PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836437

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836437

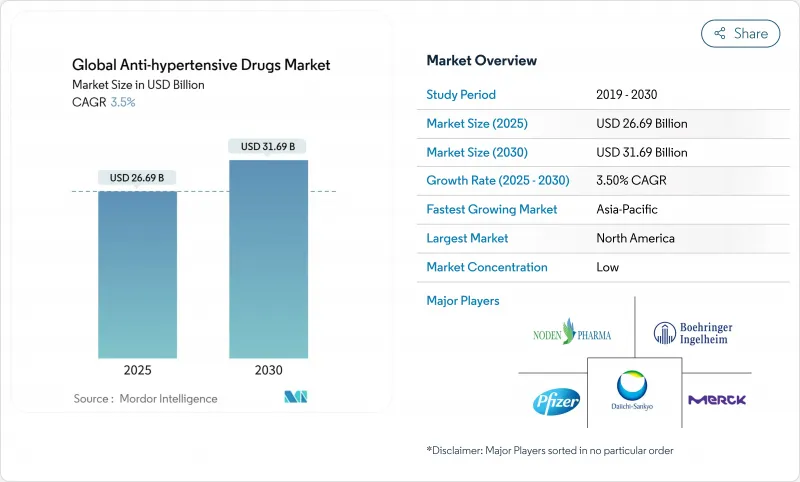

Global Anti-hypertensive Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The antihypertensive drugs market is valued at USD 26.69 billion in 2025 and is forecast to reach USD 31.69 billion in 2030, advancing at a 3.5% CAGR.

Uptake is anchored in escalating hypertension prevalence, an older global population, and steady innovation in fixed-dose combinations that improve adherence. Emerging long-acting injectable therapies and AI-enabled dose-titration platforms add fresh clinical value while generic competition tempers overall price growth. Asia-Pacific outpaces other regions on the back of rapid urbanization, salt-heavy diets, and widening health-insurance schemes. Meanwhile, North America sustains the largest revenue pool through early adoption of novel mechanisms, broad reimbursement, and entrenched cardiology care pathways. Throughout 2025-2030, companies with balanced portfolios of breakthrough assets and cost-competitive generics are positioned to capture incremental demand, even as patent cliffs squeeze margins for older brands.

Global Anti-hypertensive Drugs Market Trends and Insights

Accelerating Obesity and Metabolic Syndrome

Metabolic syndrome affects roughly one-third of adults worldwide, and hypertension co-exists in 85% of these patients. Clinicians are moving toward agents that simultaneously address weight, glycemic control, and blood pressure, particularly GLP-1 receptor agonists that cut systolic readings by 7-10 mmHg independent of weight loss. Health-system models estimate that unchecked hypertension could push annual cardiovascular treatment costs from USD 160 billion in 2020 to USD 513 billion by 2050, reinforcing the economic case for aggressive early therapy .

Growth of Fixed-Dose Combination Therapies

Roughly 70% of patients need two or more antihypertensive agents, yet adherence drops as pill count rises. FDA approval of the first triple-combination tablet in 2025 signals a regulatory green light for upfront multi-drug products that achieved 70% control rates versus 37% on placebo. Health-economic studies put annual hospitalization savings at USD 873 per adherent patient, spurring payers to prioritize such regimens.

Patent Cliffs for Blockbuster ARBs & CCBs

Entresto loses U.S. exclusivity in mid-2025, and multiple ARB and CCB molecules face similar expiries, inviting rapid generic entry that historically erodes branded volume by up to 90% within a year. Manufacturers are countering with novel formulations and combination products, though payers favor generics for cost control.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Reimbursement for Single-Pill Regimens

- Uptake of Once-Weekly GLP-1 Combination Injectables

- Low Adherence Due to Asymptomatic Nature of Hypertension

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Angiotensin II Receptor Blockers held 31.43% antihypertensive drugs market share in 2024 thanks to proven cardio-renal benefits and favorable tolerability. Renin Inhibitors, although smaller, will climb at 4.23% CAGR as physicians adopt new pathways for resistant patients. Endothelin receptor antagonists and aldosterone synthase inhibitors, newly approved in 2025, bring additional options for hard-to-treat cases. Beta Blockers and some older Calcium Channel Blockers lose ground due to metabolic side effects, while diuretics gain renewed interest through low-dose formulations. Pipeline diversity underscores a shift toward precision mechanisms addressing comorbidity clusters and resistant hypertension niches.

The antihypertensive drugs market continues to reward classes that combine efficacy with favorable side-effect profiles. Lifecycle strategies now favor triple-combination tablets that integrate ARBs with CCBs or diuretics, anchoring brand loyalty even amid generic pressure. Novel mechanisms are expected to command premium pricing where they demonstrate clear outcome advantages, cushioning revenue against pending patent expiries. Manufacturers with broad portfolios straddling generics and innovations will navigate the transition most effectively.

The Antihypertensive Drugs Market Report Segments the Industry Into Therapeutic Class (Angiotensin Converting Enzyme (ACE) Inhibitors, Angiotensin Receptor Blockers (ARBs) and More), by Distribution Channel (Hospital Pharmacies and More), by Route of Administration (Oral, Parenteral / Injectable and More) and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 35.55% of 2024 revenue, leveraging sophisticated cardiology networks, strong insurance coverage, and fast uptake of novel classes. The United States leads, buoyed by premium prices and early use of digital health. Canada emphasizes cost-effectiveness, leaning on generics, while Mexico grows volume as coverage expands across public programs.

Europe contributes steady mid-single-digit growth under mature health systems that weigh cost and innovation in equal measure. Germany and the United Kingdom spearhead clinical adoption of advanced mechanisms, whereas Southern Europe leans on high generic penetration. Value-based contracting accelerates fixed-dose uptake in major EU markets.

Asia-Pacific stands out as the fastest-expanding region with a 5.67% CAGR. China's bulk-procurement policies have cut prices yet boosted volumes, while India benefits from large-scale manufacturing and rising domestic demand. Japan's aging demographic sustains spending on cardio-metabolic care. Local salt-sensitivity profiles and genetic variations prompt region-specific research programs, creating scope for differentiated therapies.

South America shows gradual improvement amid economic recovery and hypertension awareness campaigns, though currency volatility tempers premium-drug uptake. Middle East and Africa remain nascent but promising as governments invest in non-communicable disease control and private insurance penetration rises.

- Cepheid (Danaher)

- Roche

- Beckton Dickinson

- Abbott Laboratories

- Hologic

- QIAGEN

- Thermo Fisher Scientific

- bioMerieux

- Siemens Healthineers

- Beckman Coulter Diagnostics

- FUJIFILM

- SD Biosensor

- Molbio Diagnostics

- Oxford Immunotec

- Meridian Bioscience

- LumiraDx

- Tauns Laboratories

- QuantuMDx

- Luminex (DiaSorin)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of drug-resistant TB strains

- 4.2.2 WHO endorsement & national roll-outs of NAAT platforms

- 4.2.3 Government funding & global health initiatives

- 4.2.4 Emergence of AI-powered microscopy & digital radiology triage

- 4.2.5 Decentralised near-POC molecular platforms

- 4.2.6 Subscription-based diagnostics-as-a-service models

- 4.3 Market Restraints

- 4.3.1 High cost of molecular tests & cartridges

- 4.3.2 Shortage of skilled laboratory infrastructure

- 4.3.3 Supply-chain fragility for single-source cartridges

- 4.3.4 Competition from emerging non-sputum biomarkers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Test Type (Value)

- 5.1.1 Culture-based Tests

- 5.1.2 Smear Microscopy

- 5.1.3 Nucleic Acid Amplification Tests (NAAT)/PCR

- 5.1.4 Interferon-Gamma Release Assays (IGRA)

- 5.1.5 Tuberculin Skin Test (Mantoux)

- 5.1.6 Radiographic & Imaging Tests

- 5.1.7 Other Tests

- 5.2 By Technology (Value)

- 5.2.1 Culture-based

- 5.2.2 Molecular Diagnostics (PCR/NAAT)

- 5.2.3 Immunoassays (IGRA/LAM)

- 5.2.4 Radiology/X-ray

- 5.2.5 AI-enhanced Digital Microscopy

- 5.2.6 Others

- 5.3 By End-User (Value)

- 5.3.1 Hospitals & Clinics

- 5.3.2 Diagnostic Laboratories

- 5.3.3 Academic & Research Institutes

- 5.3.4 Others

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Cepheid (Danaher)

- 6.3.2 Roche Diagnostics

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 Abbott Laboratories

- 6.3.5 Hologic Inc.

- 6.3.6 Qiagen N.V.

- 6.3.7 Thermo Fisher Scientific Inc.

- 6.3.8 BioMerieux SA

- 6.3.9 Siemens Healthineers

- 6.3.10 Beckman Coulter Diagnostics

- 6.3.11 Fujifilm Holdings Corporation

- 6.3.12 SD Biosensor

- 6.3.13 Molbio Diagnostics

- 6.3.14 Oxford Immunotec

- 6.3.15 Meridian Bioscience

- 6.3.16 LumiraDx

- 6.3.17 Tauns Laboratories

- 6.3.18 QuantuMDx

- 6.3.19 Luminex (DiaSorin)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment