PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836434

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836434

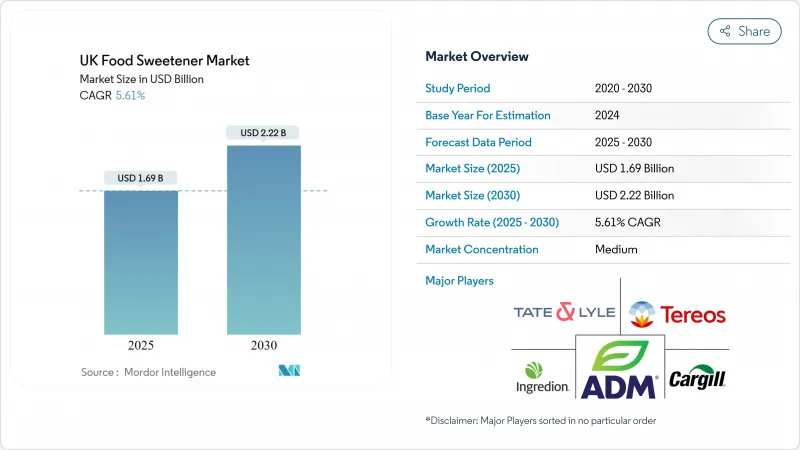

UK Food Sweetener - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK sweetener market size, estimated to be valued at USD 1.69 billion in 2025 and is expected to reach USD 2.22 billion by 2030, with a CAGR of 5.61%.

The market growth is driven by England's dominant position in the sweeteners industry, extensive research and development activities conducted by multinational suppliers, and significant retailer support for sugar-reduced private-label products. Natural high-intensity sweeteners, such as stevia and monk fruit, are gaining substantial market share following the Food Standards Agency's relaxation of novel-food regulations. Liquid sweetener formats enhance production efficiency and streamline manufacturing processes in soft-drink concentrates and sauce applications. Technological improvements in taste-modulation technologies, bio-conversion processes, and sweet proteins effectively address aftertaste challenges, enabling food and beverage brands to meet 2025 levy requirements while preserving the desired product taste profile .

UK Food Sweetener Market Trends and Insights

Rising Prevalence of Obesity and Diabetes

The high prevalence of overweight and obese adults in the UK generates substantial socio-economic costs annually. Government health policies encourage food manufacturers to reformulate products by limiting free-sugar content in daily energy consumption. This has increased sweetener usage in baked goods, cereals, and beverages. Manufacturers targeting price-sensitive consumer segments implement high-intensity sweetening systems to maintain affordable pricing while addressing public health requirements. The growing National Health Service (NHS) expenditure on diabetes management reinforces preventive nutrition programs, driving demand for sweeteners that preserve familiar taste profiles. .

Sugar-Tax Driven Shift to Low-Calorie Alternatives

The Soft Drinks Industry Levy has fundamentally transformed beverage formulations, achieving a 46% reduction in sugar content across affected products since implementation. Current regulatory proposals seek to strengthen the framework by lowering the taxable threshold to 4g per 100ml and eliminating existing milk-based exemptions . More than 50% of beverage manufacturers have strategically reformulated their product portfolios to avoid financial penalties, demonstrating the levy's substantial influence in redirecting consumption patterns toward sweetener alternatives. Policymakers are actively considering extending the taxation framework to include biscuits and chocolate products, which would unlock significant new market opportunities in the sweetener industry. The consistent allocation of levy revenue to school sports programs continues to maintain strong cross-party political support, indicating a potential systematic expansion of the levy that may accelerate sweetener adoption across mainstream consumer brands and product categories.

Consumer Skepticism Towards Artificial Sweeteners

The World Health Organization's 2024 advisory on non-sugar sweeteners' effectiveness in weight management heightened public scrutiny of aspartame and saccharin. While regulatory bodies consistently affirm these sweeteners' safety through scientific evidence, widespread media coverage has intensified consumer hesitation, particularly among parents concerned about long-term health effects. Natural sweetener manufacturers capitalize on this sentiment but command significant price premiums, creating a distinct two-tier market structure. Companies have responded by implementing comprehensive labeling practices and launching targeted consumer education initiatives. However, persistent concerns continue to impact sales of traditional artificial sweeteners, especially in rural areas where deep-rooted consumer trust issues and limited product awareness remain significant barriers to adoption.

Other drivers and restraints analyzed in the detailed report include:

- Clean-Label Demand Driving Plant-Based Sweetener Adoption

- Rapid Innovation in Reduced-Sugar Food and Beverage Products

- Taste Profile and Aftertaste Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sucrose maintains a 48.15% share of the UK sweeteners market in 2024, supported by established recipes and cost advantages. High-intensity sweeteners, including stevia, sucralose, and acesulfame-K, are growing at a 7.10% CAGR through 2030, driven by manufacturers' efforts to comply with sugar levies and reduce calorie content. The UK market for high-intensity sweeteners is expected to expand by approximately one-third, supported by Avansya's fermented reb-M products that combine natural ingredients with sugar-like taste characteristics. Starch hydrolysates and polyols provide medium-calorie alternatives, while xylitol and sorbitol maintain consistent demand in dental hygiene products like gums and mints. Allulose and tagatose await novel food approval, which could expand product options in the market.

Consumer demand for natural ingredients is prompting manufacturers to incorporate natural sweetener extracts. Monk fruit usage is expanding after receiving regulatory approvals, while the October 2024 collaboration between Tate & Lyle and Manus Bio aims to increase stevia Reb M production capacity. Although natural sweeteners have not reached price equivalence with bulk sugar, the fluctuating sugar prices are narrowing this cost gap. While World Health Organization discussions may affect aspartame usage, sucralose retains its market position in industrial baking applications, particularly in cake mix formulations, due to its heat stability properties.

Powder sweeteners dominated the market with a 44.22% share in 2024, driven by their convenience in dry mix applications. However, liquid sweeteners are growing at a 7.24% CAGR, as beverage manufacturers prefer their pump-metering precision and faster dissolution rates in high-volume production lines. The UK liquid sweeteners market share continues to expand as concentrated syrups reduce storage costs. While crystal-coated particles enable controlled release in confectionery applications, they face manufacturing scale-up difficulties. New hybrid encapsulated formats combine the easy dispersion of liquids with the storage stability of powders.

Manufacturing facilities in the Midlands are transitioning to tanker deliveries of sucrose syrups and stevia solutions to minimize production interruptions. Powder formats maintain their importance in foodservice sachets and retail pouches where precise dosage and moisture resistance are essential. Increased regulatory requirements for microbiological safety in liquid sweeteners drive new investments in aseptic processing equipment.

The UK Food Sweetener Market is Segmented by Product Type (Sucrose, Starch Sweeteners and Sugar Alcohols, and More), Application (Bakery and Confectionery, Dairy and Desserts, Beverages, and More), Form (Powder, Liquid, and Crystal), Category (Conventional and Organic), and Region (England, Scotland, Wales, and Northern Ireland). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tate & Lyle PLC

- Cargill Inc.

- ADM

- Ingredion Inc.

- Tereos S.A.

- Associated British Foods plc

- GLG Life Tech Corp.

- Roquette Freres

- Sudzucker

- DuPont

- Celanese Corporation

- Ajinomoto Co.

- JK Sucralose

- Evolva Holding

- Cosun Beet Company

- Foodchem International Corporation

- SandW Seed Company

- Layn Natural Ingredients

- DSM-Firmenich

- Amyris Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Obesity and Diabetes

- 4.2.2 Sugar-tax Driven Shift to Low-calorie Alternatives

- 4.2.3 Clean-Label Demand Driving Plant-Based Sweetener Adoption

- 4.2.4 Rapid Innovation in Reduced-Sugar Food and Beverage Products

- 4.2.5 Expanding Functional Foods and Low-Calorie Beverage Categories

- 4.2.6 Government and Regulatory Support for Sugar Reduction Initiatives

- 4.3 Market Restraints

- 4.3.1 Consumer Skepticism Towards Artificial Sweeteners

- 4.3.2 Taste Profile and Aftertaste Issues

- 4.3.3 Price Volatility in Raw Materials for Natural Sweeteners

- 4.3.4 Formulation Complexity and Product Stability Issues

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Sucrose

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Xylitol

- 5.1.2.6 Other Starch Sweeteners and Sugar Alcohols

- 5.1.3 High-Intensity Sweeteners

- 5.1.3.1 Artificial High-Intensity Sweeteners

- 5.1.3.1.1 Sucralose

- 5.1.3.1.2 Aspartame

- 5.1.3.1.3 Saccharin

- 5.1.3.1.4 Neotame

- 5.1.3.1.5 Cyclamate

- 5.1.3.1.6 Acesulfame Potassium (Ace-K)

- 5.1.3.1.7 Other Artificial HIS

- 5.1.3.2 Natural High-Intensity Sweeteners

- 5.1.3.2.1 Stevia Extract

- 5.1.3.2.2 Monk Fruit Extract

- 5.1.3.2.3 Other Natural HIS

- 5.1.4 Other Sweeteners

- 5.2 By Application

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy and Desserts

- 5.2.3 Beverages

- 5.2.4 Soups, Sauces, and Dressings

- 5.2.5 Other Applications

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.3.3 Crystal

- 5.4 By Category

- 5.4.1 Conventional

- 5.4.2 Organic

- 5.5 By Region

- 5.5.1 England

- 5.5.2 Scotland

- 5.5.3 Wales

- 5.5.4 Northern Ireland

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Cargill Inc.

- 6.4.3 ADM

- 6.4.4 Ingredion Inc.

- 6.4.5 Tereos S.A.

- 6.4.6 Associated British Foods plc

- 6.4.7 GLG Life Tech Corp.

- 6.4.8 Roquette Freres

- 6.4.9 Sudzucker

- 6.4.10 DuPont

- 6.4.11 Celanese Corporation

- 6.4.12 Ajinomoto Co.

- 6.4.13 JK Sucralose

- 6.4.14 Evolva Holding

- 6.4.15 Cosun Beet Company

- 6.4.16 Foodchem International Corporation

- 6.4.17 SandW Seed Company

- 6.4.18 Layn Natural Ingredients

- 6.4.19 DSM-Firmenich

- 6.4.20 Amyris Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK