PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836439

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836439

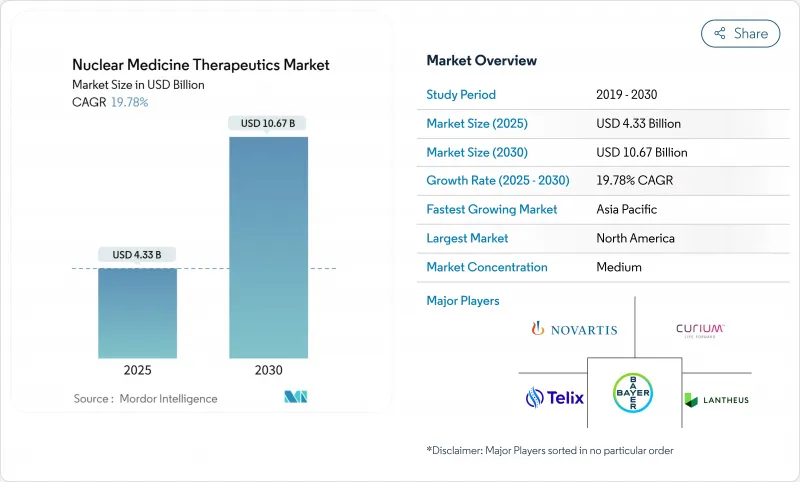

Nuclear Medicine Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nuclear medicine therapeutics market stands at USD 4.33 billion in 2025 and is forecast to reach USD 10.67 billion by 2030, advancing at a 19.78% CAGR.

Demand accelerates as radiopharmaceuticals shift from palliative options toward first-line treatments across oncology, neurology, and cardiology. Breakthroughs in alpha-emitting isotopes, growing reimbursement support, and a steady pipeline of theranostic agents continue to expand procedure volumes. Manufacturers pursue in-house isotope production to curb supply bottlenecks, while hospitals adopt artificial-intelligence-enabled dosimetry to improve outcomes. Regionally, strong North American infrastructure anchors the nuclear medicine therapeutics market, but Asia Pacific's rapid build-out of cyclotrons and specialized clinics positions it as a long-term growth engine.

Global Nuclear Medicine Therapeutics Market Trends and Insights

High Burden of Cancer

Global cancer incidence is projected to exceed 29.9 million new cases by 2040, intensifying demand for alternatives to surgery and chemotherapy. Alpha-emitting agents such as actinium-225 PSMA therapy deliver concentrated energy to tumors with minimal collateral damage, shifting protocols toward radiopharmaceutical first-line use. Companies expedite research programs, and Pluvicto has become the first blockbuster radioligand, validating commercial potential. Theranostics now allow clinicians to image, treat, and follow tumors in one workflow, reducing redundant therapies and improving quality of life.

Advances in Targeted Radiopharmaceuticals

Lead-212 and terbium-161 represent the next wave of isotopes. Orano Med opened the world's first industrial-scale lead-212 plant in January 2025, ensuring reliable supply for alpha programs. Preclinical data show terbium-161 outperforms lutetium-177 in lymphoma models, opening new avenues for hematologic malignancies. Enhanced chelators and vectors extend half-life in vivo, broadening indications such as beta-amyloid plaque targeting for Alzheimer's disease.

High Cost of Radiopharmaceutical Procedures

Therapies based on lutetium-177 often exceed USD 50,000 per course, presenting affordability hurdles. CMS now reimburses diagnostic radiopharmaceuticals above USD 630 separately, improving hospital economics. Outcome-based pricing and risk-sharing contracts are under exploration, allowing wider adoption without eroding margins.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Minimally Invasive and Precision Medicine

- Strategic Initiatives of Market Players

- Complex Production and Short Life of Radioisotopes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beta emitters controlled 67.58% of the nuclear medicine therapeutics market in 2024 as clinicians favored established isotopes such as lutetium-177 and iodine-131. Lutetium-177's uptake accelerated after SHINE Technologies introduced high-specific-activity Ilumira, delivering tighter tumor targeting and easing manufacturing constraints. Alpha emitters post the strongest trajectory: the nuclear medicine therapeutics market size for alpha emitters is projected to expand at 23.55% CAGR through 2030, driven by commercial actinium-225 output from Eckert & Ziegler.

Alpha emitters' high LET radiation cuts treatment cycles, improving patient convenience. Lead-212's practical half-life supports centralized production, while radium-223 retains value for bone metastases. Beta-based yttrium-90 broadened beyond hepatocellular carcinoma into synovectomy, extending the nuclear medicine therapeutics market's clinical footprint.

Targeted radioligand therapy delivered 49.56% of overall revenue in 2024. The PSMAfore Phase 3 study confirmed lutetium-177 PSMA-617's median progression-free survival advantage in taxane-naive prostate cancer. Real-world evidence showed 73.5% overall survival at follow-up for Pluvicto-treated patients. BNCT follows with a 20.11% CAGR, leveraging novel boron-containing nanoparticles that pair neutron activation with immune checkpoint inhibition.

Radio-immunotherapy marries monoclonal antibodies with high-energy isotopes, opening hard-to-reach solid tumors. Automated planning tools limit operator variability, supporting a broader user base and expanding the nuclear medicine therapeutics market even in smaller treatment centers.

The Nuclear Medicine Therapeutics Market Report is Segmented by Type (Alpha Emitters [Actinium-225 and More], Beta Emitters [ Iodine-131 and More], and Brachytherapy [Cesium-131 and More]), Therapeutic Modality (Radio-Immunotherapy, Brachytherapy, and More), Application (Oncology, Cardiology, and More), and End User (Hospitals & Cancer Centers, and More) Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 46.12% revenue in 2024 on the back of 2,000+ PET/CT units and favorable CMS reimbursement that unbundles high-priced isotopes. The United States hosts an expanding isotope production base, as Novartis invests over USD 200 million in domestic facilities to hedge against imports. Sutter Health's AI-imaging partnership with GE HealthCare democratizes advanced services across California.

Asia Pacific records the fastest 22.43% CAGR. China licensed over 40 radiopharmaceuticals and targets 10 million annual procedures by 2035, underpinning local demand. SHINE Technologies partners with Primo Biotech to distribute lutetium-177 across Taiwan, Japan, South Korea, and Singapore, solidifying supply lines. Australia's new production complexes and strong government support create a regional export hub.

Europe shows steadier expansion, backed by robust R&D and EMA approvals, yet reactor outages expose supply fragilities. Orano's thorium-228 project seeks to add redundancy to isotope chains. Middle East and Africa progress slowly, although Israel and Saudi Arabia plan cyclotron-based facilities that will seed future growth.

- Actinium Pharmaceutical

- Alpha Tau Medical

- Bayer

- Fusion Pharmaceuticals

- IBA Radiopharma Solutions

- RadioMedix

- Telix Pharmaceuticals

- NTP Radioisotopes

- Bracco

- Cardinal Health

- Nordion Inc. (Sotera Health)

- Triad Isotopes (Jubilant)

- Novartis

- Curium Pharma

- Lantheus Holdings

- POINT Biopharma

- NorthStar Medical Radioisotopes

- ITM SE

- BWXT Medical

- Eckert & Ziegler

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden Of Cancer

- 4.2.2 Advances In Targeted Radiopharmaceuticals

- 4.2.3 Rising Demand For Minimally Invasive And Precision Medicine

- 4.2.4 Strategic Initiatives Of Market Players On Nuclear Medicine Therapeutics And Product Launch

- 4.2.5 Expansion Of Nuclear Medicine Infrastructure

- 4.2.6 Improved Clinical Evidence And Reimbursement Support

- 4.3 Market Restraints

- 4.3.1 High Cost Of Radiopharmaceutical Procedures

- 4.3.2 Stringent Regulatory And Licensing Barriers

- 4.3.3 Complex Production And Short Life Of Radioisotopes

- 4.3.4 Scarcity Of Trained Radiochemists

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Alpha Emitters

- 5.1.1.1 Radium-223 (Ra-223) & Alpharadin

- 5.1.1.2 Actinium-225 (Ac-225)

- 5.1.1.3 Lead-212 / Bismuth-212

- 5.1.1.4 Others

- 5.1.2 Beta Emitters

- 5.1.2.1 Iodine-131 (I-131)

- 5.1.2.2 Lutetium-177 (Lu-177)

- 5.1.2.3 Yttrium-90 (Y-90)

- 5.1.2.4 Others

- 5.1.3 Brachytherapy

- 5.1.3.1 Cesium-131

- 5.1.3.2 Iodine-125

- 5.1.3.3 Palladium-103

- 5.1.1 Alpha Emitters

- 5.2 By Therapeutic Modality

- 5.2.1 Targeted Radioligand Therapy (RLT)

- 5.2.2 Radio-immunotherapy

- 5.2.3 Brachytherapy

- 5.2.4 Boron Neutron Capture Therapy (BNCT)

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.2 Cardiology

- 5.3.3 Endocrinology (Thyroid, Parathyroid)

- 5.3.4 Neurology

- 5.3.5 Pain Palliation / Bone Metastasis

- 5.4 By End-user

- 5.4.1 Hospitals & Cancer Centers

- 5.4.2 Specialty Clinics

- 5.4.3 Academic & Research Institutes

- 5.4.4 Radiopharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Actinium Pharmaceuticals Inc.

- 6.3.2 Alpha Tau Medical Ltd

- 6.3.3 Bayer AG

- 6.3.4 Fusion Pharmaceuticals

- 6.3.5 IBA Radiopharma Solutions

- 6.3.6 RadioMedix Inc.

- 6.3.7 Telix Pharmaceuticals Ltd

- 6.3.8 NTP Radioisotopes

- 6.3.9 Bracco SpA

- 6.3.10 Cardinal Health Inc.

- 6.3.11 Nordion Inc. (Sotera Health)

- 6.3.12 Triad Isotopes (Jubilant)

- 6.3.13 Novartis AG

- 6.3.14 Curium Pharma

- 6.3.15 Lantheus Holdings

- 6.3.16 POINT Biopharma

- 6.3.17 NorthStar Medical Radioisotopes

- 6.3.18 ITM SE

- 6.3.19 BWXT Medical

- 6.3.20 Eckert & Ziegler

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment