AppTec

- 6.3.7 SGS SA

- 6.3.8 bioMerieux SA

- 6.3.9 Avance Biosciences

- 6.3.10 Cytovance Biologics

- 6.3.11 Toxikon (Labcorp)

- 6.3.12 Nelson Labs

- 6.3.13 Pacific BioLabs

- 6.3.14 Steris PLC

- 6.3.15 Pall Corporation (Danaher)

- 6.3.16 Sartorius AG

- 6.3.17 Promega Corporation

- 6.3.18 Creative BioLabs

- 6.3.19 Microbac Laboratories

- 6.3.20 Alcami Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment