PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836432

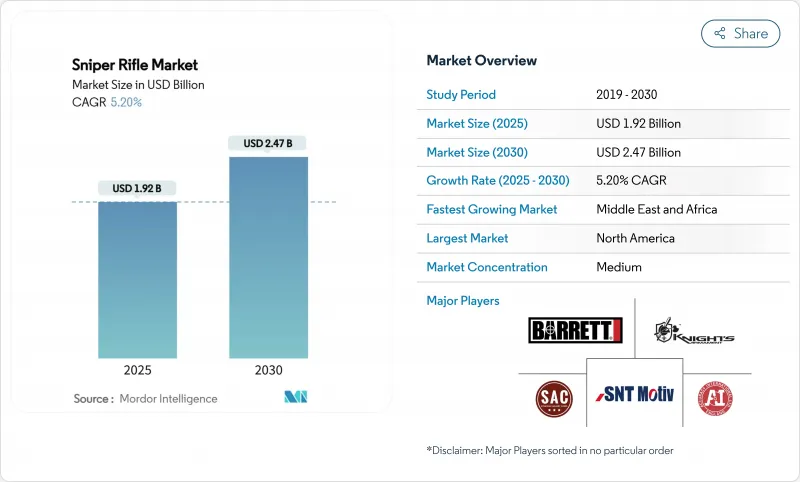

Sniper Rifle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sniper rifle market size is estimated at USD 1.92 billion in 2025, and is expected to reach USD 2.47 billion by 2030, reflecting a CAGR of 5.20% during the forecast period.

Ongoing defense-modernization programs, the proliferation of multi-caliber weapon platforms, and demand for digitally enabled optics sustain this steady trajectory. Military recapitalization programs in the United States, Europe, and the Gulf states continue to anchor procurement volumes, while long-range competitive shooting and hunting build a sizeable civilian revenue base. Accelerating innovation in optical fire-control, the emergence of lead-free precision ammunition, and rising homeland-security procurements in response to urban counter-sniper requirements further reinforce future growth. At the same time, tightened export-control regimes and higher life-cycle costs temper adoption among budget-constrained end users, fostering measured but resilient expansion across the sniper rifles market.

Global Sniper Rifle Market Trends and Insights

Increased Defense Modernization Budgets Fueling Sniper Rifle Procurement

Escalating allocations for precision-fire capabilities in NATO and partner nations translate into multi-year rifle replacement programs and optics upgrades. The US Army earmarked USD 367.3 million for Next-Generation Squad Weapons in fiscal 2025, and the US Marine Corps completed its 587-unit MK22 program ahead of schedule, underscoring institutional priority for multi-caliber, extreme-range performance. Gulf-state outlays-headlined by Saudi Arabia's USD 100 billion framework purchase-add another sizeable demand pool, while smaller European militaries such as Norway and Germany standardize on new long-range rifles to match near-peer threats. These synchronous initiatives reward manufacturers that pair first-round hit probability with simplified logistic chains, positioning the sniper rifles market for enduring large-volume orders.

Growing Popularity of Long-Range Precision Shooting in the Civilian Market

Competitive shooting leagues, long-range hunting, and recreational precision matches create a vibrant non-military sales channel. Smith & Wesson attributed a meaningful share of its USD 535.8 million FY2024 net sales to precision long guns tailored for the 1,000-yard firing line. Higher civilian throughput allows shared manufacturing lines with military programs, lowering unit costs and accelerating the trickle-down of aftermarket tunable triggers, carbon-fiber barrels, and advanced ballistic calculators. The sub-MOA performance standard now expected by civilian enthusiasts pressures suppliers to maintain continuous product refresh cycles, indirectly benefiting military users that leverage the same production tooling for government contracts.

Tightened Export Controls and ITAR Restrictions Limiting International Sales Opportunities

The May 2024 amendments to the US Export Administration Regulations introduced new license requirements for an expanded group of firearms and "crime-control" items, adding lead time and compliance cost for American manufacturers. While aimed at curbing illicit diversion, the rules inadvertently steer some foreign buyers toward suppliers operating under less stringent regimes. Compliance overhead includes legal reviews, individual part number classification, third-party due diligence fees, eroding margin on small-lot exports, and complicated after-sales support agreements.

Other drivers and restraints analyzed in the detailed report include:

- Counter-Sniper Capability Upgrades Driving Law-Enforcement Modernization

- Integration of Digital Optics and Multisensor Fusion Enhancing Targeting Systems

- Elevated Procurement and Long-Term Maintenance Costs Restricting Broader Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beyond 1,000 m rifles generated 52.11% of the total 2024 revenue, and the segment is advancing at a 6.14% CAGR as militaries prioritize overmatch at standoff distances. The sniper rifle market size for these extreme-range systems is forecast to widen by USD 0.29 billion between 2025 and 2030, reflecting procurement of .338 NM and .50 BMG platforms in active theaters. First-round hit efficacy at two kilometers underpins tactical doctrines emphasizing counter-battery engagements and anti-materiel roles. Procurement contracts increasingly include integrated suppressors and multi-sensor day-night optics to reduce signature while preserving target acquisition.

Up to 1,000 m rifles remain vital for police tactical units and urban warfare where line-of-sight is constrained. These weapons, generally chambered in 7.62 NATO or 6.5 mm Creedmoor, log consistent volume because training costs are lower and logistical commonality with service rifles simplifies ammunition supply. While their share of the sniper rifles market revenue slips slightly through the forecast horizon, consistent replenishment and replacement cycles ensure a solid customer base among national guard and gendarmerie formations.

The .338 Lapua segment accounted for 23.89% of 2024 revenue thanks to widespread military qualification and established supply chains across Europe, North America, and Asia. As many armies extend qualified engagement ranges to 1,500 m, this caliber remains the benchmark for anti-personnel precision with acceptable recoil. The sniper rifle market share held by .338 Lapua erodes only marginally as new entrants arrive, but absolute demand grows in line with overall market expansion.

"Other Calibers," encompassing .300 Norma Magnum, 8.6 Blackout, and emerging 9.4 mm cartridges, register the fastest 5.98% CAGR amid efforts to balance ballistic coefficient, barrel life, and suppressed-fire performance. Multi-caliber actions allow units to select cartridges matched to altitude, temperature, and target set, insulating users from availability shocks in any commodity supply chain. Legacy 7.62*51 mm NATO is the default training round, preserving institutional knowledge while minimizing per-shot expenditure.

The Sniper Rifle Market Report is Segmented by Range (Up To 1, 000 M, and Beyond 1, 000 M), Caliber (7. 62*51 Mm, . 300 Winchester Magnum, . 338 Lapua Magnum, . 50 BMG, and Other Calibers), Operating Mechanism (Bolt-Action and Semi-Automatic), Application (Military, Homeland Security, and Civilian), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America anchored 38.77% of 2024 turnover owing to sustained US defense appropriations and the world's largest civilian precision-shooting community. The sniper rifle market size in the region benefits from economies of scale as manufacturers spread fixed R&D costs over government and commercial runs. At the same time, buy-American provisions keep domestic content above 80% in most federal contracts. Canadian special operations units follow US modernization patterns, further bolstering regional demand.

Europe maintains a significant share through gradual but steady recapitalization among NATO members seeking interoperability and extended effective ranges. Procurement agendas here emphasize integrated suppressors, lead-free ammunition compliance, and digital day-night optics, aligning with stringent environmental and soldier-sustainability standards. High-altitude training sites in Norway, Germany, and Italy also provide grounds for extreme-cold barrel metallurgy, feeding innovation that circulates back into global product lines.

The Middle East and Africa are poised for a 6.89% CAGR as Gulf monarchies advance multi-billion-dollar rearmament programs and sub-Saharan forces invest in counter-terror and border-security capabilities. Large-volume orders from Saudi Arabia and the United Arab Emirates influence platform standardization across the broader region. African special forces gravitate toward European bolt-action models compatible with NATO ammunition supply chains. Local maintenance-training partnerships often accompany these contracts, building indigenous armorer skill sets that support lifecycle sustainment.

Asia-Pacific records rising adoption propelled by India's emerging indigenous manufacturing base and Australian special operations requirements for anti-materiel systems with multi-role optics. Parallel economic growth in Southeast Asia yields discretionary security budgets that include long-range sniper assets, though deliveries remain sensitive to export-control approvals from Western OEMs. South America shows moderate demand, driven mainly by specialized police units combating transnational crime in mixed urban-jungle environments, with procurement cycles closely tied to multilateral public-security funding.

- SNT Motiv Co., Ltd.

- Savage Arms, Inc.

- FN Browning Group

- Knights Armament Company

- Accuracy International Ltd.

- Strategic Armory Corps, LLC

- Zastava Arms USA

- B&T AG

- PGM Precision

- Heckler & Koch GmbH

- Barrett Firearms Mfg, Inc.

- STEYR ARMS GmbH

- Desert Tech LLC

- RemArms LLC

- Lobaev Arms

- Sabatti S.p.A.

- Sako Ltd. (Beretta Holding S.A.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased defense modernization budgets fueling sniper rifle procurement

- 4.2.2 Growing popularity of long-range precision shooting in the civilian market

- 4.2.3 Counter-sniper capability upgrades driving law enforcement modernization

- 4.2.4 Integration of digital optics and multisensor fusion enhancing targeting systems

- 4.2.5 Logistics benefits driving adoption of modular multi-caliber sniper platforms

- 4.2.6 Environmental regulations accelerating shift toward lead-free sniper ammunition

- 4.3 Market Restraints

- 4.3.1 Tightened export controls and ITAR restrictions limiting international sales opportunities

- 4.3.2 Elevated procurement and long-term maintenance costs restricting broader adoption

- 4.3.3 Emergence of counter-UAS directed-energy systems diminishing the strategic role of snipers

- 4.3.4 Limited integration with next-gen soldier systems and battlefield networks delaying modernization uptake

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Range

- 5.1.1 Up to 1,000 m

- 5.1.2 Beyond 1,000 m

- 5.2 By Caliber

- 5.2.1 7.62*51 mm

- 5.2.2 .300 Winchester Magnum

- 5.2.3 .338 Lapua Magnum

- 5.2.4 .50 BMG

- 5.2.5 Other Calibers

- 5.3 By Operating Mechanism

- 5.3.1 Bolt-Action

- 5.3.2 Semi-Automatic

- 5.4 By Application

- 5.4.1 Military

- 5.4.2 Homeland Security

- 5.4.3 Civilian

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 SNT Motiv Co., Ltd.

- 6.4.2 Savage Arms, Inc.

- 6.4.3 FN Browning Group

- 6.4.4 Knights Armament Company

- 6.4.5 Accuracy International Ltd.

- 6.4.6 Strategic Armory Corps, LLC

- 6.4.7 Zastava Arms USA

- 6.4.8 B&T AG

- 6.4.9 PGM Precision

- 6.4.10 Heckler & Koch GmbH

- 6.4.11 Barrett Firearms Mfg, Inc.

- 6.4.12 STEYR ARMS GmbH

- 6.4.13 Desert Tech LLC

- 6.4.14 RemArms LLC

- 6.4.15 Lobaev Arms

- 6.4.16 Sabatti S.p.A.

- 6.4.17 Sako Ltd. (Beretta Holding S.A.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment